Buyers saw some supply price into a stable market on Tuesday as a wide variety of education deals dominated the municipal bond calendar.

With yields mostly unchanged on the day and minimal trading, a New York underwriter said the short end of the municipal market was trading sideways Tuesday in terms of pricing under pressure from compressed yields.

“It seems kind of quiet after a quiet Monday as well,” he said, noting that the short end has “that much more room to run — especially with the compressed yields we are seeing through 10 years.”

“I think the deals this week are probably going to do fine just because there is so much cash around,” he said.

The underwriter noted that the tax-exempt calendar is on the lighter side this week — with much of the volume consisting of taxable deals — which will be problematic going forward.

“We are going to be heading into July with a supply-demand imbalance and that will lead to more spread compression,” he explained. “You are seeing buyers absorbing lower coupons that they would not normally be participating in,” he added.

For example, some accounts are accepting 4% coupons instead of 5%, and 3% instead of 4% — and in some cases 2% depending on the structure and maturity.

“There are some retail investors looking for that structure to get a discount in 15 to 20 years,” he said.

He said the calendar will be light next week as the market pauses for the July 4th holiday.

“We will most likely only have a three-day week with Friday’s holiday and people cutting out early,” he said.

Primary market

Citigroup priced and repriced the Lewisville Independent School District, Texas’ (NR/AAA/AAA/NR) $263 million of unlimited tax school building and refunding bonds. The deal is backed by the Permanent School Fund guarantee program.

The bonds were repriced to yield from 0.25% with a 5% coupon in 2021 to 2.28% with a 2.25% coupon in 2040. The bonds were tentatively priced to yield from 0.31% with a 5% coupon in 2021 to 2.28% with a 2.25% coupon in 2040.

Piper Sandler priced the Barbers Hill Independent School District, Chambers County, Texas’ (Aaa/AAA/NR/NR) $140 million of unlimited tax school building bonds backed by the PSF.

The deal was priced to yield from 0.33% with a 5% coupon in 2022 to 1.98% with a 3% coupon in 2040; a 2042 term bond was priced to yield 1.80% in 2042.

BOK Financial Securities priced the Corsicana Independent School District, Texas’ (Aaa/NR/NR/NR) $71 million of taxable unlimited tax refunding bonds. The deal is backed by the Permanent School Fund guarantee program.

The taxable bonds were priced at par to yield from 1.452% in 2027 to 2.52% in 2040 and 2.75% in 2045. The capital appreciation bonds were priced as zeros to yield from 0.79% in 2020 to 1.692% in 2026.

Frost Bank took indications of oi interest on the Abilene Independent School District, Texas’ $70 million of taxable unlimited tax refunding bonds. The deal is backed by the PSF.

Wells Fargo Securities priced the Pontiac School District, Mich.’s (Aa1/NR/NR.NR) $90 million of unlimited tax GO school building and site bonds backed by the Michigan School Bond Qualification and Loan Program (SBQLP).

The issue was priced to yield from 0.72% with a 5% coupon in 2022 to 2.38% with a 4% coupon in 2040. A 2045 term was priced to yield 2.53% with a 4% coupon and a 2050 term was priced to yield 2.58% with a 4% coupon.

In the competitive arena, the Anchor Bay School District, Mich., (NR/AA/NR/NR) sold $97.02 million of taxable general obligation refunding bonds backed by the Michigan School Bond Qualification and Loan Program.

Morgan Stanley won the issue with a true interest cost of 1.9291%. Proceeds will be used to refund certain indebtedness of the district.

Baker Tilly Municipal Advisors was the financial advisor; the Thun Law Firm was the bond counsel.

Away from the education sector, Citigroup priced Houston, Texas’ $148.525 million of airport system special facilities revenue refunding bonds (NR/NR/BB-/NR) for United Airlines Inc. airport improvement projects, subject to the alternative minimum tax.

The deal consisted of $66.89 million of Series 2020C bonds, $47.47 million of Series 2020B-2 bonds and $34.165 million of Series 2020A bonds.

The Series 2020C bonds were priced to yield 4.625% with a 5% coupon in 2027, the Series 2020B-2 bonds were priced to yield 4.375% with a 5% coupon in 2027; and the 2020A bonds were priced to yield 4.375% with a 5% coupon in 2027.

BofA Securities priced the Western Municipal Water District Facilities Authority, Calif.’s (NR/AA+/AA+/NR) tax-exempt and taxable water revenue bonds.

The $90.875 million of Series 2020A exempts were priced with 5% coupons to yield from 0.12% in 2021 to 1.47% in 2040, 1.68% in 2045 and 1.75% in 2050.

Secondary market

Some notable trades on Tuesday:

The short end showed little movement in benchmarks. Palo Alto, California USD 5s of 2021 traded at 0.21%. King County, Washington SC #411, 3s of 2022, traded at 0.29%-0.31%. Charlotte, North Carolina GOs, 5s of 2023 traded at 0.28%.

Polk County, Iowa 5s of 2023 traded at 0.37%-0.35%.

Washington GOs, 5s of 2025, traded at 0.46%-0.45%. Delaware GOs 5s of 2028 tradedat 0.78%-0.77%.

Kind County, Washington 4s of 2029, 0.97%-0.90%. Prince Georges County, Maryland 5s of 2031 traded at 1.04%.

Collin County Community College, Texas 5s of 2032 traded at 1.24%.

Dallas Waters 4s of 2040 traded at 1.74%-1.70%.

Out a little longer, New York City TFAs 4s of 2045 traded at 2.21%.

University of Washington 5s of 2050 traded at 1.84%-1.83%.

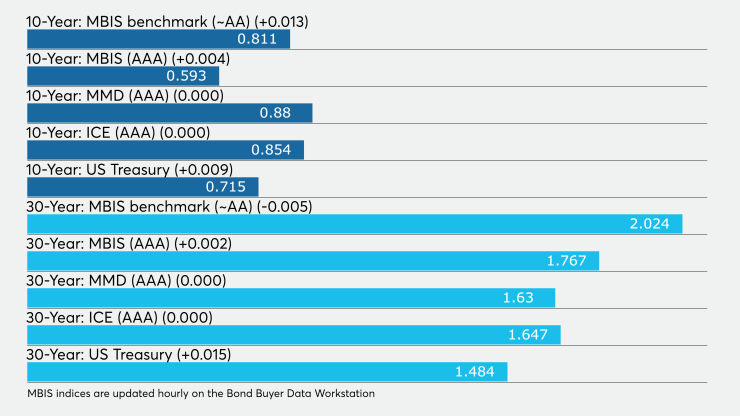

On MMD’s AAA benchmark scale, yields were unchanged throughout the curve. Yields on the 2021 and 2023 maturities were steady at 0.25% and 0.27%, respectively. The yield on the 10-year GO muni was flat at 0.88% while the 30-year yield was unchanged at 1.63%.

The 10-year muni-to-Treasury ratio was calculated at 124.1% while the 30-year muni-to-Treasury ratio stood at 110.1%, according to MMD.

Muni bonds were settling into full summer trading mode, ICE Data Services said in a Tuesday market comment.

“Yields on the ICE muni curve are basically unchanged across the board,” ICE said. “The new-issue calendar remains light. Secondary market activity picked up yesterday’s slow pace.”

The ICE AAA municipal yield curve showed yields were unchanged, with the 2021 and 2022 maturities at 0.230% and 0.236%, respectively. Out longer, the 10-year maturity was steady at 0.854% while the 30-year was flat at 1.647%.

ICE reported the 10-year muni-to-Treasury ratio stood at 128% while the 30-year ratio was at 108%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.22% and the 2022 maturity at 0.27% while the 10-year muni was at 0.89% and the 30-year stood at 1.64%.

The BVAL AAA municipal yield curve showed yields were unchanged, with the 2021 and 2022 maturities at 0.190% and 0.24%, respectively. Out longer, the 10-year maturity was steady at 0.83% while the 30-year was flat at 1.65%.

Munis were also little changed on the MBIS benchmark and AAA scales.

Treasuries were weaker as stocks traded higher.

The three-month Treasury note was yielding 0.155%, the 10-year Treasury was yielding 0.715% and the 30-year Treasury was yielding 1.484%.

The Dow rose 0.80%, the S&P 500 increased 0.80% and the Nasdaq gained 1.17%.