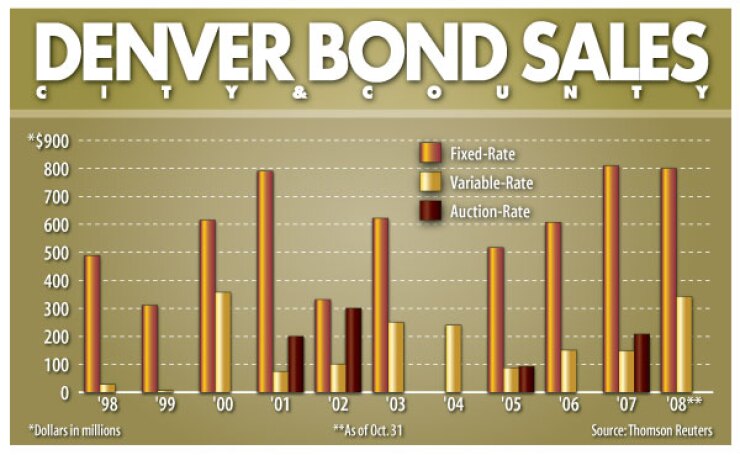

DALLAS - Denver plans to refinance $200 million of variable-rate airport bonds today and another $93 million on Friday to rid the debt of backing by MBIA Insurance Co. When the deals close, Denver International Airport will have refinanced $1.1 billion of debt this year.

"It's a good story to tell," said Stan Koniz, chief financial officer at DIA. "Over $1 billion of refinancing when we didn't even plan to go to the market at all this year."

The city-county government has decided to leave $200 million of auction-rate securities in place after failing to find an opening in the market earlier this year.

"The rates have been resetting at around 4.5%, so we've decided to leave them in place," Koniz said.

Morgan Stanley serves as lead manager with Ramirez & Co. as co-manager. The city's financial advisers were Depfa First Albany Securities and Estrada Hinojosa & Co.

Letters of credit from the Belgian bank KBC Bank NV and German bank Landesbank Baden-Württemberg replace the MBIA insurance.

The remarketing agent for the bonds is JPMorgan.

The bonds will refinance a July 2000 issue that was led by now-defunct Lehman Brothers. The 2000 bonds were downgraded from triple-A to AA by Fitch Ratings on April 4, to AA by Standard & Poor's July 5, and to A2 by Moody's Investors Service on June 20.

Fitch withdrew the rating it assigned in July when it became apparent the refinancing deal could not be completed at that time. Last week, Fitch issued a new report with its AA long-term rating based on the airport's A-plus system revenue bond rating and the letter of credit. A short-term F1-plus was also assigned to the LOCs.

Standard & Poor's rated the new bonds AA based on the LOC, with an A-minus underlying credit.

Under the terms of the variable-rate bonds, the bank is obligated to make payments of principal and interest when due as well as the purchase price for tendered bonds during the weekly and monthly interest-rate modes.

The $100 million of Series 2008B and C bonds will begin paying interest in the weekly interest rate mode on Dec. 1, but may be converted to a daily, monthly, semiannual, term, flexible, or fixed rate.

Denver intended to convert $200 million of auction-rate securities as a Series 2008F1-4 issue in July. But the conversion was postponed due to market conditions and is not expected to happen this year.

In April, Denver issued the $609 million of senior-lien Series 2008A1-A4 airport bonds to refund ARS and variable-rate demand bonds. Another $100 million in subordinate-lien ARS were refunded with commercial paper. In addition, Denver issued the Series 2008B refunding bonds in late June to refund the Aviation Department's outstanding Series 2005C1-C2 VRDBs. None of the airport's 21 interest rate swaps have been terminated as part of the restructuring.

The DIA bond issues coincide with a $987 million capital program that runs through 2013, a series of refunding deals in the wake of the auction-rate securities collapse, and one of the most financially challenging years in the history of aviation.

Denver International Airport's largest carrier, United Airlines, is struggling with record fuel prices as it continues to recover from its 2002 bankruptcy while seeking a merger partner. The home-grown discount carrier Frontier Airlines, DIA's second-largest carrier, is currently in bankruptcy and competing with the newly arrived Southwest Airlines, the nation's most profitable carrier.

Frontier recently assumed its lease at the airport and is current on all payments due to the airport. Southwest Airlines grew its market share at DIA - which it only entered in January 2006 - to about 5.3% of total enplanements in 2007.

The airport served a record 25 million enplaned passengers in 2007, with January to June 2008 year-to-date results up 4.4% over the previous year.

Fitch analysts, who confer an A-plus on the DIA bonds, said they expect the strong enplanement growth rate to ease "as the competitive environment stabilizes and as fares align with demand and the growth in regional economy." The airport's feasibility consultant forecasts an average annual growth rate of 1.7% through 2013, growing more in step with the economy.

In September, Standard & Poor's raised its general obligation rating on Denver to AAA, based on the city's "consistently healthy financial performance, including historical maintenance of very strong fund balances and prudent management of city budgets."

At the same time, the agency raised the rating on various city lease-secured obligations to AA-plus from AA.

"We expect that the city will continue to hold a good fund balance position in the future," said analyst David Hitchcock.