WASHINGTON – Budget cuts to Medicaid and other federal programs that state and local governments depend on are included in the budget resolution congressional Republicans are considering as their blueprint to enable tax reform.

The federal budget cuts would be used to help pay for tax cuts under their blueprint, adding a second setback for state and local governments already facing the prospect of losing the federal deduction for state and local taxes.

Michael Leachman, director of state fiscal research for the Center on Budget and Policy Priorities, which supports social safety net programs, called the proposed budget cuts the elimination of SALT deduction “a big one-two punch.”

“At the same you would be shifting huge new costs to states and localities, you would be restricting their ability to raise new revenue to deal with the fallout,’’ Leachman said.

House Republicans approved

The Senate’s budget resolution was approved by the Senate Budget Committee in a partisan vote last week. It is expected to receive a floor vote later this month.

The two chambers will need to reconcile their differences and pass a joint budget resolution in order to move ahead with the fall legislative priority of enacting tax reform.

Both budget resolutions would trim non-defense discretionary spending in the 2018 fiscal year that began Oct. 1. Those programs are currently operating under a temporary measure that expires Dec. 8, so Congress would have to enact spending cuts after point.

A budget resolution for the 2018 fiscal year also will enable Senate Republicans to waive the 60-vote super-majority required under its rules and pass tax reform by a simple majority.

That’s the same process Senate Republicans used over the summer in a failed bid to repeal the 2010 Affordable Care Act, commonly referred to as Obamacare. Municipal bond market experts are monitoring the debate over tax reform for its impact, especially the effort to preserve the tax deduction for state and local taxes.

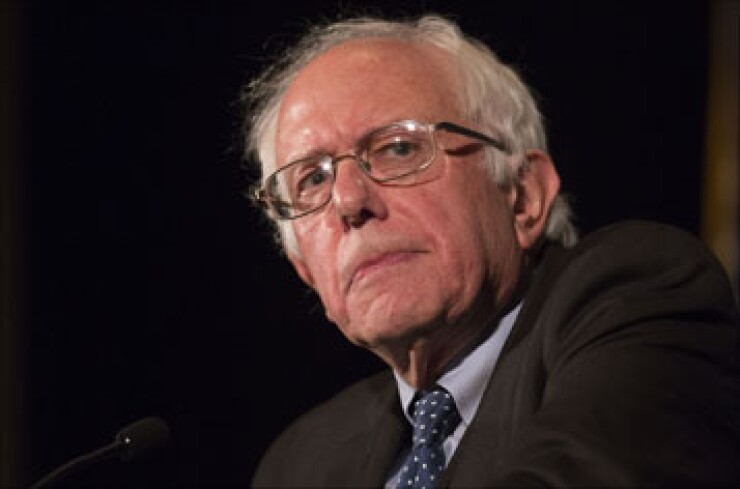

“At a time of massive income and wealth inequality, the Republican budget takes from the middle class and those in need, and gives huge tax breaks to the wealthiest people in this country,” Sen. Bernie Sanders, I-Vt., said Sept. 29.

Sanders, the ranking minority member of the Senate Budget Committee, accused Republicans of using the proposed cuts that include

Sanders estimated that Medicaid, which is the largest single source of federal aid to the states, would be cut by $1 trillion over the next decade.

The Senate and House resolutions both call for spending cuts over the next decade with the Senate version cutting non-defense discretionary spending by $800 billion and House cutting $1.4 trillion, Leachman said.

Domestic spending priorities such as border security, research and the FBI are less likely to be targeted for cuts than support for state and local programs such as K-through-12 education and police and fire departments, Leachman said.

The House version instructs 11 committees to achieve at least $203 billion in mandatory savings and reforms over 10 years to entitlement programs.

The Senate resolution allows $1.5 trillion in new deficit spending over the coming decade, which the House version does not do.

The feud between Sen. Bob Corker, R-Tenn. and President Trump that erupted into public view over the weekend could help derail the plan for new deficit spending and force the Senate to take the same approach as the House.

That’s because Corker has vowed to not support any plan that increases the deficit.

But Trump said Tuesday he doesn’t think his differences with Corker will affect tax reform.

“I don't think so at all” Trump told reporters. “I think we're well on our way. It's very -- the people of this country want tax cuts. They want lower taxes.”