Connecticut’s $750 million of general obligation bonds hit the market on Thursday as municipal buyers snapped up the last of the week’s sizeable deals.

Cumberland: Good quarter for munis

The first quarter of the year was good for the tax-free bond market as yields trended down, according to Cumberland Advisors.

Cumberland said there were two main reasons munis had a good run so far this year — volume is down while demand is up.

“A great deal of the drop in supply can be traced to the 2017 tax reform act, which prohibited advance refundings of older, higher-coupon municipal bonds,” Cumberland said in a Thursday market comment. “Refundings were an important source of supply in past years, particularly in 2014 and 2016.”

Meanwhile, demand has been higher, particularly in high-tax states like New York, New Jersey and California.

“Because of the SALT provisions of the tax bill, the cost (in terms of foregone yield) of owning out-of-state bonds in these states is much higher. We don’t see this demand factor changing,” the report said.

Cumberland looked at what this could mean for the market.

“Clearly there has been a reversal in bond market sentiment since last October, when the 10-year Treasury reached nearly 3.25%. The 10-year is back to a 2.45% yield, but the drop of 80 basis points has been accompanied by almost no drop in the rate of core inflation (nor any rise). And even though headline inflation has fallen (mainly due to oil), the drop in real yields has caused us to reassess bond markets in general and tax-free bonds in particular,” Cumberland said.

“We think the SALT provisions are resulting in people — particularly in high-tax states — paying more this year in income taxes. In a market that has seen a resumption of bond fund inflows, we are concerned that the approaching tax deadline may see some bond selling, either directly or in bond fund form, to pay for the taxes,” Cumberland said. “We are also concerned that state and local governments — again, particularly those in high-tax states — will be under pressure from their citizens to cut taxes to make up for the extra taxes being borne because of the SALT provisions. If high-tax states oblige but don’t cut expenses, debt-service coverage could suffer.”

Primary market

Barclays Capital priced Connecticut’s (A1/A/A+/AA-) $750 million of tax-exempt Series 2019A GOs for institutions after holding a one-day retail order period, demand for the bonds was reportedly high, traders said.

Citigroup priced Travis County, Texas’ (Aaa/AAA/NR) $273.03 million of Series 2019A limited tax certificates of obligation.

Wells Fargo Securities priced the University of Massachusetts Building Authority’s (Aa2/AA-/AA)$208.68 million of Senior Series 2019-1 refunding revenue bonds.

BofA Securities received the award on the Connecticut Airport Authority’s (NR/A-/BBB) $151.17 million of Series 2019A AMT and Series 2019B taxable customer facility charge revenue bonds for the ground transportation center project. The taxable 2030-2032 maturities are insured by Assured Guaranty Municipal and rated AA by S&P.

RBC Capital Markets received the award on the North Carolina Housing Finance Agency’s (Aa1/AA+/NR) $146.7 million of Series 41 homeownership revenue bonds.

The Eugene School District No. 4J, Ore., (Aa1/NR/NR) competitively sold $150 million of GOs backed by the Oregon School bond guarantee program. Morgan Stanley won the deal with a true interest cost of 2.9593%. Proceeds will be used to finance capital costs. The financial advisor is Piper Jaffray; the bond counsel is Mersereau Shannon.

Bond sales

Bond Buyer 30-day visible supply at $4.78B

The supply calendar fell $1.78 billion to $4.78 billion on Thursday. It’s composed of $1.98 billion of competitive sales and $2.80 billion of negotiated deals.

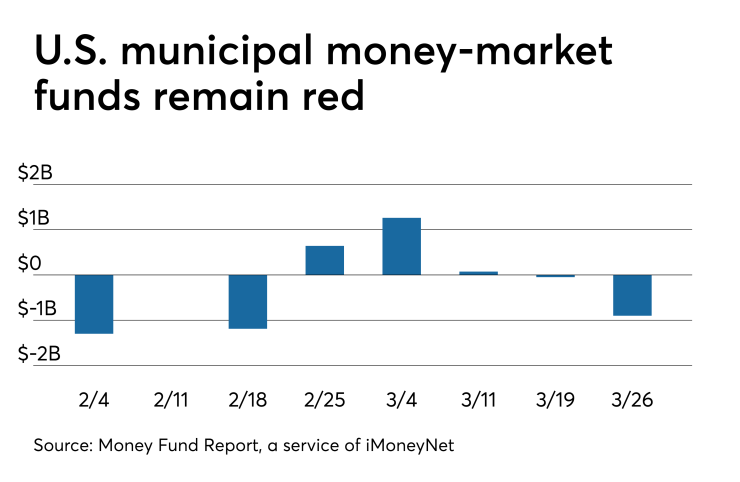

Muni money market funds see outflows again

Tax-free municipal money market fund assets decreased $901.7 million, lowering their total net assets to $138.58 billion in the week ended March 25, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds dipped to 1.13% from 1.19% last week.

Taxable money-fund assets gained $26.55 billion in the week ended March 26, bringing total net assets to $2.918 trillion.

The average, seven-day simple yield for the 806 taxable reporting funds was unchanged at 2.07% from last week.

Overall, the combined total net assets of the 996 reporting money funds increased $25.65 billion to $3.057 trillion in the week ended March 26. It marks the 12th consecutive week total money-fund assets have exceeded $3 trillion.

Secondary market

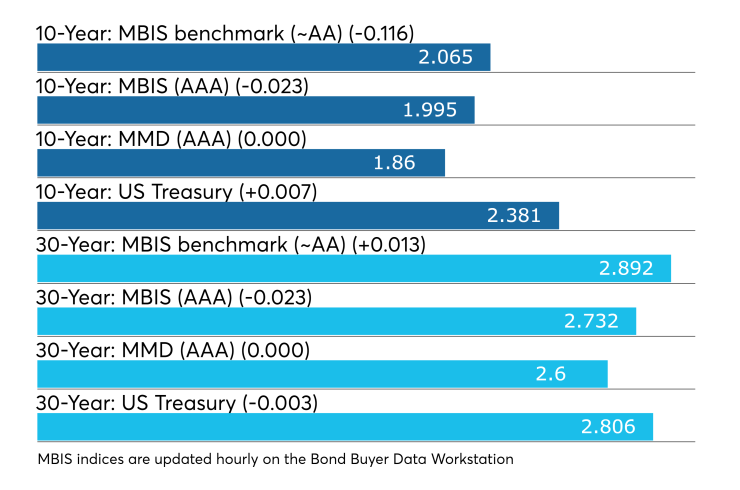

Municipals were mostly stronger on the MBIS benchmark scale Thursday, which showed yields falling in the 10-year maturity while rising in the 30-year maturity. High-grade munis were also mostly stronger on the MBIS AAA scale, which showed yields falling both in the 10-year and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO muni and on the 30-year muni remained unchanged.

The 10-year muni-to-Treasury ratio was calculated at 77.9% while the 30-year muni-to-Treasury ratio stood at 92.5%, according to MMD.

Treasuries were mixed as stocks traded higher.

“The ICE Muni Yield Curve is one basis point lower in the 10-year, with the rest of the curve movement more muted. The tobacco and high-yield sectors are unchanged today,” ICE Data Services said in a Thursday market comment.

Previous session's activity

The MSRB reported 43,804 trades Wednesday on volume of $14.89 billion. California, New York and Texas were most traded, with the Golden State taking 16.066% of the market, the Empire State taking 15.344% and the Lone Star State taking 9.694%. The most actively traded issue was the NYC TFA Series 2019 C-1 4s of 2042 which traded 50 times on volume of $75.12 million.

Treasury auctions bills

The Treasury Department Thursday auctioned $50 billion of four-week bills at a 2.400% high yield, a price of 99.813333. The coupon equivalent was 2.445%. The bid-to-cover ratio was 3.01. Tenders at the high rate were allotted 67.48%. The median rate was 2.380%. The low rate was 2.360%.

Treasury also auctioned $35 billion of eight-week bills at a 2.395% high yield, a price of 99.627444. The coupon equivalent was 2.444%. The bid-to-cover ratio was 3.11. Tenders at the high rate were allotted 37.63%. The median rate was 2.380%. The low rate was 2.350%.

And Treasury auctioned $32 billion of seven-year notes, with a 2 1/4% coupon and a 2.281% high yield, a price of 99.800487. The bid-to-cover ratio was 2.54. Tenders at the high yield were allotted 62.72%. All competitive tenders at lower yields were accepted in full. The median yield was 2.241%. The low yield was 2.150%.

Treasury to sell bills

The Treasury Department said Thursday it will auction $45 billion 92-day bills and $39 billion 182-day discount bills Monday. The 92s settle April 4, and are due July 5, and the 182s settle April 4, and are due Oct. 3. Currently, there are $35.999 billion 91-days outstanding and no 182s.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.