Municipal bond buyers grabbed up general obligation bonds from California and New York City on Thursday as the two deals priced for institutions while AAA benchmarks showed a slightly firmer market following Treasury strength..

Tobacco road

While he still believes the high-yield space has limited upside earnings potential, there will likely be buyers seeking more yield as overall interest rates are expected to stay low and range-bound, according Jeffrey Lipton, head of municipal research at Oppenheimer & Co.

Lipton said in a Wednesday market comment that the “carry” [cost to hold the bonds on the books] in the high-yield tobacco market is limiting overall losses as the sector is essentially converging on par.

Tobacco securitization bonds are backed by revenue that tobacco companies agreed to pay under a 1998 master settlement agreement to compensate 46 states, Washington D.C. and Puerto Rico for expenses stemming from health problems related to tobacco use.

States have received more than $50 billion so far under the MSA, according to the National Association of State Attorneys General, which manages the agreement. The payments are based on cigarette consumption and the bonds are secured by the states' share of revenue from the MSA.

“We are curious to see if the announced resignation of FDA CommissionerScott Gottlieb scheduled for next month will have implications for the high-yield tobacco sector. Gottlieb had been a very vocal opponent of tobacco and e-cigarette consumption among youths and promoted efforts to curtail their use. He views teen vaping as an epidemic and has supported the elimination of menthol in cigarette production,” Lipton wrote. “Already in March, we have seen some supportive bids for tobacco bonds as some buyers now see a slower rate of decline in cigarette use and thus better cash flows that underlie tobacco securitization repayment.”

In Wednesday trading, ICE Data Services reported that “tobacco bonds are active today following the resignation of Scott Gottlieb as head of the Food & Drug Administration. The bonds are 1 bps to 2 bps lower in yield today,”

Separately, an added appreciation for munis is now being experienced this year as individuals file their 2018 tax returns with many finding unexpected liabilities under revised tax tables and limitations placed on the state and local taxes, SALT, deductibility by the Tax Cuts and Jobs Act.

Lipton said he finds it ironic that while tax season is one of those yearly events that generates selling as taxpayers need cash to cover their April bills – against the current tax backdrop, munis are now becoming even more desirable amid a growing need to shelter income.

He also sees the possibility of more supply coming to market later in the year.

“Having a strong pipeline for product demand should help to encourage issuers to enter the market and perhaps this aspect can be joined with still attractive borrowing terms and a more market-friendly Fed as supporting arguments for heavier supply,” Lipton said. “Munis are still operating against a net-buyer backdrop and so for now better relative value opportunities may be hard to achieve.”

Primary market

Citigroup priced California’s (Aa3/AA-/AA-) $2.28 billion of various purpose refunding and new-money general obligation bonds for institutions after a one-day retail order period.

Ravenous investors devoured the Cal GOs as the deal's timing and structure was attractive given the lack of state paper and the "tremendous" local demand for the specialty state's paper in the months following the tax reform act, sources said Wednesday.

The one- to 10-year slope of the yield curve was most appealing to retail investors who have been favoring the short and intermediate range lately, while institutions were focused out longer, according to a New York trader.

"Generally the deal was priced slightly wider than where secondary bonds were trading, which is probably because of the size of the deal," another New York trader said. "The limit on state and local deductions brought in lots of retail, but $2.3 billion is not only going to be sold to the Cal retail market, so Citi backed the prices up, but still had some small holes."

The deal demonstrates a reversal in seasonal patterns -- largely due to the combination of a national supply scarcity and increased demand as investors continue to confirm to the changes following tax reform, according to Reid Smith, Director of Fixed Income Strategies and Senior Portfolio anager at Ziegler Capital Management.

"Seasonally, we usually see more supply at this time of the year and more outflows from funds -- as well as other selling going on -- to fund tax bills for April 15," Smith said. "Normally we see this strong demand in January due to reinvestment season, but now it's persisting into March and becoming steady going into tax period, which traditionally has been a time of outflows," Smith added. "We're seeing it in states that used to have deductions of state and local taxes that now don't have that anymore."

Smith said the the bifurcated coupon structure for the institutional pricing also was appealing.

Lead manager Citi structured the new-money maturities with bifurcated coupons ranging from 2021 with 5% and 4% coupons and 1.56% yield to 2049 with 4% and 5% coupons yielding 3.58% and 3.25%, respectively. The bifurcated coupons on the refunding portion ranged from 2021 with 5% and 4% coupons yielding 1.52% to 2035 with 3.125% and 5% coupons yielding 3.23% and 2.54%, respectively.

Smith said that many deals like California's are coming to market with more refunding than new-money financings. "That's the consistent structure in the market," he said. "Even though new money is up, a lot of supply is driven through refunding deals and recycling that money into the market."

Siebert Cisneros Shank priced New York City’s (Aaa/AA/AA) $914.11 million of Fiscal 2019 Series E and F tax-exempt bonds for institutions after a two-day retail order period.

NYC also competitively sold $72.5 million of taxable Fiscal 2019 Series F, Subseries F-2 GOs, which JPMorgan Securities won with a true interest cost of 3.135%. The bonds are due from 2020 to 2028 and attracted 13 bidders.

“During a two-day retail order period for the tax-exempt bonds, the city received $564 million of orders from individual investors, of which approximately $538 million was usable,” the city said in a statement. “During the institutional order period, the city received approximately $580 million of priority orders, representing 1.5x the bonds offered for sale to institutional investors. At the repricing following the institutional order period, yields were increased by 1-2 basis points for maturities in 2021-2024 and decreased by 2-3 basis points for maturities in 2030-2035.”

One New York trader said Tuesday's New York City GO sale also had some unsold blocks on maturities not spoken for after the institutional pricing -- primarily inside of five years -- but the deal had a positive tone overall after the pricing.

"Longer maturities in the 15-year range had yields lowered, so overall a good deal," he said, noting that a hearty $564 million of the $913 million sale consisted of retail orders.

Tuesday’s bond sales

Bond Buyer 30-day visible supply at $7.61B

The supply calendar fell $1.11 billion to $7.61 billion Wednesday composed of $2.71 billion of competitive sales and $4.90 billion of negotiated deals.

ICI: Muni funds see $2.63B inflow

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.626 billion in the week ended Feb. 27, the Investment Company Institute reported on Wednesday.

This followed an inflow of $2.472 billion from the tax-exempt mutual funds in the week ended Feb. 20.

Long-term muni funds alone saw an inflow of $2.440 billion after an inflow of $2.351 billion in the previous week while ETF muni funds saw an inflow of $186 million after an inflow of $121 million in the prior week.

Taxable bond funds saw combined inflows of $9.053 billion in the latest reporting week after inflows of $6.096 billion in the previous week.

ICI said the total combined estimated inflows into all long-term mutual funds and exchange-traded funds were $11.962 billion for the week ended Feb. 27 after inflows of $7.373 billion in the prior week.

Secondary market

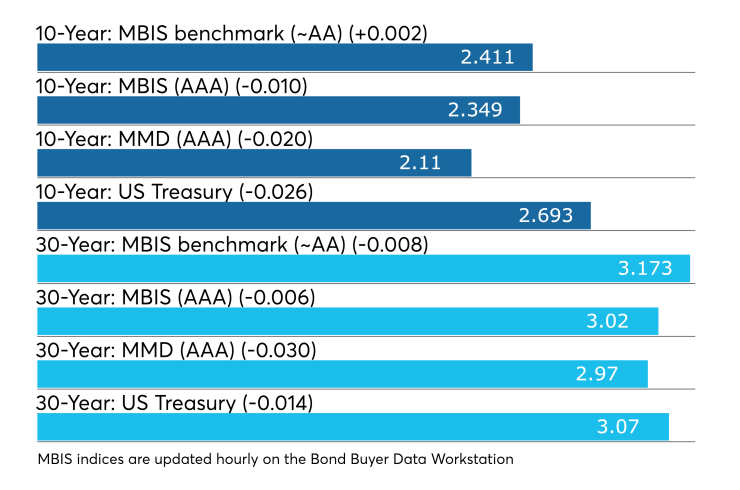

Municipal bonds were mixed Wednesday, according to the MBIS benchmark scale, with muni yields rising less than a basis point in the 10-year maturity and rising less than a basis point in the 30-year maturity. High-grade munis were mostly stronger, with yields falling one basis point in the 10-year maturity and less than a basis points in the 30-year maturity.

Investment-grade municipals were stronger on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni falling two basis points while the yield on the 30-year muni dropped three basis points.

Treasury bonds were stronger as stock prices declined.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 78.4% while the 30-year muni-to-Treasury ratio stood at 96.9%, according to MMD.

Previous session's activity

The MSRB reported 44,219 trades on Tuesday on $12.84 billion of volume. California, Texas and New York were most traded, with the Golden State taking 12.262% of the market, the Lone Star State taking 11.951% and the Empire State taking 9.0%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.