A surge of supply swept over the municipal bond market on Wednesday as Pennsylvania and the Kansas City IDA sold large issues. Price guidance was issued on the Florida Development Finance Corp.’s $950 million deal for Virgin Trains, which is expected to price on Thursday.

Primary market

Pennsylvania (Aa3/A+/AA-) competitively sold $886.875 million of unlimited tax general obligation bonds, first refunding series of 2019. BofA Securities won the bonds with a true interest cost of 1.757%.

The deal was priced as 5s to yield from 1.38% in 2019 to 2.03% in 2030. The largest tranche of the deal, $123.8 million, was the 10-year with a 5% coupon, which today yielded 1.96% (+31 to MMD AAA benchmark). In last May's deal, the 10-year with a 5% coupon yielded 3.1%. The deal was downsized by about $13.125 million on the short end and on the longest maturity, 5s of 2030.

Proceeds will be used for current and advance refunding of certain outstanding debt. The financial advisors are PFM Financial Advisors and Sustainable Capital Advisors. The bond counsel are McNees Wallace and Frannie Reilly, along with the State Attorney General.

In the negotiated sector, Morgan Stanley priced the Kansas City Industrial Development Authority, Missouri’s (A2/A/A) $887.7 million of special obligation airport bonds for the Kansas City International Airport terminal modernization project.

The issue consists of Series 2019B bonds subject to the alternative minimum tax and Series 2019C non-AMT bonds. The Series 2019B 2049 and 2055 maturities totaling about $195 million are insured by Assured Guaranty Municipal.

Morgan Stanley issued price guidance for the Florida Development Finance Corp.’s $950 million of Series 2019B (Aaa-VMIG1/NR/NR) surface transportation facility revenue bonds subject to the alternative minimum tax for the Virgin Trains USA Passenger Rail project.

The bonds are due Jan. 1 2049 with a mandatory tender of March 17, 2020 and an earliest optional mode change on July 22. Price guidance shows bonds priced at par to yield 1.95%, or 65 basis points above the comparable MMD maturity.

"The Aaa long-term rating is based on the strong legal structure and the high credit quality of investments securing the bonds. The VMIG1 short-term rating is based on cash-flow projections that demonstrate that total trustee-held monies in the escrow reserve redemption account will be sufficient for full and timely debt service payments through and including the mandatory tender date in March 2020," Moody's said. "The borrower may elect to release the escrow securities in order to remarket all or a portion of the escrow bonds prior to the mandatory tender date, but only upon delivery of an updated verification report, and delivery to the trustee of a rating confirmation with respect to the remaining escrow bonds from Moody's."

Wells Fargo Securities priced Wake County, North Carolina’s (Aa1/AA+/AA+) $196.805 million of Series 2019 limited obligation bonds.

JPMorgan priced the New York City Housing Development Corp.’s (Aa2/AA+/NR) $490.595 million of Series 2019 E-1 and E-2 multifamily housing revenue sustainable neighborhood bonds after holding a one-day retail order period.

Morgan Stanley priced the New York City Housing Development Corp.'s (Aa2/AA+/NR) $175 million of taxable Series 2019F multi-family housing revenue sustainable neighborhood bonds.

Piper Jaffray priced the Katy Independent School District of Fort Bend, Harris and Waller Counties, Texas’ (PSF: Aaa/AAA/NR) $190.98 million of Series 2019 unlimited tax school building bonds.

Piper also priced the Bethel School District No. 403 of Pierce County, Washington’s (Wash. State Insured: Aa1/NR/NR) $124.33 million of Series 2019 unlimited tax GOs.

Morgan Stanley priced for retail the Municipal Improvement Corp. of Los Angeles, California’s (NR/AA-/NR/AA) $189.42 million of Series 2019A lease revenue bonds for capital equipment and Series 2019B lease revenue refunding bonds for real property.

RBC Capital Markets received the official award on the New Mexico Municipal Energy Acquisition Authority’s (E:Aa2/NR/E:AA)$616.21 million of Series 2019 gas supply revenue refunding and acquisition bonds.

Fort Worth, Texas (Aa3/AA/AA+) competitively sold $106.595 million of Series 2019 general purpose bonds. Morgan Stanley won the issue with a TIC of 2.5584%. Hilltop Securities and Estrada Hinojosa are the financial advisors. McCall Parkhurst, Kelly Hart and the State Attorney General are the bond counsel.

Tuesday’s bond sales

ICI: Muni funds see $1.4B inflow

Long-term municipal bond funds and exchange-traded funds took in a combined inflow of $1.430 billion in the week ended June 5, the Investment Company Institute reported on Wednesday.

It was the 22nd straight week of inflows and followed an inflow of $1.624 billion into the tax-exempt mutual funds in the previous week.

Long-term muni funds alone saw an inflow of $1.263 billion after an inflow of $1.398 billion in the previous week; ETF muni funds alone saw an inflow of $167 million after an inflow of $226 million in the prior week.

Taxable bond funds saw combined inflows of $3.226 billion in the latest reporting week after inflows of $1.402 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $5.355 billion after outflows of $2.721 billion in the prior week.

Secondary market

Munis were weaker on the

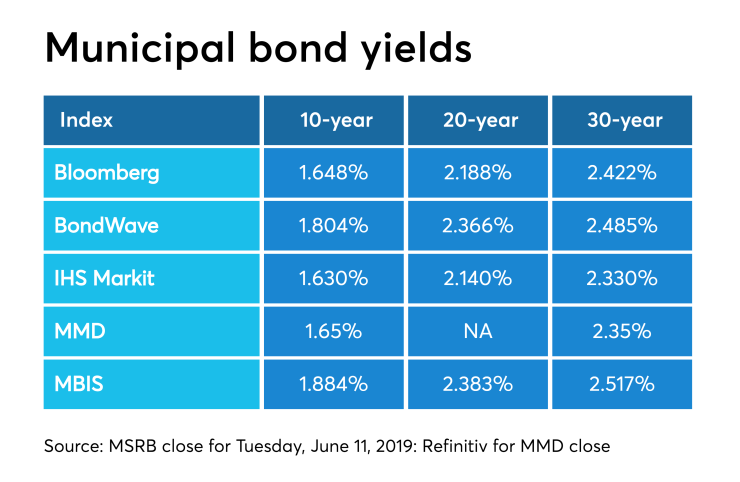

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO and the the 30-year muni remained unchanged.

“Secondary trading remained light and mixed with all the attention on the primary new issuance,” Greg Saulnier, a municipal bond analyst at Refinitiv. “That being said, some concession could be required to move a block here and there in order to make room for new issues, but overall there wasn't a sense of widespread selling.”

The 10-year muni-to-Treasury ratio was calculated at 77.6% while the 30-year muni-to-Treasury ratio stood at 89.7%, according to MMD.

Treasuries were mixed as stocks traded lower. The Treasury three-month was yielding 2.220%, the two-year was yielding 1.889%, the five-year was yielding 1.864%, the 10-year was yielding 2.121% and the 30-year was yielding 2.619%.

Previous session's activity

The MSRB reported 37,399 trades Tuesday on volume of $11.42 billion. The 30-day average trade summary showed on a par amount basis of $12.61 million that customers bought $6.21 million, customers sold $4.26 million and interdealer trades totaled $2.13 million.

California, New York and Texas were most traded, with the Golden State taking 14.414% of the market, the Empire State taking 12.23% and the Lone Star State taking 10.27%.

The most actively traded security was the Syracuse, N.Y., Series 2019A BANs 2s of 2020, which traded 79 times on volume of $35.55 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.