CHICAGO - Plans for a new bond-financed, privately operated $425 million convention center and medical mart in Cleveland took a significant step forward this week with the announcement that Cuyahoga County will acquire the existing convention center site from the city for $20 million to make way for the new complex.

County commissioners are expected to ratify the deal at a meeting tomorrow. The agreement still needs approval from the Cleveland City Council and several other privately held properties must be acquired, but officials working on the 10-year-long effort to get a new center built called it a major Cuyahoga.

"If the county was not able to reach agreement with the city, we would have been back to square one in looking at sites," said Frederick Nance, an attorney with Squire, Sanders & Dempsey LLP.

The firm is serving as legal counsel to the county on the project and Nance was lead negotiator on the county's agreement with Chicago-based Merchandise Mart Properties Inc. to build the facility and operate it.

"The fact there is a resolution is a major step forward," he said.

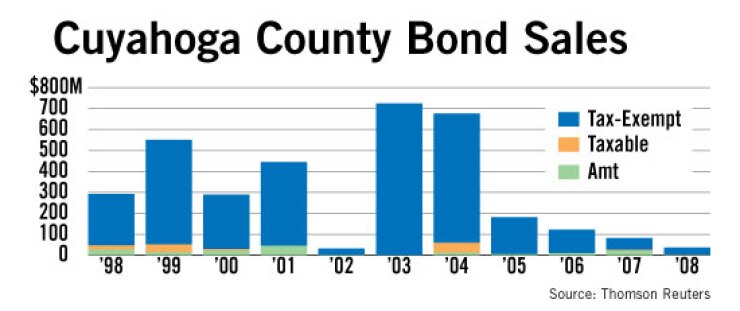

Under the financing plan, the county plans to issue taxable bonds as soon as next year and loan the proceeds to the private operator to finance construction. The bonds would be repaid with proceeds of the quarter-cent sales tax Cuyahoga has been collecting for the project since October 2007.

The revenue bonds would be secured by the county's non-tax revenues and the final size will depend on the deal's timing and the amount of sales tax revenues collected as the time of pricing, added David Goodman of Squire Sanders, a public finance attorney.

The tax raises about $40 million annually. The initial collections are expected to cover the initial design and engineering costs, so the bond sale won't be needed until next year, Nance said.

The county has focused on site selection, property acquisition, and finalizing the agreement with the private operator over the last year, so a finance team including underwriters and bond counsel have not yet been selected.

The agreement reached with the city calls for a $20 million payment from the county that will go into Cleveland's general fund. Cuyahoga officials agreed to urge the private operator to meet minimum thresholds in doling out design and construction work to local businesses and county residents. Portions of the park located over the underground convention center would remain open space.

"Today, the public makes an investment in the future of this city, county, and the region," said county Board of Commissioners President Tim Hagan, who announced the agreement with Cleveland Mayor Frank Jackson on Monday.

The convention center is located under the Cleveland Mall, a long public park established early in the last century in downtown Cleveland that also houses civic and governmental buildings. The county still needs to acquire several adjacent privately held properties or it can demolish its administration building and annex to make room for the new complex.

The convention center would replace the current facility, which is considered obsolete. The new medical mart would provide showrooms for state-of-the-art health care technology and tools aimed at attracting medical industry trade shows, drug companies, and health care equipment buyers, providing a much-needed economic boost for the city and region.

Cleveland is considered an attractive site for such a medical mart complex because it has a significant health care base, as it is home to the well-respected and prominent Cleveland Clinic, MetroHealth and University Hospitals.

The county considered using a traditional public model for designing and constructing the complex but rejected it in favor of a public-private partnership with Merchandise Mart Properties Inc. The county will have to forgo a tax-exemption on the bond issue because of the extensive involvement of a private company in the project, but the county believes the added interest costs are offset by other favorable features of the P3.

MMPI will be required to cover cost overruns, future maintenance, and capital costs to keep the facility in a state-of-the-art condition. The company also will use a design-build model that the county believes will save on costs and time. Cuyahoga officials also believe the involvement of a well-respected company with a solid track record such as MMPI is a plus in attracting trade shows and other business.

"The county was willing to do a taxable bond issue to gain those advantages," Nance said.

Cuyahoga last month reached a development agreement with the company and will finalize the plan with a financing agreement next year. The county will own the facility but lease it until 2027 to the company. After the initial term of the lease and possible extensions expire, the county will retain ownership of the facility.

The county also will have a say in various phases of the design of the project. It will pay the company more than $40 million annually to operate the facility but much of it will be returned to retire the debt and MMPI will be able to keep revenues generated at the facility.

Some elected officials and members of the public were critical of the agreement because it was reached before final site agreements were struck and design plans drawn up, and some have misgivings about handing over public funds to a private, for-profit company. The county's negotiations have drawn criticism also for the lack of public input sought.