The first of this week’s new paper hit the street with deals continuing to produce lower yields and oversubscription.

“I’m seeing some jaw-dropping yields these days but no one seems to be blinking,” said one New York trader.

Primary market

RBC Capital Markets priced Allegheny County Hospital Development Authority, Pa.’s (A1/A+/A+) $743.415 million of Series 2019A UPMC revenue bonds for retail investors on Tuesday, ahead of institutional pricing on Wednesday.

Piper Jaffray priced Baltimore, Md.’s $306.265 million of a variety of water bonds.

Bank of America priced San Mateo-Foster City Public Financing Authority’s (Aa2/AA-/NR) $270 million of wastewater revenue bonds for the clean water program. The deal was original scheduled for a par amount of $227 million.

JPMorgan priced the Health and Educational Facilities Authority’s (Aa2/AA-/ ) $228.975 million of revenue bonds for the Mosaic Health System.

In the competitive arena, Prince George’s County, Md., (Aaa/AAA/AAA) sold $329 million of general obligation bonds, with Wells Fargo winning the bidding with a true interest cost of 2.3213%.

Also, Minneapolis sold $112.42 million of GO bonds. Hutchinson Shockey won with a TIC of 1.9226%.

David Hammer, head of muni bond portfolio management at PIMCO said he believes tax-exempt municipal bonds may offer investors some key advantages, particularly as the economic expansion enters its later stages.

“The asset class will remain resilient even if the economy slows, with support from flat issuance, low relative defaults and continued demand for high quality `safe-haven' tax-efficient income — particularly in high-tax states where state and local tax deductions have been curtailed,” he said. “However, we expect more dispersion across the more than 30 municipal sectors than in recent years, and believe active management and robust credit research will be critical to identify potential winners and losers ahead of the next downturn.”

He added that the muni yield curve remains relatively steep as U.S. banks and insurance companies buy fewer long-dated muni bonds, given lower corporate tax rates following federal tax reform.

“The steeper curve presents an opportunity for investors to earn roll-down and carry by purchasing longer-dated maturities that have cheapened and may benefit from potential price appreciation,” Hammer said. “We think 20-year (non-callable to 10) maturities look attractive, offering close to a 3.5% tax-free yield, including roll-down return. Assuming the highest federal tax rate (40.8%), this equates to a roughly 5.9% tax-equivalent yield.”

Tuesday’s bond sales

Secondary market

Munis were stronger on the

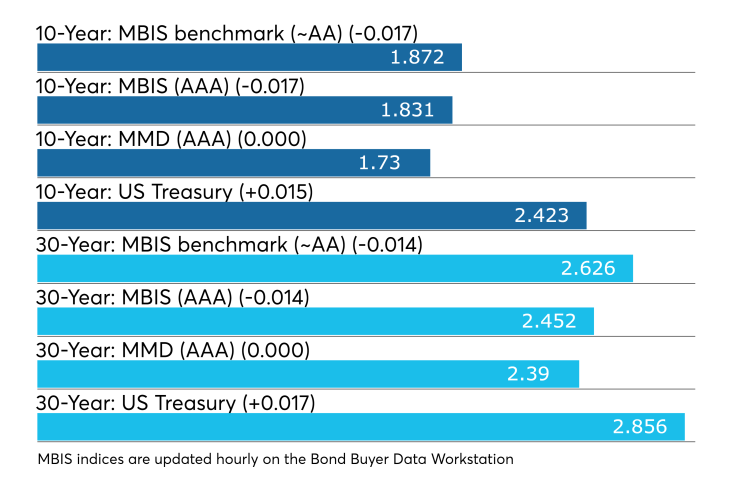

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni GO and the 30-year muni yield were flat.

Stocks ended the day slightly up, as did Treasuries.

The 10-year muni-to-Treasury ratio was calculated at 71.3% while the 30-year muni-to-Treasury ratio stood at 83.6%, according to MMD.

Previous session's activity

The MSRB reported 35,355 trades for Monday on volume of $9.574 billion. The 30-day average trade summary showed on a par amount basis of $129.340 million that customers bought $293.924 million, customers sold $82.001 million and interdealer trades totaled $45.701 million.

California, Texas and New York were most traded, with the Golden State taking 15.979% of the market, the Lone Star State taking 14.194% and the Empire State taking 8.961%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. 0s of 2051, which traded 80 times on volume of $38.155 million.

Treasury to sell $50B 4-week bills

The Treasury Department said it will sell $50 billion of four-week discount bills Thursday. There are currently $35 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.