The primary municipal bond market will see only a handful of deals price Wednesday, as it waits for the Federal Open Market Committee to make an announcement regarding interest rates.

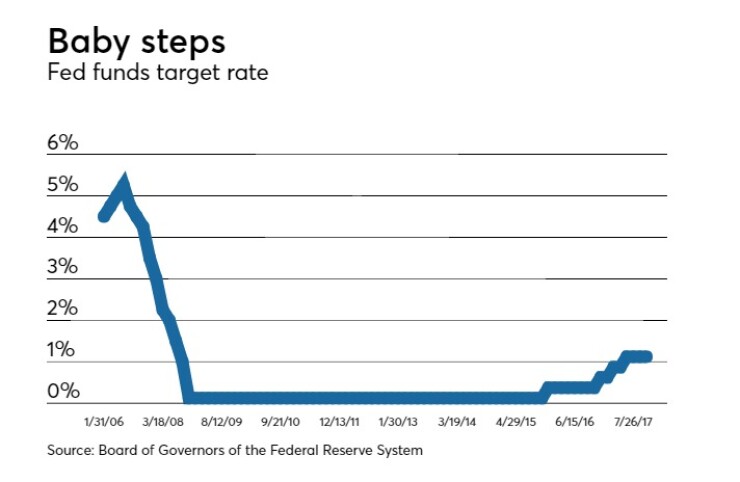

The market expectation is that the Federal Open Market Committee will hold the fed funds rate target range unchanged at 1.00% to 1.25%.

Secondary market

U.S. Treasuries were mostly weaker Wednesday morning. The yield on the two-year Treasury nudged up to 1.62% from 1.59%, the 10-year Treasury yield was higher at 2.38% from 2.37% and yield on the 30-year Treasury bond was steady at 2.87%.

Top-shelf municipal bonds finished Tuesday mostly unchanged, with the intermediate and long end of the curve steady and front end yields up by as many as three basis points.

The yield on the 10-year benchmark muni general obligation was flat from 2.01% on Monday, while the 30-year GO yield was also unmoved from 2.83%, according to a final read of Municipal Market Data`s triple-A scale.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.6% compared with 84.8% on Monday, while the 30-year muni-to-Treasury ratio stood at 98.4% versus 98.2%, according to MMD.

AP-MBIS 10-year muni at 2.325%, 30-year at 2.888%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was stronger on early trading Wednesday morning.

The 10-year muni benchmark yield dropped to 2.325% from the final read of 2.335% on Tuesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,532 trades on Tuesday on volume of $10.713 billion.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.65 billion to $9.34 billion on Wednesday. The total is comprised of $4.32 billion of competitive sales and $5.02 billion of negotiated deals.

Primary market

The Federal Open Market Committee is expected to take no action on interest rates at its meeting. President Trump is expected to make his nomination for Federal Reserve chair the next day. In typical fashion, not much action takes place on a day when the FOMC meets.

Bank of America Merrill Lynch is expected to price the Mayor and City Council of Baltimore, Md.’s $227 million of general obligation consolidated public improvement and refunding taxable bonds on Wednesday. The deal is rated Aa2 by Moody’s Investors Service and AA-minus by S&P Global Ratings.

Wells Fargo is slated to price the County of Guilford, N.C.’s $178.64 million of GO refunding bonds. The deal carries top ratings of triple-A by Moody’s, S&P and Fitch Ratings.

In the competitive arena, Williamson County, Tenn., is scheduled to sell a total of $125 million in two separate sales. The deals are rated Aaa by Moody’s.

Spokane, Wash., School District is expected to sell a total of $107.045 million in three separate sales and will be backed by the Washington State School District Credit Enhancement Program.

Massachusetts is slated to sell $142.64 million of federal highway grant anticipation notes for the Accelerated Bridge Program and is rated Aa2 by Moody’s and AAA by S&P.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.