The municipal market concentrated on the Federal Reserve Board, waiting for the highly anticipated 25 basis-point interest rate hike in Jerome Powell’s debut leading the policy meeting, but kept an eye on inclement weather.

“Everyone is waiting for the Fed, but I think it’s hard to get a read on the market today in New York because I think everyone in the city can’t wait to get out of here before we get trapped,” said a New York trader just before noon as the tri-state area was getting pelted by snow, with up to a foot expected during its fourth Nor’easter in a month.

While the quarter-point hike is expected, and priced in, the trader said there is some uncertainty about what happens after the announcement.

“It’s always a surprise how the market reacts,” he said. “Quite often you get a flat yield curve, but it always somewhat of a story and we’re not quite sure what will happen after the 25-basis-point cut.”

Before noon, the 10-year Treasury market was at 2.90%, he noted. “It seems like that would be weaker after the Fed,” closer to the rumored 3% target.

The trader said interest rates aside, the market is still pining away for volume.

“The dynamics are one thing, but we need supply,” he explained. “The supply needs to come in here; without the supply there’s no real price evidence for people” who need a benchmark and barometer on new issues in order to feel comfortable participating.

Others said there many distractions this week, including the Fed meeting.

“This week is chock full of risk events, including a potential partial federal government shutdown on Friday, the Fed meeting on Wednesday under new Fed chairman Jerome Powell, and an expected 25 bps Fed Funds rate hike to 1.50%–1.75% following the meeting, and the G-20 Finance Ministers meeting,” Peter Block, managing director of credit research at Ramirez & Co. wrote in his weekly municipal report on Wednesday.

“The market will be looking for clues as to whether or not Powell is open to four vs. three total rate hikes in 2018 that are currently reflected in the Fed dot plot,” he wrote. “The bond market is up and stocks are down significantly today on investor concerns ahead of the FOMC meeting of a more aggressive rates path.”

Primary Market

The muni primary action is light on Wednesday, as it typically is on days when the FOMC meets.

As for the only scheduled notable deal, Ramirez priced the Los Angeles Department of Airports’ $226.45 million of senior refunding revenue bonds subject to alternative minimum tax. The deal is rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

Wednesday’s bond sale

Department of Airports for the City of Los Angeles:

Bond Buyer 30-day visible supply at $5.60B

The Bond Buyer's 30-day visible supply calendar decreased $1.222 billion to $5.60 billion on Wednesday. The total is comprised of $2.34 billion of competitive sales and $3.26 billion of negotiated deals.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,768 trades on Tuesday on volume of $11.344 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 14.346% of the market, the Lone Star State taking 11.083% and the Empire State taking 10.024%.

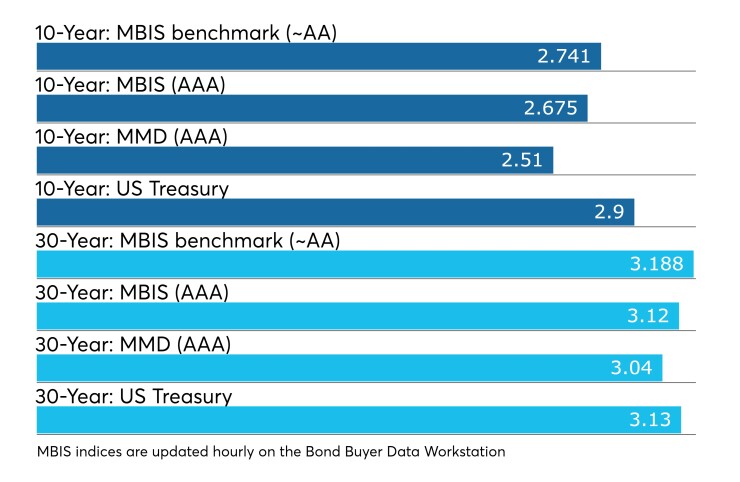

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.