All The Bond Buyer's weekly yield indexes increased this week, and the one-year note index rose 107 basis points, the largest one-week index since it began in July 1989.

The one-year note index rose to 2.09% from 1.02% last week. The previous record increase was 57 basis points on Jan. 16, 1991, and the previous record decline was 90 basis points on Jan. 10, 2001.

The jump comes after the one-year note fell 190 basis points from the start of 2008 through last week.

In a written report, Phil Fischer, municipal strategist at Merrill Lynch & Co., wrote that, as of last Wednesday, "ratios [of municipals to Treasuries] at the front end of the curve have fallen precipitously with the fall of short rates. It is highly unusual to see one-year ratios in the low-50% range, especially as Fed funds have fallen."

"This, however, is a clear reflection of the degree of credit tranching in the market," Fischer wrote. "Money market funds and other short-term investors have bid up AAA and AA bonds and sold others (especially A-rated bonds where the rating of the insurer is in doubt). The result is a shortage of the highest quality short-term debt driving down the AAA ratio."

Evan Rourke, portfolio manager at MD Sass, said the exaggerated one-year firmness seen prior to this week reflected the troubles in both the auction-rate and variable-rate demand note markets.

"On the VRDN side, you have buyers putting insured VRDNs to the dealers, causing clean VRDNs, where there's no immediate threat of downgrade, to trade very, very rich," Rourke said. "What happened was because money funds couldn't find eligible variable rate paper, they started to extend out and look at one-year securities, anything under 15 months. So it drove down the yields dramatically."

But, he continued, because yields were driven down so much, this week municipals became rich relative to taxables, so there was a spike in redemptions.

"Then, rates started to back up the other way as funds looked to sell this paper, and that trade unwound," Rourke said. "I think that's some of what you're seeing in that one year muni, just a reflection of the turmoil further down the variable rate curve."

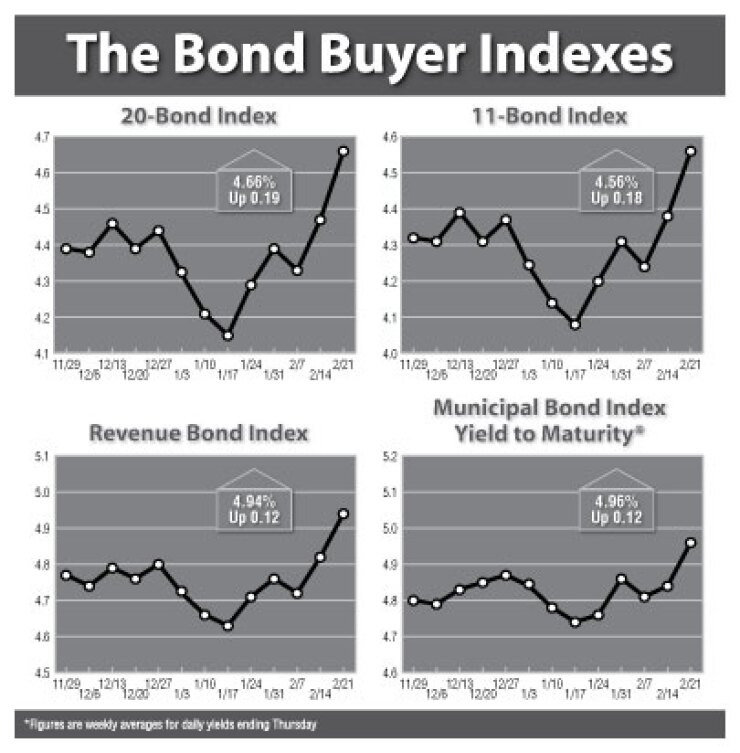

The revenue bond index rose 12 basis points, to 4.94%, which is the highest since Aug. 17, 2006, when it was 4.97%.

The 20-Bond GO Index rose 19 basis points, to 4.66%, which is the highest since Aug. 30, 2007, when it was 4.70%.

The 11-Bond GO Index rose 18 basis points, to 4.56%, which is the highest since Aug. 30, 2007, when it was 4.64%.

The 10-year Treasury note yield declined 9 basis points, to 3.76%, but remained above its 3.75% level from two weeks ago.

The 30-year Treasury bond yield declined 14 basis points, to 4.54%, but remained above its 4.52% level from two weeks ago.

The weekly average yield to maturity of The Bond Buyer's municipal bond index rose 12 basis points, to 4.96%, which is the highest since the week ended Aug. 30, 2007, when it was 4.99%.