BRADENTON, Fla. - Jefferson County, Ala., Wednesday filed a

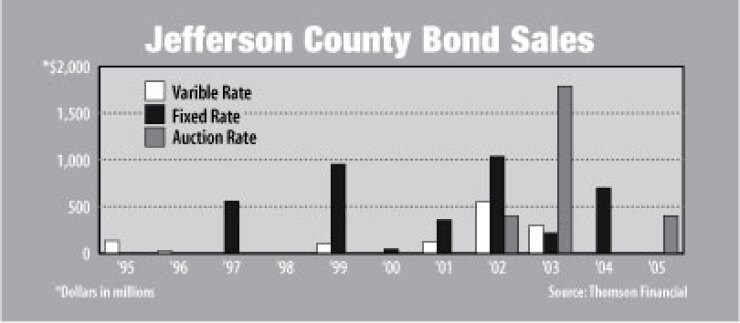

The county has $4.6 billion of outstanding debt, of which $2 billion is in auction-rate securities. Most of the outstanding debt and swaps covering a notional amount of $5.59 billion are related to the county's controversial sewer system. As of July 31, the swap portfolio had a negative mark-to-market value of $71.4 million, according the material event filing the county made.

The auctions of county auction-rate securities failed on Feb. 13 and Feb. 14 on a total of $234.5 million of warrants, the county's notice said. Much of the county's warrants, which are similar to bonds, are insured by Financial Guaranty Insurance Co.or XL Capital Assurance Inc., both of which were downgraded by the major rating agencies.

"As a result of the ratings downgrades ... the interest rates borne by the variable rate demand warrants and the auction rate warrants have increased significantly," the material event notice said. "As of Feb.14, 2008, the interest rates borne by the variable-rate demand warrants ranged from 3.08% to 10% and the interest rates borne by the auction-rate warrants ranged from 3.92% to 6.25%."

The notice also says "the floating-rate payments received by the county under its interest rate swap agreements, that are intended to offset interest payments on the warrants, have decreased as a result of a fall in short term rates."

The county receives 67% of the one-month London Interbank Offered Rate as floating rate payments under a majority of the swap agreements, the notice stated. As of February 14, 2008, one-month Libor was 3.11625%.

Jefferson County Commission President Bettye Fine Collins on Monday asked fellow commissioners and the county's financial advisers not to comment about the debt program and its impact on the county's budget. The county is expected to release a report in the next two weeks about its options with respect to the troubled debt program.

From Oct. 1 to Jan. 31, the first four months of fiscal 2008, the county incurred $6 million in unanticipated additional interest costs and officials expect higher than anticipated interest costs through the rest of the fiscal year, the notice said. Approximately $104.7 million is available in a construction fund to pay debt service.

"This is a text book example of many of the things that can go wrong based on the current credit crisis," said Peter Shapiro, managing director of Swap Financial Group, after reviewing the material event notice. "The single greatest contributor to the troubles they are having is the downgrading of the bond insurers. They have very heavy exposure to two of the weakest bond insurers."

Although the swaps are mentioned in the notice, Shapiro said it reflects the impact the county is suffering on a cash basis. The swaps are hedges against floating rate changes. "The problem is that the floating rate bonds are now performing vastly worse than anyone could have expected," Shapiro said.

Shapiro said the county clearly needs to take action to improve the performance of its floating rate bonds. Those could include obtaining a credit substitution to supplant the weaker insurers and converting the auction rate securities to variable rate demand obligations.

"All of that is easier said than done," Shapiro said. He also commended Jefferson County officials for releasing a thorough statement, and said, "They have a very big debt program and it's good to see someone being this candid."

The largest portion of the county's debt portfolio is $3.25 billion of sewer revenue warrants. That debt is rated A3 by Moody's Investors Service and A by Standard & Poor's.

Moody's spokesman Thomas Lemmon said the agency has contacted Jefferson County about the current situation.

"We're looking into it and trying to get more information," Standard & Poor's analyst James Breeding said.

Shapiro said that this is a tough situation for Jefferson County "but it's a perfect illustration of the bond insurance crisis and auction rate meltdown. They've been hit by what's going on in the credit markets, not what they have done. No one would have anticipated this."

There are signs of order coming back into the auction rate market, Shapiro said, "but it's been terribly wounded and I can't believe it will get back to where it was."