Municipal bond buyers saw a deluge of deals sweep into the marketplace on Wednesday, led by a California issuer offering short-term paper.

Primary market

Los Angeles County, California, (MIG1/AP1+/F1+) came to market with a big negotiated note issue on Wednesday, a rarity in a market where most large note offerings are done competitively.

BofA Securities priced the county’s $700 million of tax and revenue anticipation notes at 103.703 with a 5% coupon to yield 1.24%.

Morgan Stanley, Drexel Hamilton, Mischler Financial Group and Stifel were members of the group.

In June of 2018, the county sold $700 million of TRANs as 4s at 102.386 to yield 1.55%. Those notes, which mature on June 28, were trading on Wednesday at a low price of 100.152, a low yield of 1.326%.

Ahead of the sale, Fitch Ratings boosted the county’s rating to AA+, affecting more than $2 billion of outstanding debt. Fitch also raised the County’s certificates of appreciation and lease revenue bonds to AA.

Fitch said the upgrade reflected “the combined strength of the county's continued solid revenue performance and prospects, strong economic underpinnings, moderately low long-term liability burden, and highest level of gap-closing capacity.”

The county’s GOs are rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings.

BofA priced Clark County, Nevada’s $348.57 million of Series 2019A (Aa3/A+/NR) airport system subordinate lien refunding revenue bonds nit subject to the alternative minimum tax and Series 2019B (Aa2/AA-/NR) airport system revenue AMT bonds for McCarran International Airport.

Morgan Stanley priced the Texas Public Finance Authority’s (Aa1/AA+/NR) $250 million of Series 2019 lease revenue and refunding bonds.

Ramirez & Co. circulated a pre-marketing scale on the Metropolitan Washington Airports Authority’s $164.3 million of Series 2019A (A2/A-/NR) first senior lien revenue refunding bonds for the Dulles Metrorail and capital improvements. The deal is slated to be priced on Thursday.

Barclays priced the Connecticut Health and Educational Facilities Authority’s (Aa3/AA-/AA-) $168.275 million of Series B revenue bonds as a remarketing for Yale New Haven Health.

Citigroup received the written award on the Tennessee Housing Development Agency’s (Aa1/AA+/NR) $200 million of residential finance program non-AMT bonds, Issue 2019-2.

RBC Capital Markets received the official award on the Chaffey Joint Union High School District (Aa1/AA-/NR) of San Bernardino County, California’s $100 million of Series D Election of 2012 GOs.

In the competitive arena, the Clark County School District, Nevada, (AGM: A1/AA+/NR) sold $200 million of Series 2019A limited tax general obligation building bonds. BofA won the issue with a true interest cost of 2.9972%.

Proceeds will be used to acquire, construct, improve, and equip the district’s school facilities. Zions Public Finance is the financial advisor; Sherman & Howard is the bond counsel.

The district last competitively sold comparable bonds on Oct. 18, 2018, when Citigroup won $200 million of Series 2018B GOs with a true interest cost of 3.8365%.

Massachusetts (Aa1/AA/AA+) sold $196 million of GO refunding bonds. BofA won the issue with a TIC of 1.6563%.

PFM Financial Advisors was the financial advisor; Mintz Levin was the bond counsel.

Loudoun County, Virginia (Aaa/AAA/AAA) sold $170.37 million of Series 2019A GO public improvement bonds. Wells Fargo Securities won the issue with a TIC of 2.2829%.

Proceeds will be used to finance the acquisition, construction, renovation and equipping of public schools and public facilities. Davenport & Co. was the financial advisors; Nixon Peabody was the bond counsel.

Wednesday’s bond sales

ICI: Muni funds see $1.6B inflow

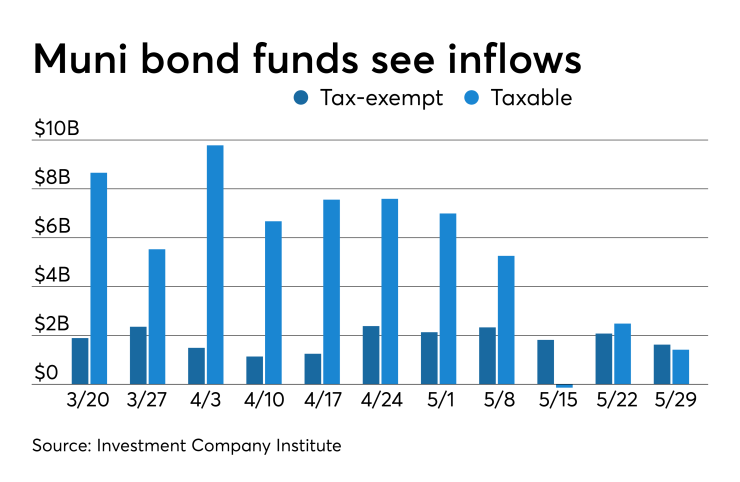

Long-term municipal bond funds and exchange-traded funds took in a combined inflow of $1.624 billion in the week ended May 29, the Investment Company Institute reported on Wednesday.

It was the 21st straight week of inflows and followed an inflow of $2.078 billion into the tax-exempt mutual funds in the previous week.

Long-term muni funds alone saw an inflow of $1.398 billion after an inflow of $1.932 billion in the previous week; ETF muni funds alone saw an inflow of $226 million after an inflow of $146 million in the prior week.

Taxable bond funds saw combined inflows of $1.416 billion in the latest reporting week after inflows of $2.486 billion in the previous week.

ICI said the total combined estimated outflows from all long-term mutual funds and ETFs were $2.708 billion after inflows of $7.834 billion in the prior week.

Secondary market

Munis were mixed on the

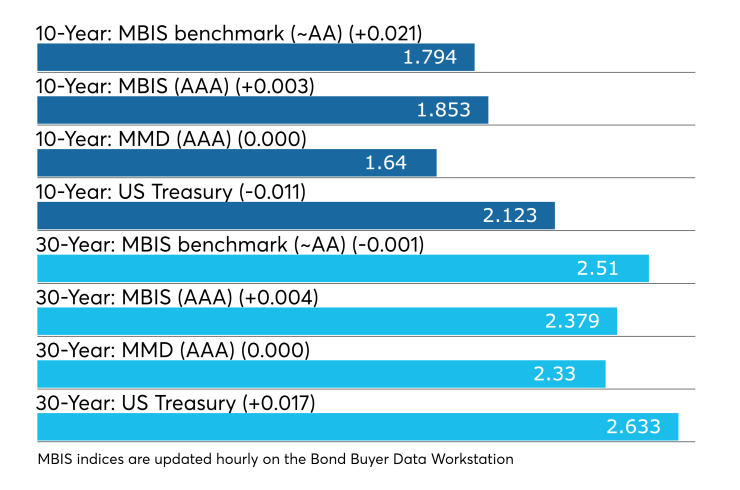

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO was steady at 1.64% and the yield on the 30-year muni was unchanged at 2.33%.

The 10-year muni-to-Treasury ratio was calculated at 77.2% while the 30-year muni-to-Treasury ratio stood at 88.5%, according to MMD.

Treasuries were mixed as stock prices rose. The Treasury three-month was yielding 2.341%, the two-year was yielding 1.839%, the five-year was yielding 1.868%, the 10-year was yielding 2.123% and the 30-year was yielding 2.633%.

“The ICE Muni Yield Curve is hovering within one basis point of yesterday’s levels,” ICE Data Services said in a Wednesday market comment. “High-yield and tobacco bonds are also stable. Taxables are lower in the short end with the one-year down almost eight basis points, but the 30-year maturities are up three basis points.”

Previous session's activity

The MSRB reported 42,212 trades Tuesday on volume of $14.29 billion. The 30-day average trade summary showed on a par amount basis of $12.62 million that customers bought $6.23 million, customers sold $4.15 million and interdealer trades totaled $2.24 million.

California, Texas and New York were most traded, with the Golden State taking 13.989% of the market, the Lone Star State taking 12.496% of the market, and the Empire State taking 8.809%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured A-1 5s of 2058, which traded 52 times on volume of $37.88 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.