CHICAGO - A series of fiscal challenges await triple-A rated Omaha's new mayor and a City Council that take office Monday as revenues falter and pension liabilities pose a long-term strain.

The transition in leadership with incoming Mayor Jim Suttle comes as the city's finance team remains busy with a handful of financings. Omaha recently sold $65 million of lease revenue bonds and will sell another $45 million next spring to finance construction of a new NCAA World Series stadium.

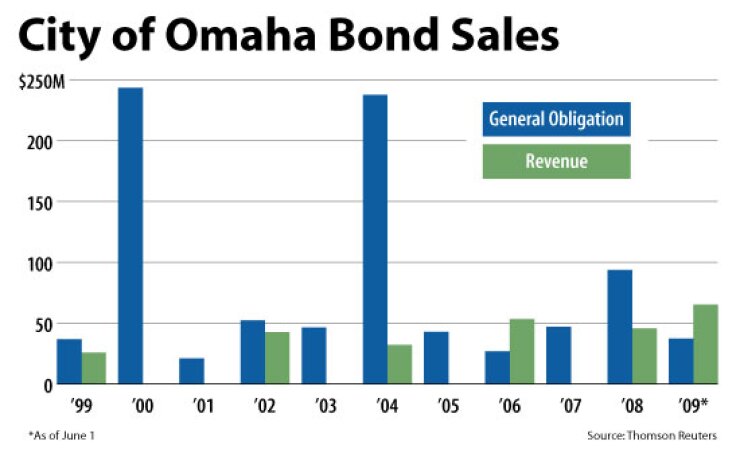

The city is readying a $20 million to $30 million sale of sewer revenue bonds for this summer to launch the construction phase of a long-planned $1.5 billion to $2 billion capital improvement program to meet standards mandated by the U.S. Environmental Protection Agency. Officials also are planning to sell roughly $18 million of general obligation debt this fall.

The sewer issuance stems from EPA rules affecting local governments with combined sewer systems that carry both sewage and storm water. Most municipalities with combined sewer systems are expected to develop long-term overflow control plans to comply with a 1994 EPA order. The agency has estimated that 762 cities across the country are affected.

Under the long-term plan to upgrade the system and limit the dumping of untreated sewage into clean waterways, Omaha will separate some of its combined sewers, construct new storm water treatment plants that will run in wet weather and use faster acting chemicals, and build a 5.8-mile tunnel along the Missouri River to carry overflow to treatment plants. The city is required under a consent agreement with regulators to lower the amount of untreated sewage that flows into waterways by 2024.

"This will mark our first issue to fund construction," said city finance director Carol Ebdon. "Our formal plan for the program should be approved by the state and federal EPA this fall."

Omaha in 2006 sold $53 million for various projects and to fund the study on the needed upgrades and annual issuance is expected to continue. State and federal regulators have signed off on the draft version of the capital plan.

Ebdon expects to issue the debt as soon as July and it's expected that the city will work with longtime underwriter D.A. Davidson & Co. in the lead spot with Kutak Rock LLP serving as bond counsel. To fund the mammoth overhaul, sewer rate increases began last year and will continue through 2010 with additional rate hikes between 2011 and 2014 that have not yet been adopted by the City Council.

The size of the upcoming transaction is slightly below previous estimates because of federal stimulus funds Omaha now expects to receive. The city will seek to use the state revolving fund for some issuance and is reviewing the potential use of the federal government's taxable Build America Bond program, Ebdon added.

After the sewer deal, the city will sell $16 million to $18 million of GOs with the final size depending on refunding opportunities, according to Comptroller Al Herink. The city's $558 million of GO debt carries a Aa1 from Moody's Investors Service and AAA from Standard & Poor's.

Suttle, a council member since 2005 and a Democrat, beat his Republican opponent, former mayor Hal Daub, in the mayoral race last month. The retiring Democratic incumbent Mike Fahey did not seek re-election. He endorsed Suttle. although they were considered to have a strained relationship that included differences over the baseball stadium project.

Suttle, a licensed engineer who had once served as public works director and has also held transportation planning posts in other cities, has already weighed in on several fiscal issues facing Omaha. He has called for a tentative agreement with city unions for a 2.75% raise annually for three years to be renegotiated if layoffs and service cuts are to be avoided to address a budget deficit that has grown to nearly $14 million as sales tax collections falter.

Omaha revised its collections downward last December and expects sales taxes - representing 45% of operating revenues - to remain flat. Properties were recently reassessed and lower values are expected to impact next year's budget.

"We continue to keep an eye on the sales tax and other key revenues," Ebdon said.

Moody's wrote in a recent report that the city's credit remains sound.

"Moody's expects management to continue to focus on maintaining budgetary financial balance," the agency said. "This focus, along with significant revenue raising flexibility, should allow for healthy financial operations." Strengths cited include the city's large, diverse and stable economic base with average socio-economic indicators, strong fiscal management, and a manageable debt burden.

A significant long-term challenge is a growing unfunded pension liability that is estimated to have risen to $764.9 million as of last year. The city has failed to keep up with actuarial determined payments, posing a risk to its credit. It also faces an unfunded liability of $300 million for other post-employment benefits.

Suttle has said he would push for legislative support for a proposed sales tax increase and other measures endorsed by a Fahey-appointed pension task force to tackle the city's unfunded pension liabilities. The task force last month rejected spending cuts and the sale of city assets in favor of a sales tax increase or property tax hike and new garbage fee to generate an additional $15 million needed annually to shore up the fund.

The recommendations also call for various reforms that would save $15 million. Officials have warned that left unchecked, the liability will grow into the billions and the city will run out of funds to fully cover benefits in 20 years.

Ebdon is leaving her post as the new mayor takes office, though she said her decision to return to her previous position on the faculty at the University of Nebraska in Omaha was not driven but the election. "I came here for what was supposed to be a year and ended up five years," she said. Fahey asked Ebdon, who had served on his mayoral advisory team, to take the finance post.

Herink, the city's longtime comptroller of 30 years, will remain in his position.

Another deal on Omaha's horizon is the final debt financing - about $45 million - for the new NCAA World Series baseball stadium that will replace the 60-year-old Rosenblatt Stadium. The city sold $65 million of tax-exempt lease revenue bonds last month through the Omaha Public Facilities Corp., capturing a true interest cost of 4.67%. The lease payments are supported by a limited tax GO pledge not subject to appropriation.

The city and the National Collegiate Athletic Association signed an agreement last year that keeps the college championship in the city through 2030. Omaha has hosted the tournament in Rosenblatt Stadium since 1950.

The $140 million facility that will open in 2011 will be built downtown on city-owned parking lots adjacent to the five-year-old Qwest Center, the city's main convention center. Financing is coming from a mix of private donations, hotel and motel taxes, a car rental fee, keno revenue, and some other stadium-generated revenues.

The bonds were rated Aa1 by Moody's and AA-plus by Standard & Poor's. The latter said the rating is one notch lower than the city's AAA "due to the limited nature of the security and the lack of a full faith and credit pledge."