-

The Puerto Rico General Fund has paid out $1.5 billion on the bankruptcies after initial expectations were $370 million over nearly a decade.

August 24 -

José Pérez Riera will fill the post that has been vacant for over three years.

August 22 -

Peterson objected to the board's treatment of PREPA bondholders.

August 18 -

GoldenTree Asset Management noted the judge in Sept. 29, 2022, had demanded "meaningful deadlines" in the bankruptcy.

August 18 -

Bondholders retain the right to argue on appeal that they perfected their liens on revenues and funds.

August 17 -

Following another court ruling on a 2022 labor law the Oversight Board rejected, Puerto Rico professors doubt the local government will operate more responsibly any time soon.

August 15 -

Plan of adjustment deadline schedule gets extended to Aug. 18.

August 11 -

Economists remain guarded about the island's economic future.

August 8 -

The restructuring would make bondholders whole, but the bonds' maturities are being pushed out by 25 to 35 years.

August 7 -

Judge Swain approves another deadline extension for a proposed plan of adjustment.

August 4 -

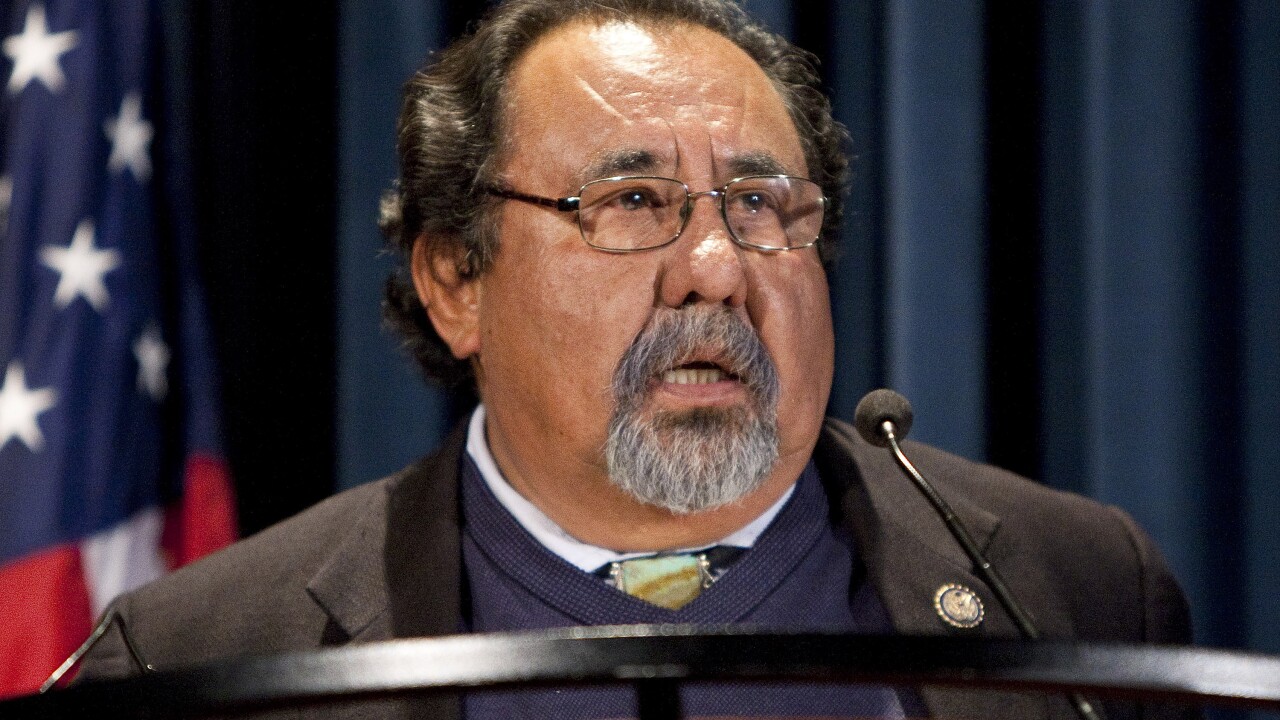

Sponsors say bill is a chance to have territories' needs addressed.

August 1 -

The board and the PREPA bond parties told Swain they had reached "an agreement in principle to resolve the outstanding perfection issues" in the bankruptcy.

July 31 -

The FOMB needs to return to its "deal mindset" so that we can end the bankruptcy at PREPA. While gaps remain between the FOMB's and bondholders' affordability analyses, they are not insurmountable.

July 17 Puerto Rico Financial Oversight and Management Board

Puerto Rico Financial Oversight and Management Board -

The May economic activity index showed an increase.

July 11 -

The money is to help AES-Puerto Rico continue to provide PREPA with electricity.

July 7 -

The fiscal 2024 General Fund increases 2.5%

June 30 -

U.S. District Judge Laura Taylor Swain ordered the Oversight Board propose a new plan of adjustment by July 14.

June 28 -

Judge Laura Taylor Swain said she found the Oversight Board expert's calculations more convincing than those of the bondholders.

June 27 -

The board is offering $2.4 billion to all bondholders while $8.5 billion of par value is outstanding.

June 26 -

The plan of adjustment hearing scheduled for late July will be postponed.

June 22