-

The municipal market can best be described as a "Goldilocks market" due to accommodative federal monetary policy, strong demand and limited supply, bond director Ben Watkins told the Cabinet.

December 15 -

For taking proactive measures to update city infrastructure during the height of pandemic, Tampa, Florida's $362.8 million water and wastewater systems revenue and refunding revenue bond transaction earned The Bond Buyer's Deal of the Year for the Southeast Region.

December 10 -

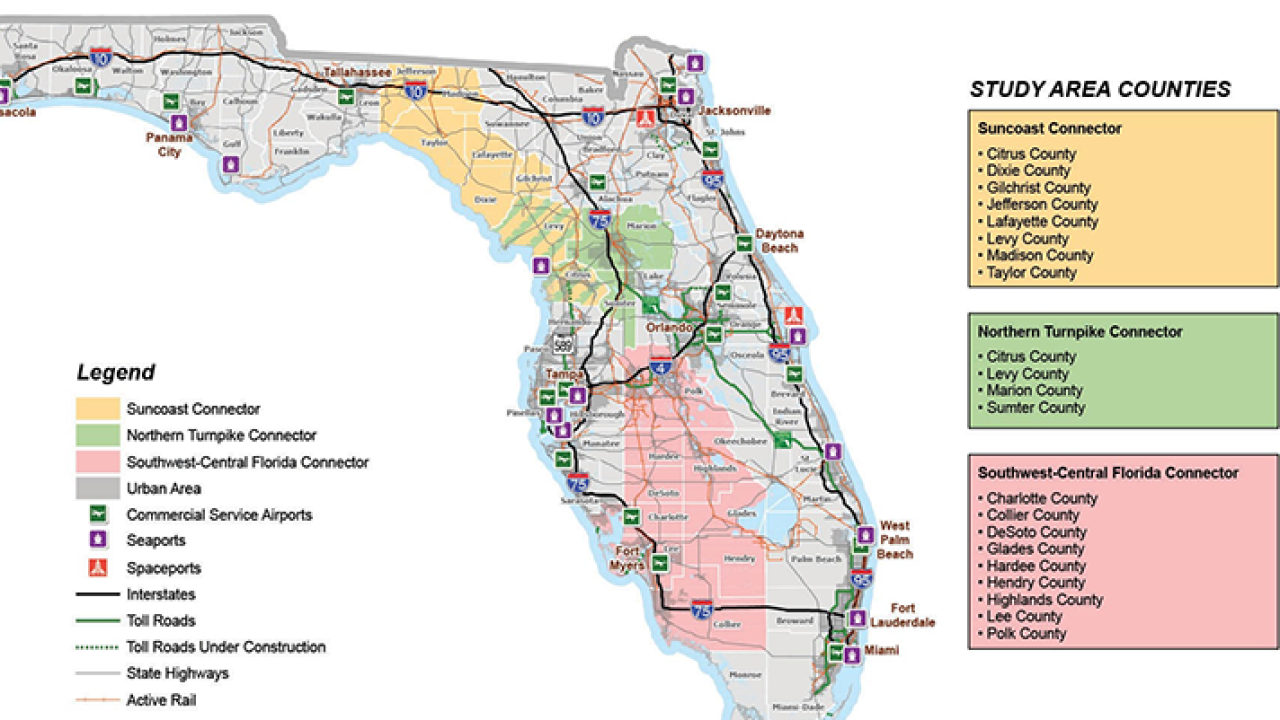

Task forces studying three proposed toll road projects failed to conclude if there is a need for the new corridors or modifications of existing roads.

December 9 -

Florida’s privately owned passenger train company, which halted service citing the coronavirus pandemic, is bringing $950 million of nonrated private activity bonds.

December 2 -

The Florida Department of Transportation extended the suspension of Garcon Point Bridge toll collections because it is being used as a detour.

October 30 -

The most significant revenue loss in Florida continues to be the drop in sales tax collections in the tourism and hospitality industries.

October 29 -

Nuveen’s John Miller, the biggest backer of Fortress Investment Group Inc.’s Brightline passenger railroad in Florida, had been skeptical of plans to forge ahead swiftly with a multi-billion dollar venture to build a second line running between Southern California and Las Vegas.

October 21 -

The Fortress Investment Group-backed passenger railroad in Florida, Brightline Holdings LLC, is offering to buy back as much as $250 million of bonds from investors for 100 cents on the dollar, about 17% more than where some of the securities have been trading.

October 21 -

Toll collections on the Garcon Point Bridge have been suspended since mid-September because of Hurricane Sally, pitting the bond trustee against the state of Florida again.

October 21 -

Bryant Miller Olive PA has practiced public finance and governmental law across the Sunshine State and the Southeast for five decades.

October 9 -

Disney in late September said it would lay off 28,000 employees at California's Disneyland and Florida's Walt Disney World resorts.

October 8 -

Florida is taking public comments about a toll road program that would add more than 300 miles of highway across broad swaths of the state.

October 7 -

The U.S. Supreme Court denied Indian River County, Florida's request for a writ of certiorari, leaving Brightline's bond financing intact.

October 6 -

Georgia's MEAG Power, Jacksonville, Florida, and its utility, JEA, received two-notch rating boosts from Moody’s after settling their federal lawsuit.

October 2 -

Even with revised estimates amid the pandemic, year-over-year revenue collections in Florida were down 4.6% in August compared with 2019.

September 28 -

Florida State University's voluntary disclosure on lower dormitory occupancy is an example of providing timely information, Moody's Investors Service said.

September 24 -

A multi-part study by Cornell Consulting concludes that Florida should not build three major toll roads that are under consideration.

September 23 -

The Florida Cabinet approved new money and refunding bonds, some of which may be sold as taxable debt with advance tax-exempt refundings no longer possible.

September 22 -

About 500 of Raymond James' workforce will be cut because of a decline in earnings due to low interest rates and the pandemic-induced economic downturn.

September 16 -

In a long-range revenue forecast, a state economist told lawmakers that it could take two or three years for Florida’s hard-hit tourism industry to recover.

September 14