-

Making the Federal Reserve's Municipal Liquidity Facility a permanent emergency lending program would be “valuable and forward thinking," Connecticut Treasurer Shawn Wooden told a House subcommittee.

September 23 -

The drenching of several regions exposed vulnerabilities that vary by state, and recurring problems that could jeopardize municipal credit.

August 24 -

Issuers sold nearly $60 billion of debt as states, cities and agencies adjusted to the COVID-19 environment and other variables.

August 20 -

Most recently, he was a principal investment officer and head of global equity at the Los Angeles County Employees Retirement Association, or LACERA.

August 18 -

Another replacement for exempt advance refundings, forward delivery bonds are attractive to issuers looking for savings and investors seeking incremental yield.

August 13 -

Children born into poverty whose births are covered by the state's Medicaid program are eligible, with funding through $600 million of GO bonds over 12 years.

July 16 -

State Treasurer Shawn Wooden discusses the state's across-the-board bond rating upgrades, its immediate challenges and initiatives such as "CT Baby Bonds." Paul Burton hosts. (19 minutes)

June 29 -

The state stands to become the 19th to legalize non-medical use of cannabis and along with it up to $97 million of new tax revenues by fiscal 2026.

June 18 -

Lawmakers could not enact the bill on the final day of the regular session, when House Republicans threatened a filibuster.

June 15 -

The state's momentum with rating agencies continued when Fitch elevated its special tax obligation bonds to AA-minus.

May 27 -

The Investment Company Institute reported another week of inflows, but at a lower clip than recent weeks with $541 million coming into municipal bond mutual funds.

May 19 -

Price indexes in the latest New York manufacturing survey came in higher than expected, furthering inflation concerns.

May 17 -

Three upgrades in two days and four in six weeks mark the state's first bond-rating upgrades in 20 years.

May 17 -

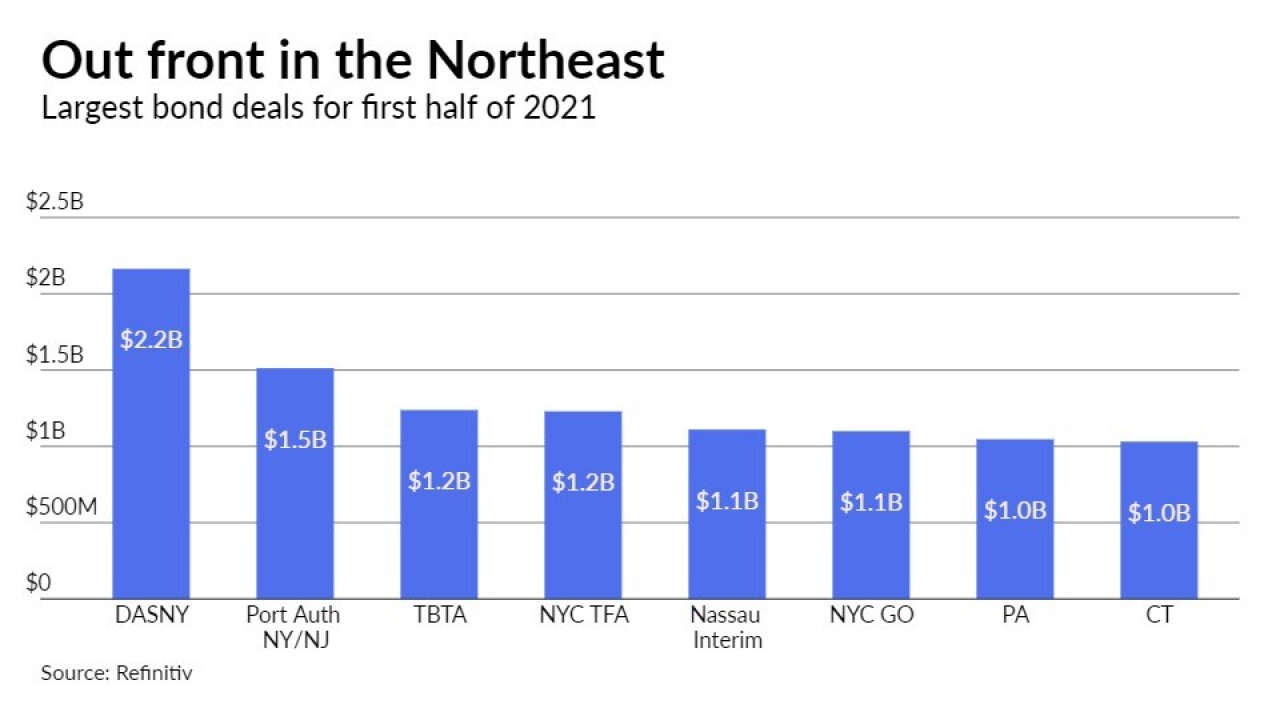

After facing outside economic data pressures and rising U.S. Treasuries, municipals ended the week on solid footing ahead of a larger calendar with newly upgraded Connecticut leading with $1 billion of exempt and taxable GOs.

May 14 -

Fitch Ratings, S&P Global Ratings and Kroll Bond Rating Agency all upgraded the Constitution State ahead of a $1 billion taxable and tax-exempt transaction set for Wednesday.

May 14 -

Officials remembered him for his diligence and the respect he earned from both sides of the political aisle.

May 12 -

Refinitiv Lipper reported $1.889 billion of inflows, with $641 million in high-yield. Negotiated deals repriced to lower yields while competitive loan yields were compelling from New Jersey and Los Angeles USD.

April 22 -

Sub-1% 10-year municipals and low ratios may test investor appetite for the asset class but it is hard to ignore the strong fundamentals and substantial fund flows in the backdrop.

April 16 -

Forward delivery sales, a replacement for tax-exempt advance refundings, could grow in 2021.

April 15 -

Buoyed by a ratings upgrade from Moody's, the state still faces challenges including high debt and legacy costs.

April 9