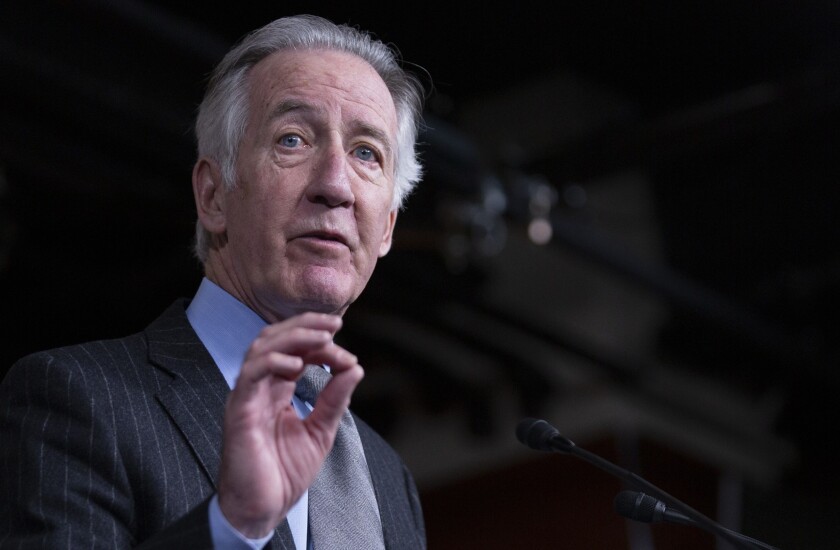

Rep. Richard Neal, D-Mass.

Neal, a former mayor of Springfield, recently won a hard-fought Democratic primary and does not face a Republican challenger on the November ballot.

Neal’s committee was responsible for the municipal bond provisions in the Moving America Forward Act which is expected to be the House Democrats’ template for infrastructure development in the next Congress.

The legislation includes a revision in the definition of bank-qualified bonds, a new program of $30 billion for qualified school infrastructure bonds and create direct-pay Qualified Infrastructure Bonds which would start with a federal 42% subsidy for interest expenses.

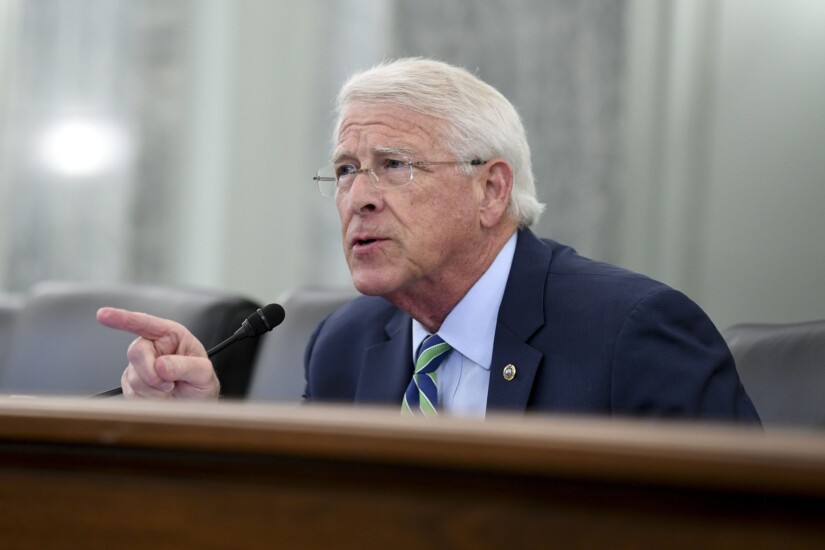

Sen. Roger Wicker, R-Miss.

Wicker and Sen. Debbie Stabenow of Michigan, who is senior Democrat on the Finance Committee, are lead sponsors of a bill to restore tax-exempt advance refunding of municipal bonds.

Wicker also is the co-author with Sen. Michael Bennet, D-Colo. of bipartisan legislation to restore direct-pay bonds for financing infrastructure.

The Wicker-Bennet American Infrastructure Bonds Act would provide a 35% federal subsidy to taxable bonds from the date of enactment through 2026, when the subsidy would drop to an estimated revenue-neutral rate of 28%.

Sen. Debbie Stabenow, D-Mich.

Stabenow's municipal finance experience includes service as a county commissioner and in both chambers of the Michigan Legislature. She doesn't face re-election until 2024.

Sen. Michael Bennet, D-Colo.

The Wicker-Bennet American Infrastructure Bonds Act would provide a 35% federal subsidy to taxable bonds from the date of enactment through 2026, when the subsidy would drop to an estimated revenue-neutral rate of 28%.

The legislation would allow state and local governments to issue taxable bonds for any public purpose expenditure that is eligible to be financed with tax-exempt bonds.

The new direct-pay bonds would be an improvement from the Build America Bonds that were authorized under the 2009 Americans Recovery and Reinvestment Act because they would be exempt from the sequestration reductions that have plagued the BABs program.

Bennet, who serves on the Senate Finance Committee, is a former superintendent of the Denver public school system who does not face re-election until 2022.

Bennet also is an original co-sponsor with Sen. Rob Portman, R-Ohio, of the bipartisan Carbon Capture Improvement Act. If more than 65% of carbon dioxide emissions from a given facility are captured and injected underground, 100% of the eligible equipment could be financed with tax-exempt private activity bonds. If less than 65% is captured and sequestered, then tax-exempt financing is permitted on a prorated basis.

Rep. Dutch Ruppersberger, D-Md.

Ruppersberger and Rep. Steve Stivers, R-Ohio, are the lead House sponsors of the Investing in Our Communities Act, H.R. 2772, to reinstate tax-exempt advance refunding which is the top legislative priority of municipal finance groups.

Ruppersberger is a former Baltimore County executive who served in local government for 17 years.

Rep. Steve Stivers, R-Ohio

The duo are the lead House sponsors of the Investing in Our Communities Act, H.R. 2772, to reinstate tax-exempt advance refunding, which is the top legislative priority of municipal finance groups.

Rep. Terri Sewell, D-Ala.

Sewell, who is a bond attorney, serves on Ways and Means Committee.

Her Municipal Bond Market Support Act is one of the provisions in the House-passed Moving America Forward Act.

Sewell also is one of the lead cosponors of a bill that would raise the limit on tax-exempt private activity bonds used for surface transportation and freight improvement projects by $5.8 billion. The current volume cap of $15 billion has nearly reached its limit.

Sen. John Cornyn, R-Texas

Cornyn, a member of the Senate Finance Committee, is continuing his advocacy for PABs as a lead sponsor of a proposal to raise the federal cap on surface transportation and freight improvement projects by $5.8 billion.

The current volume cap of $15 billion on PABs issued for highways and freight improvement has nearly reached its limit. Cornyn’s proposed Building United States Infrastructure and Leveraging Development (BUILD) Act has bipartisan support in both the House and Senate.

Sen. Mark Warner, D-Va.

He is a lead cosponsor with Sen. John Cornyn, R-Texas, of the Building United States Infrastructure and Leveraging Development (BUILD) Act which would raise the federal cap on tax-exempt private activity bonds used for surface transportation and freight improvement projects by $5.8 billion.

The current volume cap of $15 billion has nearly reached its limit.

Rep. Earl Blumenauer, D-Ore.

This bipartisan bill would raise the federal cap on tax-exempt private activity bonds issued for surface transportation and freight improvement projects by $5.8 billion.

Blumenauer is a member of both the Ways and Means Committee and the Transportation and Infrastructure Commitee.