Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

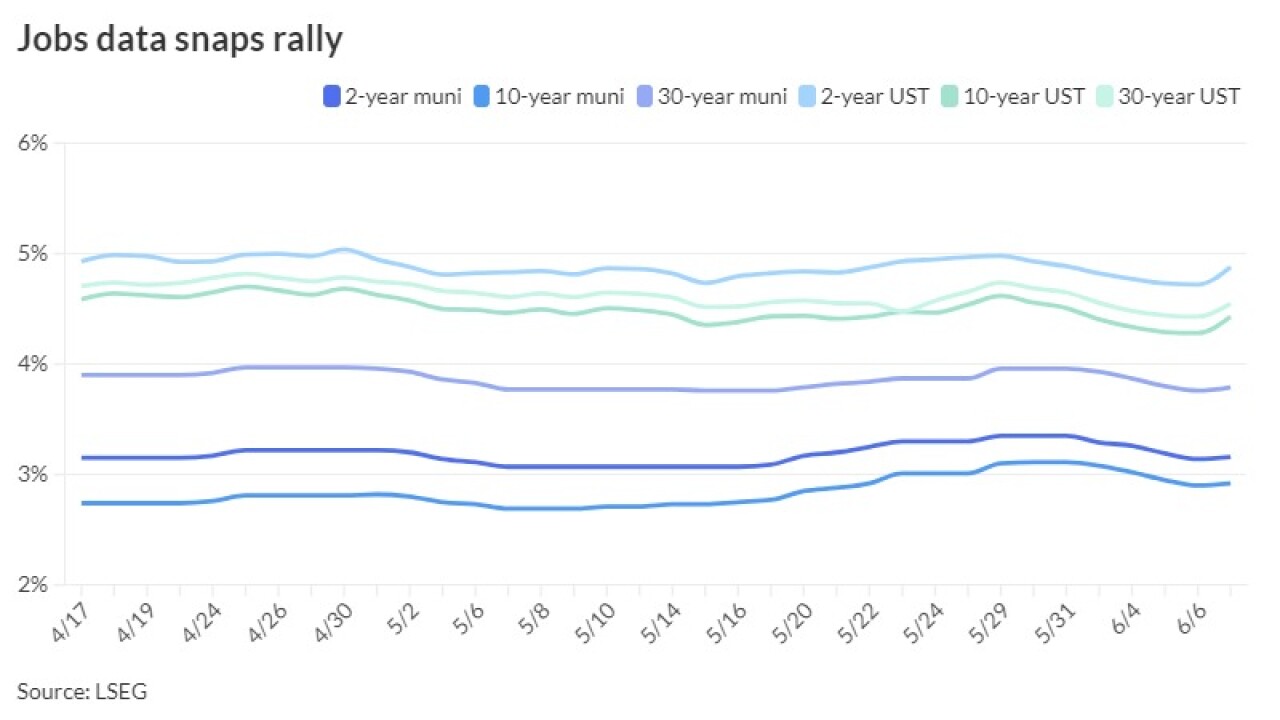

Barclays rate strategists believe the 10-year part of the Treasury curve has room to cheapen. "In that case, tax-exempts will likely not only follow, but underperform."

By Lynne FunkAugust 16 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

By Lynne FunkAugust 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

By Lynne FunkAugust 14 -

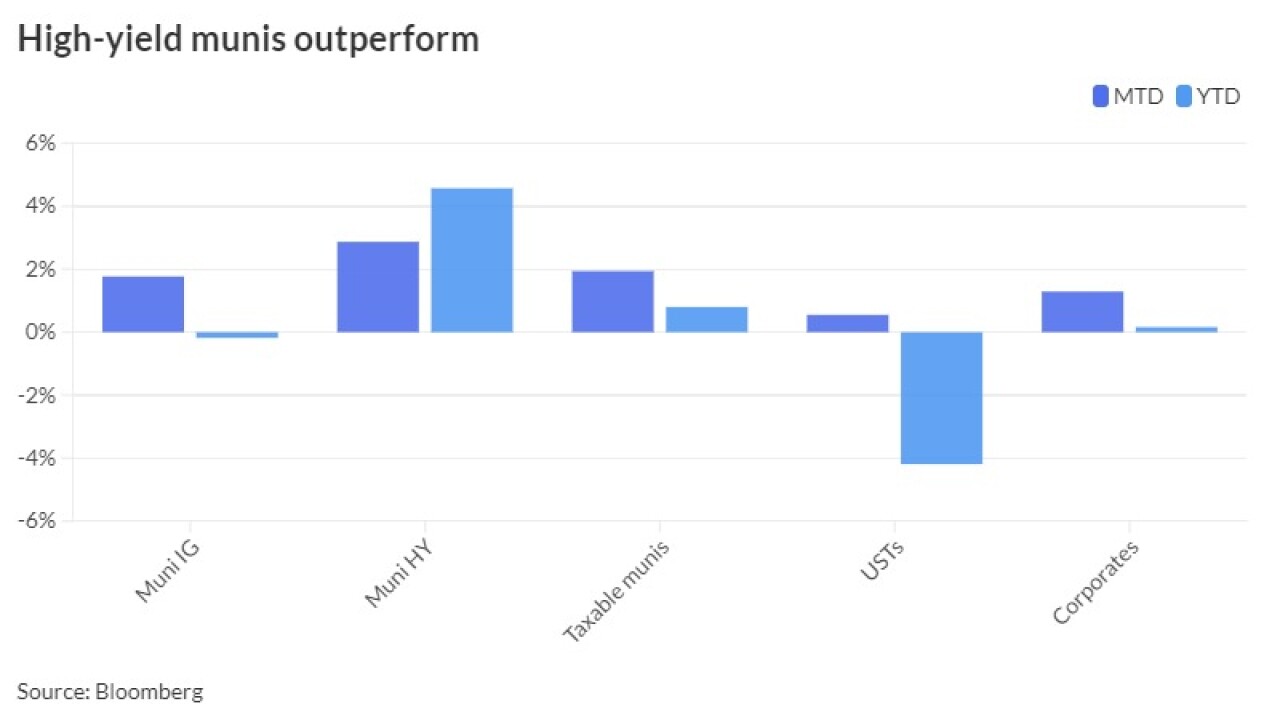

Muni returns so far in August are in the black, with the Bloomberg Municipal Index at 0.53% this month and 1.04% year to date. High-yield continues to outperform with returns at 0.68% in August and 5.99% in 2024.

By Lynne FunkAugust 9 -

Competitive deals are slated to total about $2.9 billion, near the highest for any week this year, said J.P. Morgan strategists.

By Lynne FunkJuly 8 -

In a week that culminated in headline-grabbing events — a presidential debate, several Supreme Court decisions, more macroeconomic data to add to Fed policy expectations — municipals closed on a quiet note and in the black for June.

By Lynne FunkJune 28 -

Finance officials for the city decided to be the first municipal issuer to use the distributed ledger technology for a $10 million deal, banking on cost savings, better liquidity and more access for retail investors to their bonds. Mayor Tom Koch, CFO Eric Mason and Strategic Asset Manager Rick Coscia say it should be the first of many deals for the industry.

By Lynne FunkJune 25 -

"It is hard to be overly excited about current valuations of tax-exempts relative to Treasuries; however, at tax-adjusted yields (using individual tax brackets), munis look quite attractive compared with other asset classes," noted Barclays PLC.

By Lynne FunkJune 21 -

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

By Lynne FunkJune 12 -

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

By Lynne FunkJune 7