Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

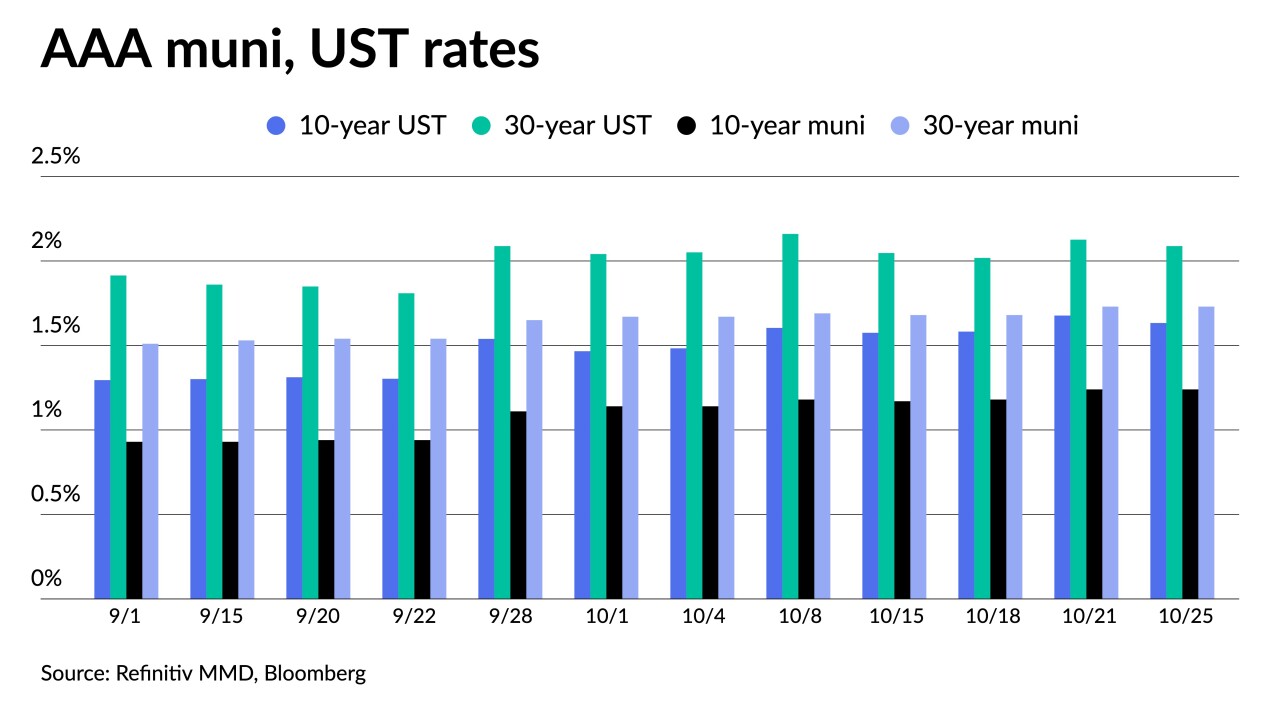

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

By Lynne FunkNovember 9 -

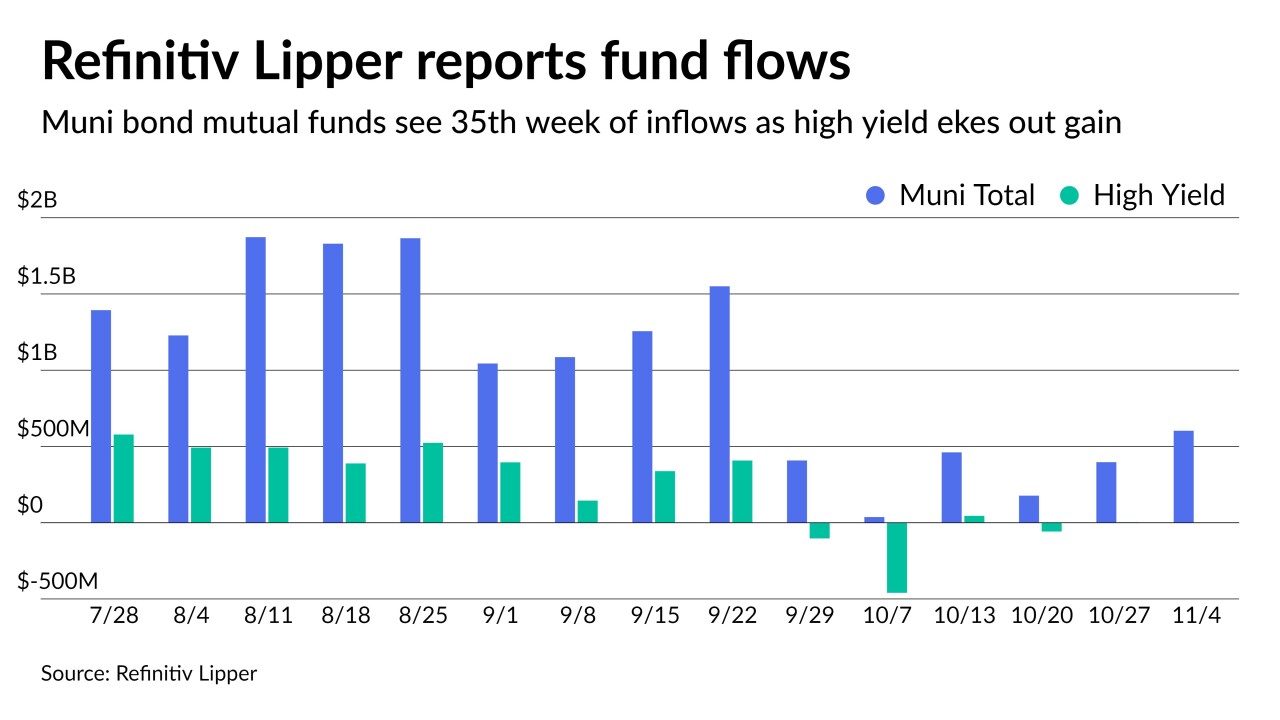

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

By Lynne FunkNovember 4 -

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

By Lynne FunkNovember 3 -

The FOMC will likely take the opportunity to profess its reliance on data to decide liftoff and reiterate the threshold for a rate hike remains higher than for taper.

By Lynne FunkNovember 2 -

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

By Lynne FunkNovember 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

By Lynne FunkOctober 29 -

The legislation Gov. Pedro Pierluisi signed late Tuesday is sufficient to issue new bonds, the board said, which was integral to getting the island out of its $33 billion bankruptcy.

By Lynne FunkOctober 28 -

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

By Lynne FunkOctober 27 -

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year.

By Lynne FunkOctober 26 -

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

By Lynne FunkOctober 25