Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

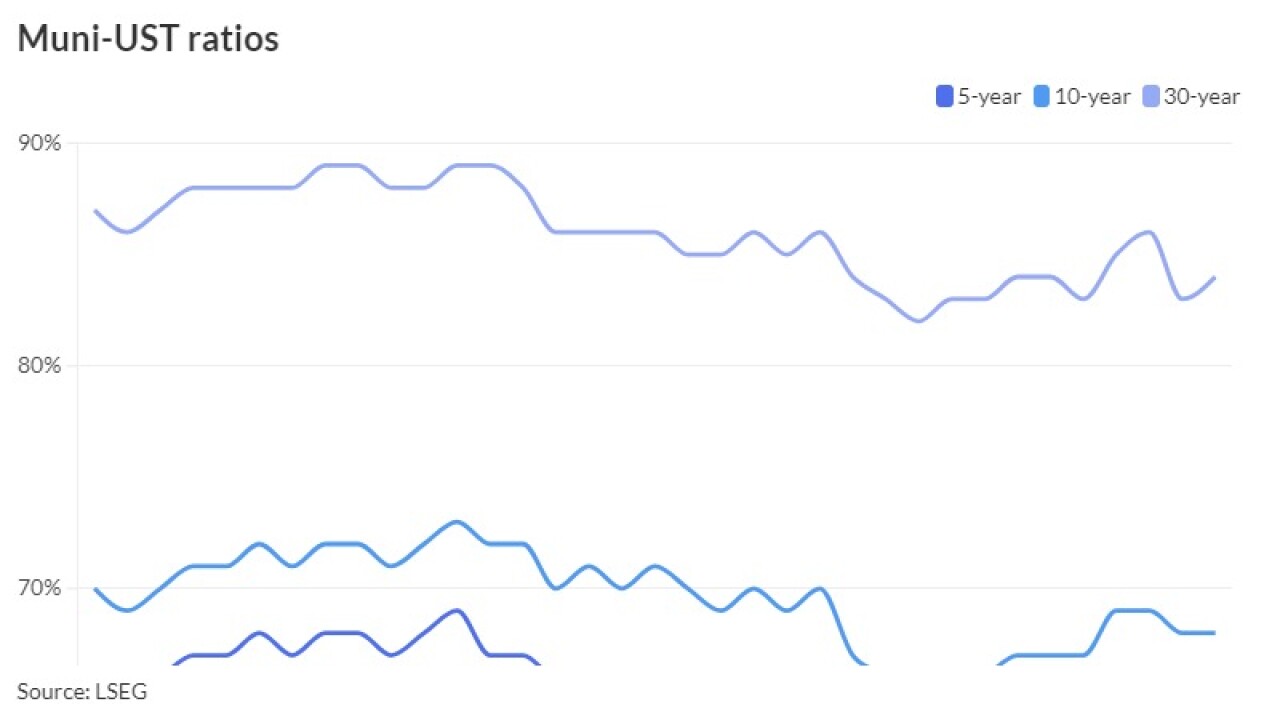

The correction to the municipal market has improved muni to UST ratios while uncertainty hangs over ahead of the election. J.P. Morgan's Peter DeGroot said the firm expects the end of next week "will mark the end of the difficult technical period in 2024 and believe that net supply in November will lead to better valuations broadly in the municipal market."

By Lynne FunkOctober 25 -

Several macro trends have converged to drive growth in municipal bond issuance, said participants at The Bond Buyer's California Public Finance conference.

By Lynne FunkOctober 25 -

Despite this week's underperformance, exempt investment-grade munis continue to outperform taxable sectors.

By Lynne FunkOctober 18 -

Municipal triple-A yield curves played catch up to USTs Friday to close out a week of more mixed economic data that has economists constantly reevaluating their Federal Reserve policy expectations with little consensus.

By Lynne FunkOctober 11 -

Municipal investors can expect just shy of $10 billion of new issues from which to choose the first full week of October and the fourth quarter, led by a $1.5 billion taxable general obligation bond offering from New York City. Connecticut is bringing $935 million of general obligation bonds.

By Lynne FunkOctober 4 -

Municipal bond mutual funds saw inflows of $1.879 billion in the latest week, marking the 14th consecutive week of inflows and the highest level of 2024, per LSEG data, reiterating the strong investor support for this market.

By Lynne FunkOctober 3 -

The biggest theme within the muni market — and what is responsible for its performance — is the amount of cash on the sidelines, with $6-plus trillion in money market funds and close to $2.5 trillion in certificates of deposits, said Julio Bonilla, a fixed-income portfolio manager at Schroders.

By Lynne FunkOctober 2 -

With supply ballooning, reinvestment dollars at lows of the year, J.P. Morgan's Peter DeGroot argues the next few weeks could offer the best opportunity to buy bonds of the year – and possibly the rate cycle. DeGroot talks about this, plus potential impacts of shifting investor behavior on market liquidity, and what the upcoming election might mean for tax policy and the muni market. Lynne Funk hosts.

By Lynne FunkOctober 1 -

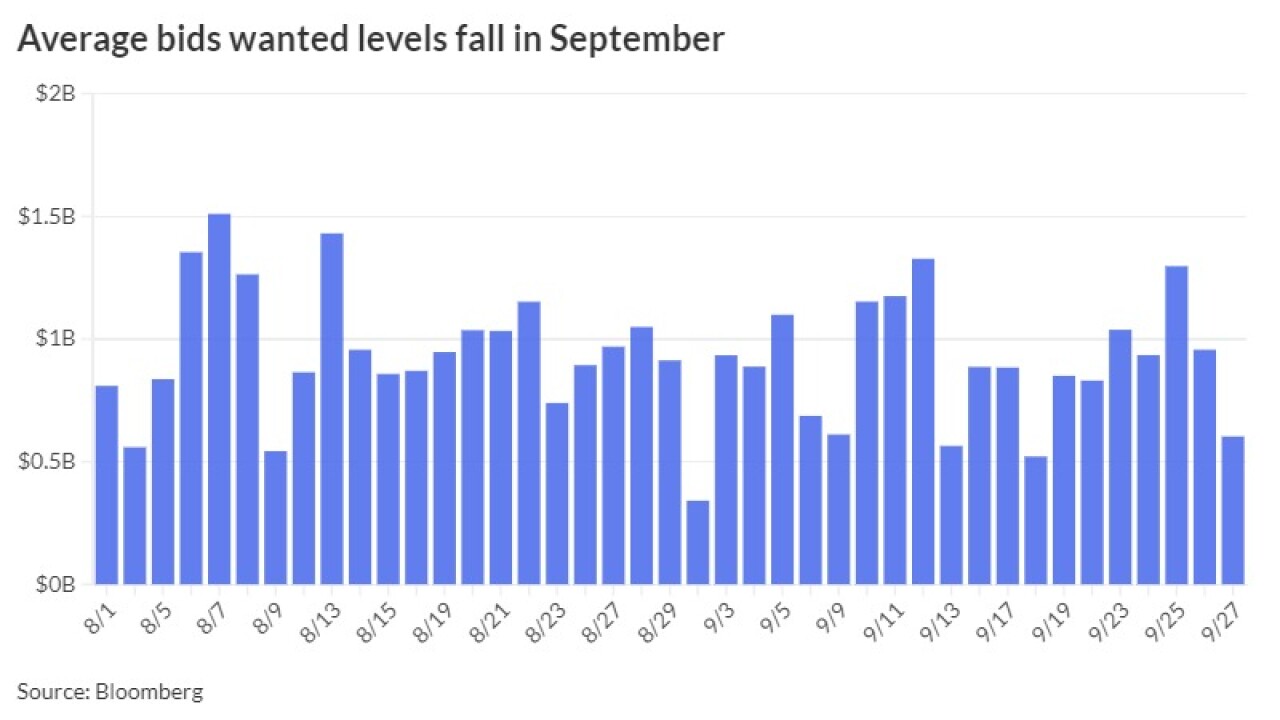

"As September draws to a close, some dynamics may prevail in October but others could undergo a shift," said NewSquare Capital's Kim Olsan. "One aspect that will continue is the level of supply coming to market."

By Lynne FunkSeptember 30 -

Municipal triple-A yield curves closed out the week with few changes, valuations were little changed, but at attractive levels, and the forward calendar climbs to more than $10 billion to open the fourth quarter.

By Lynne FunkSeptember 27