Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Experts agreed that Federal Reserve Board Chair Jerome Powell acknowledged the Fed could start tapering this year and that it would have no implications for liftoff, but not everyone was satisfied with what they heard.

By Gary SiegelAugust 27 -

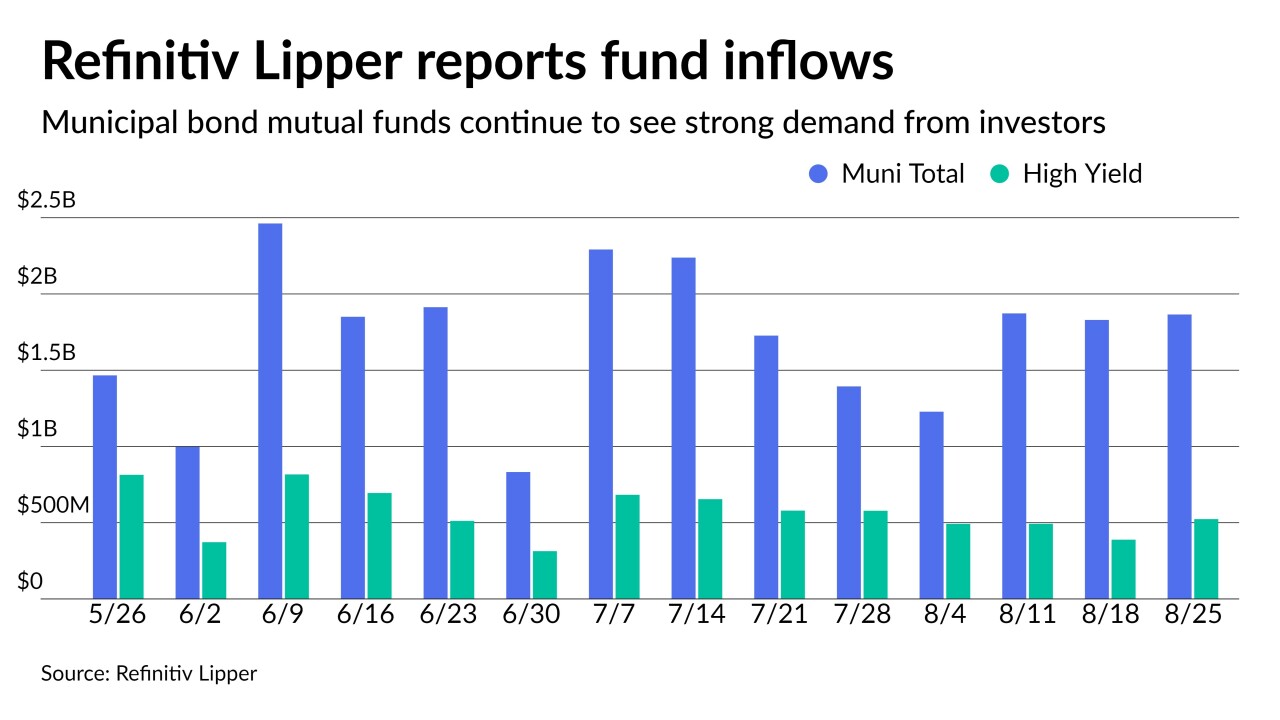

Refinitiv Lipper reported $1.9 billion of inflows, high-yield gaining $524 million, the 25th consecutive week of inflows into municipal bond mutual funds.

By Lynne FunkAugust 26 -

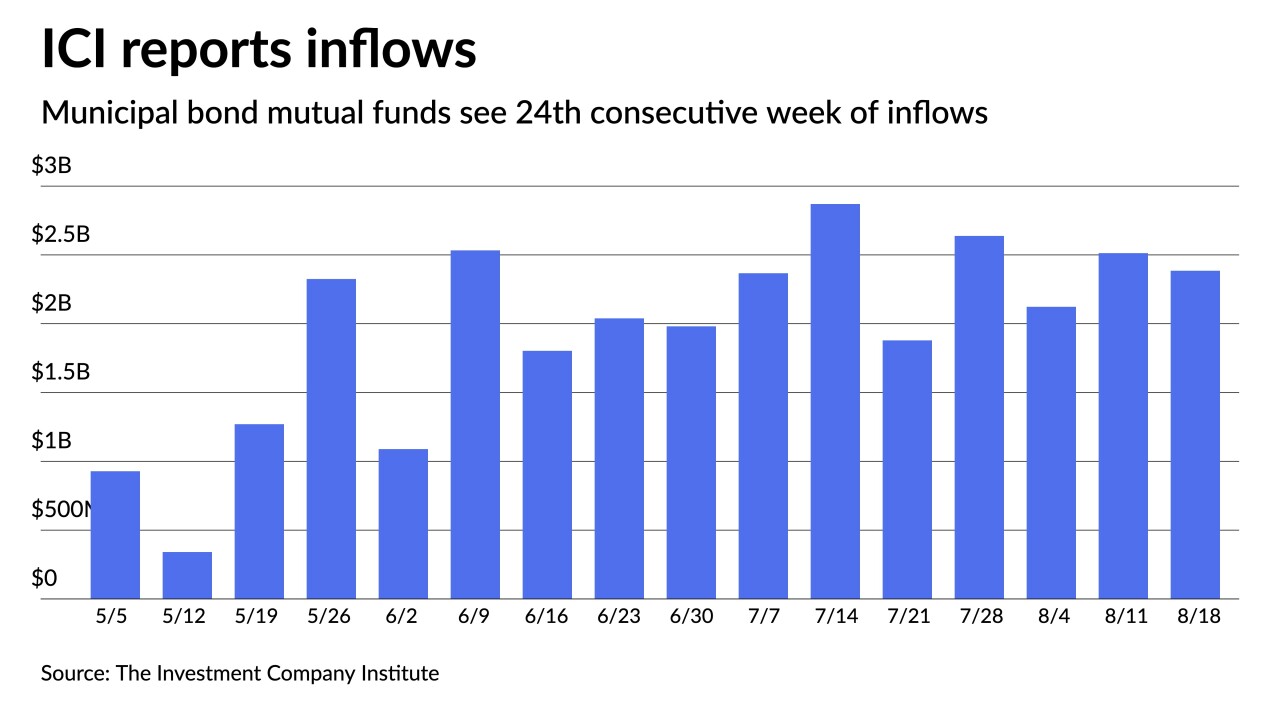

The Investment Company Institute reported $2.3 billion of inflows, bringing 2021 totals to $67 billion.

By Lynne FunkAugust 25 -

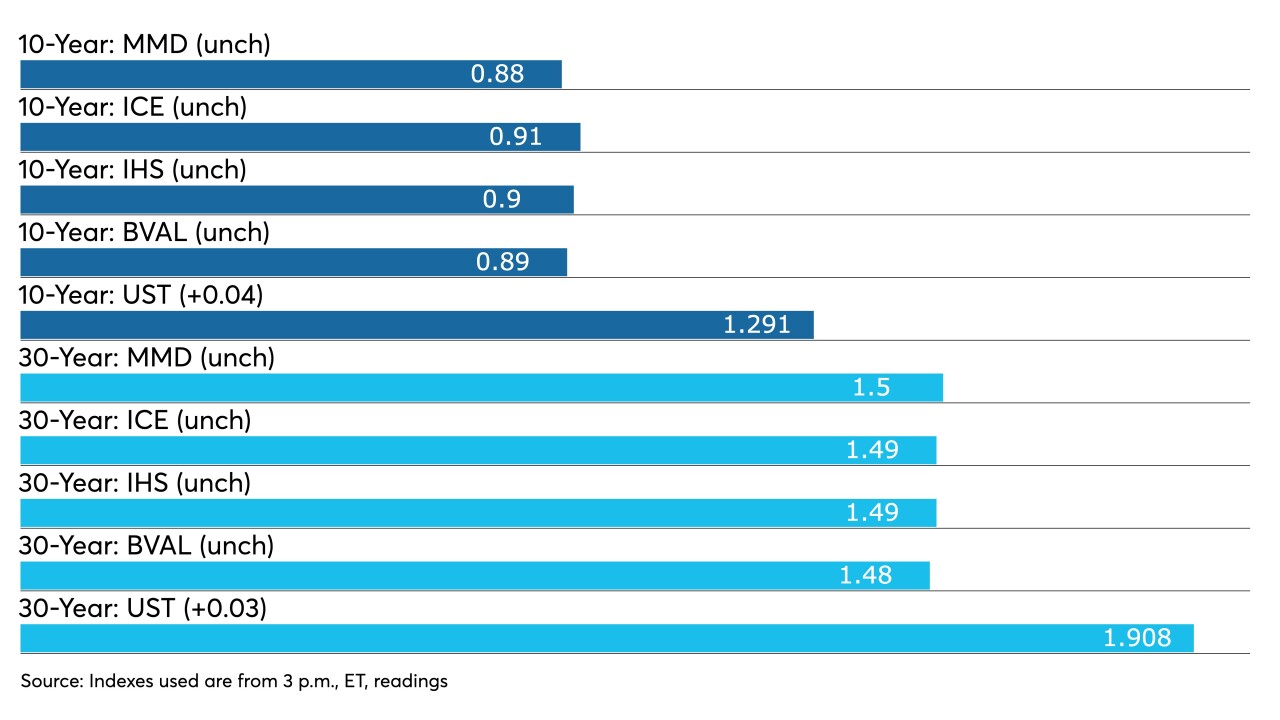

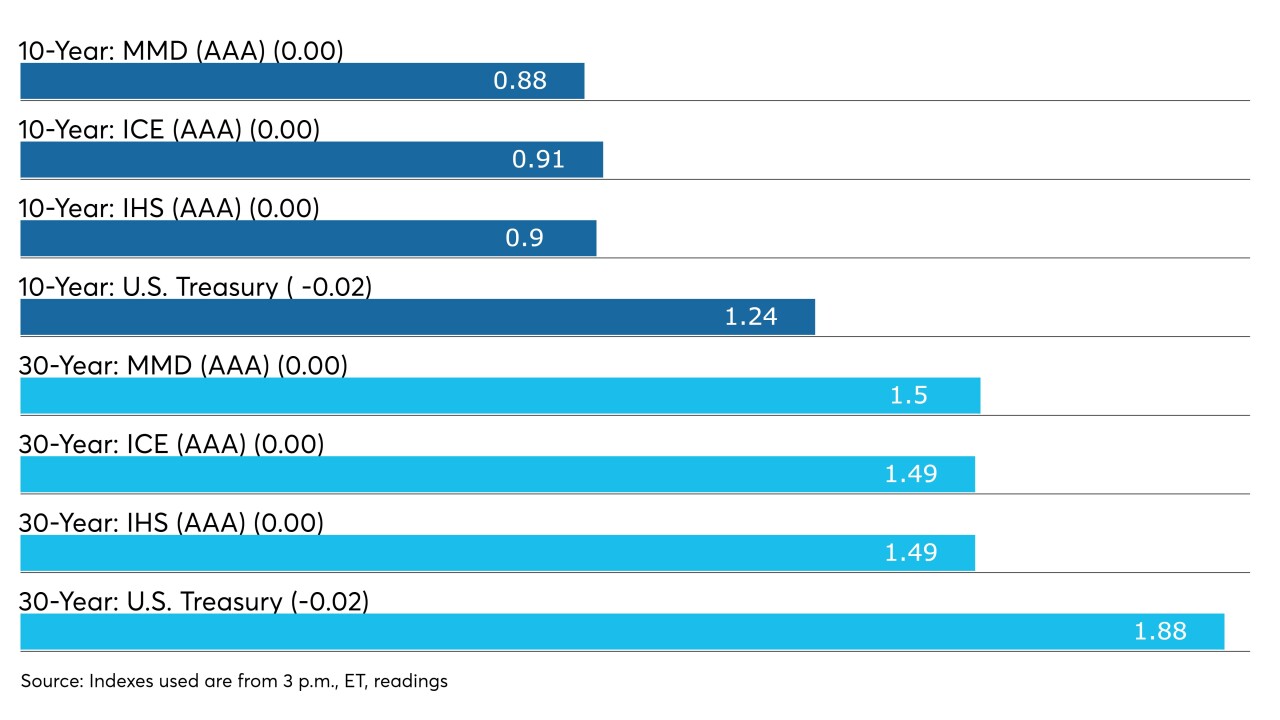

While municipals were little changed, broader markets remain focused on Jackson Hole and speculating what will be said about tapering.

By Lynne FunkAugust 24 -

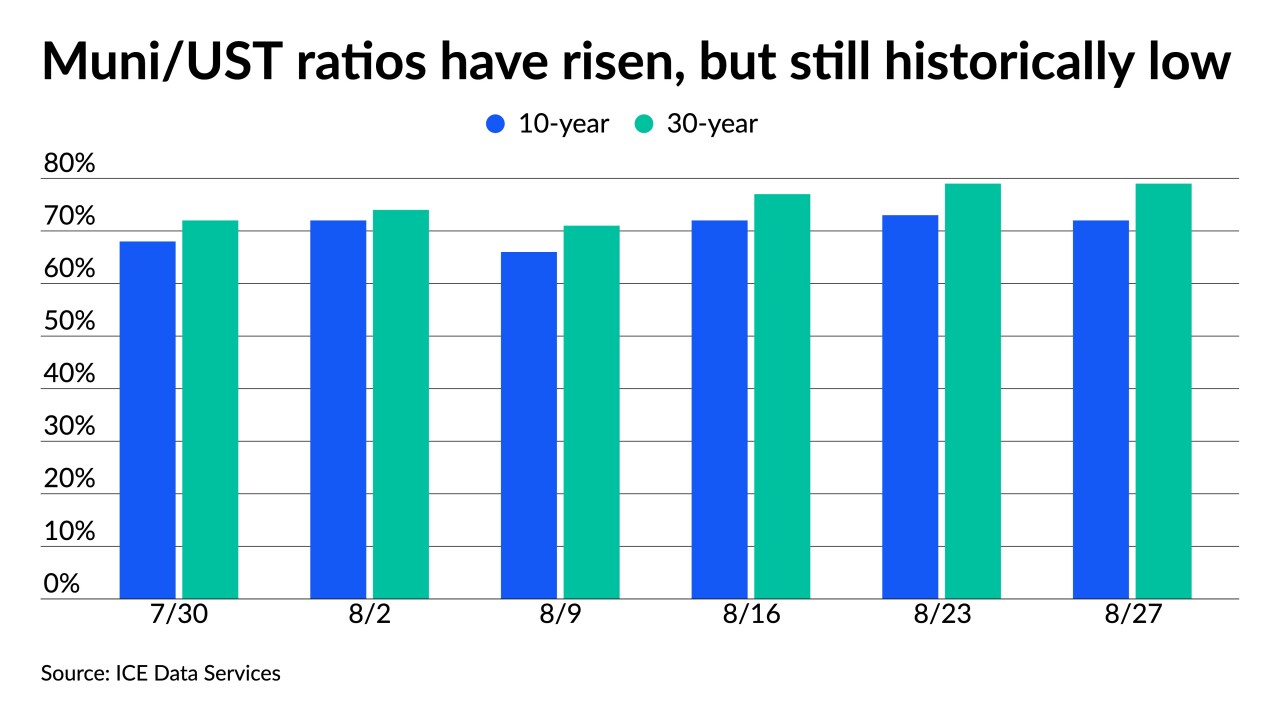

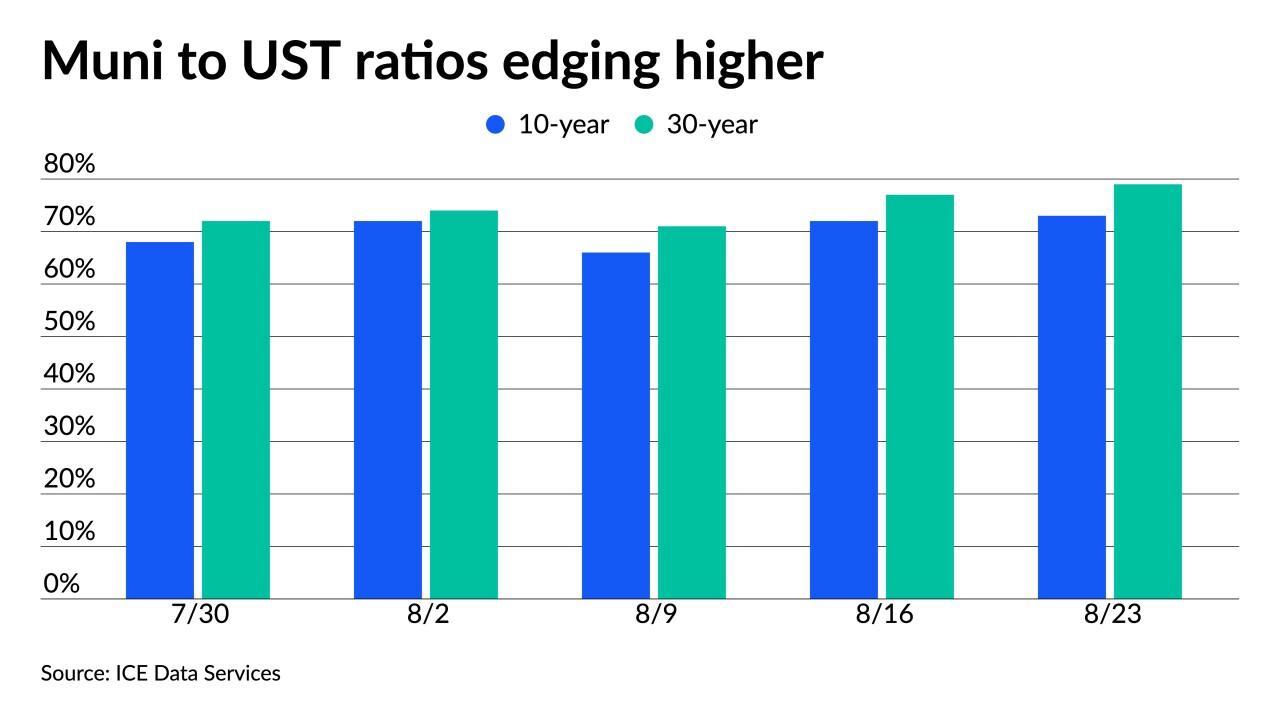

U.S. Treasuries gave little direction Monday, holding ratios and yields steady, leading most participants to argue both are satisfactory to ride out the summer.

By Lynne FunkAugust 23 -

Municipal bonds ended the week unchanged for the sixth consecutive trading session as inflows surged as more than $7 billion is headed to market next week.

August 20 -

Municipals were unchanged for the fourth consecutive day this week amid slight Treasury strength as demand for yield continued.

August 19 -

Demand was brisk in the primary market while the short-term market traded sideways on the pressure from the heavy new issue calendar, the release of the FOMC minutes and Treasury auction.

August 18 -

The Puerto Rico Aqueduct and Sewer Authority sold $813 million of senior lien revenue bonds consisting of tax-exempt refunding, taxable refunding and forward delivery refunding bonds.

August 17 -

As New York City launched the first of its two-day retail order period on $1.039 billion of GO bonds, the market was uneventful ahead of $9.76 billion in the primary market this week

August 16