With plenty of cash looking to go to work, investors are not loving the calendar or what small allocations they will be allotted as we draw near the end of tax season.

Demand is so strong that even $6.69 billion in new volume expected next week is “underwhelming” and won’t satisfy the investor appetite, according to Reid Smith, director of fixed income strategies, Ziegler Capital.

Inflows this week of $714 million into municipal mutual funds show continued interest even with the relative richness of munis beyond five years, Smith said.

“A key statistic shows that at the end of the month, dealer fixed coupon inventory is down by 32% since the beginning of the year,” he said. “We think as with this week, deals will do well and spreads will be tight.”

Smith said the demand is so heavy it is bucking the normal seasonal trend.

“Normally tax time is a time of predictable outflow to pay the IRS,” he said. “Instead we have been witnessing record inflows.”

“It seems like investors have awoken to the details of

Michael Pietronico, chief executive officer of Miller Tabak Asset Management, said the muni market right now is “trending sideways,” until the summer months and from there he expects long-term yields to decline slightly from current levels.

“Our number one message to our clients is to continue to allocate into this asset class when they have available cash as municipals will remain a very tax efficient and low volatility investment,” he said. “We view 12-year to 15-year 3% coupons at a price below 100 as the best value in the market right now.”

The biggest municipal bond issuer so far in 2019 is coming back to the market to push them further away from the rest of the pack. California (Aa3/AA-/AA-) is expected to come with another $2.1 billion of general obligation bonds just weeks after the Golden State came with $2.29 billion on March 6. The deal will be led by Morgan Stanley and is set for a retail order period on Wednesday, followed by institutional pricing on Thursday.

“It should be well subscribed for as there is plenty of cash around looking for a home,” Pietronico said.

Goldman Sachs is scheduled to price the Tuscaloosa County Industrial Development Authority’s (NR/NR/NR) $612 million for Hunt Refining Company.

Siebert Cisneros Shank & Co., L.L.C is expected to price $450 million of tax-exempt, fixed rate Second General Resolution Revenue Bonds for the New York City Municipal Water Finance Authority (Aa1/AA+/AA+) for retail investors on Monday with institutions on Tuesday. About $150 million of bond proceeds will be used to fund capital projects and the remaining willrefund certain outstanding bonds

After that, the next seven biggest deals range from $100-$194 million.

Secondary market

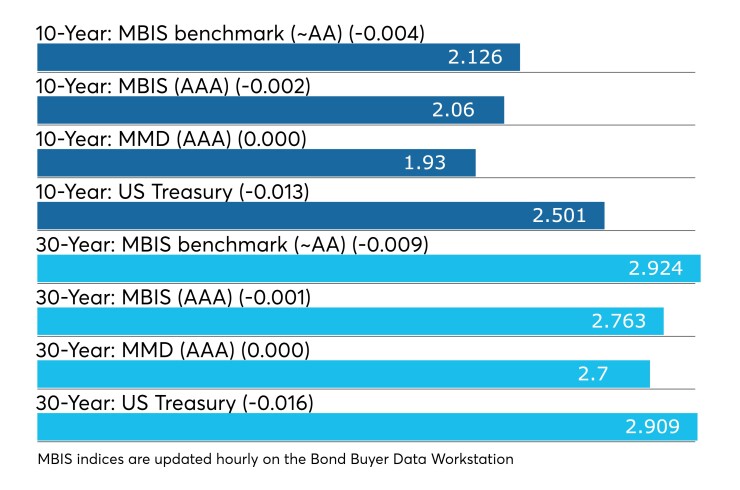

Munis were stronger on the MBIS benchmark scale Friday, which showed yields falling no more than one basis point in both the 10-year and 30-year maturities. High-grade munis were also stronger, with yields dropping less than one basis point in both the 10-year maturity and 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year and the 30-year remained unchanged.

The 10-year muni-to-Treasury ratio was calculated at 77.2% while the 30-year muni-to-Treasury ratio stood at 92.8%, according to MMD.

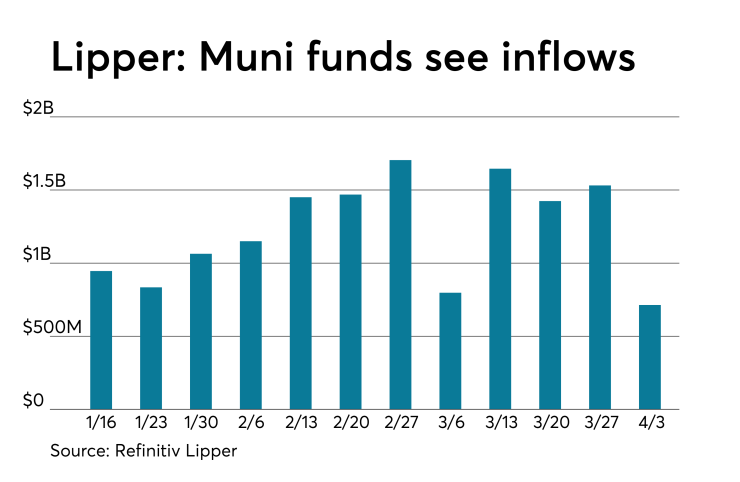

Lipper: More inflows into muni funds

For the 13th week in a row, cash rushed into municipal bond funds, according to data from Refinitiv Lipper released late Thursday.

Mutual funds which report flows weekly saw $713.606 million of inflows in the week ended April 3 after inflows of $1.532 billion in the previous week.

Exchange traded muni funds reported outflows of $73.425 million after inflows of $290.529 million in the previous week. Ex-ETFs, muni funds saw inflows of $787.031 million after inflows of $1.241 billion in the previous week.

The four-week moving average remained positive at $1.329 billion, after being in the green at $1.350 billion in the previous week.

Long-term muni bond funds had inflows of $430.846 million in the latest week after inflows of $1.129 billion in the previous week. Intermediate-term funds had inflows of $296.500 million after inflows of $318.839 million in the prior week.

National funds had inflows of $648.963 million after inflows of $1.339 billion in the previous week. High-yield muni funds reported inflows of $320.861 million in the latest week, after inflows of $491.916 million the previous week.

On Wednesday, the Investment Company Institute reported long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.356 billion in the week ended March 27, while long-term muni funds alone saw an inflow of $2.032 billion as ETF muni funds saw an inflow of $324 million.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended April 5 were from Connecticut, Florida and Oregon issuers, according to

In the GO bond sector, the Connecticut 4s of 2038 traded 45 times. In the revenue bond sector, the Florida DFC 6.5s of 2049 traded 147 times. In the taxable bond sector, the Port of Portland 4.237s of 2049 traded 23 times.

Week's actively quoted issues

Puerto Rico and Oregon names were among the most actively quoted bonds in the week ended April 5, according to IHS Markit.

On the bid side, the COFINA revenue 5s of 2058 were quoted by 137 unique dealers. On the ask side, the Lane County School District No. 4., Ore., GO 3s of 2038 were quoted by 197 dealers. Among two-sided quotes, the COFINA revenue 5s of 2058 were quoted by 32 dealers.

Previous session's activity

The MSRB reported 39,771 trades Thursday on volume of $12.52 billion.

California, New York and Texas were most traded, with the Golden State taking 17.58% of the market, the Lone Star State taking 11.771% and the Empire State taking 10.86%.

The most actively traded issue was the Philadelphia IDHA Series 2014 revenue 4s of 2044 which traded 64 times on volume of $29.11 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.