Assured Guaranty topped the ranking of municipal bond insurers, while Orrick Herrington & Sutcliffe LLP was the leading bond counsel, as declining issuance made for a challenging environment in the first quarter.

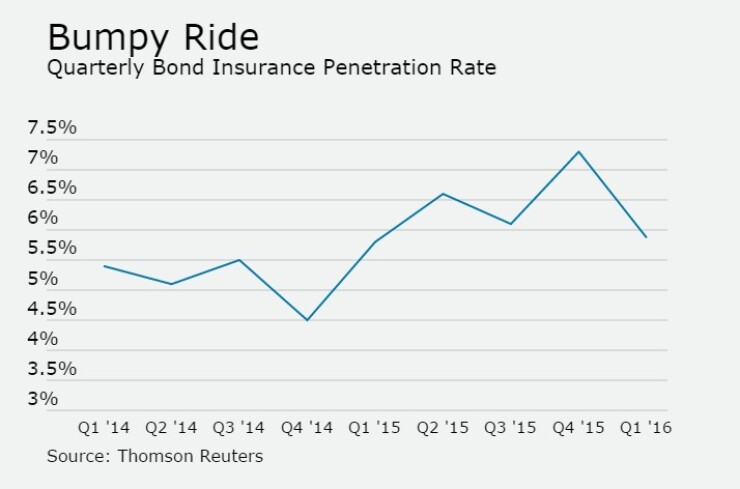

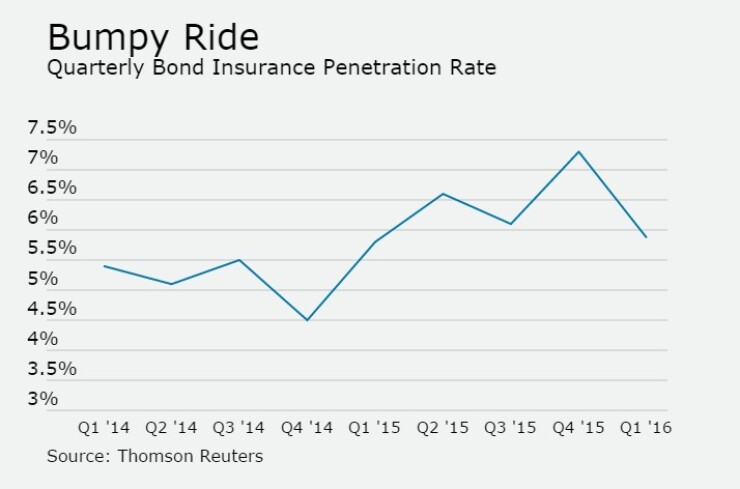

Bond insurance penetration of the municipal bond market fell to 5.87% from 7.3% in the fourth quarter, according to Thomson Reuters data. Penetration barely budged from 5.80% in the first quarter of last year, as issuance shrank 12% and historically low interest rates persisted, limiting the value of the insurance product.

Principal amount wrapped by Assured, Build America Mutual, and National Public Finance Guarantee – the three insurers writing new business – dropped to $5.61 billion over 424 deals from $6 billion in 521 deals during the same period of 2015. The decline in issuance also hit bond counsel, as the par amount of deals fell for nine of the top 15 firms.

Assured's numbers declined, as the company wrapped $3.04 billion in 196 transactions and 54.1% share of the insured market, down from $3.39 billion in 278 transactions and 56.7% market share a year earlier. The data includes Assured's subsidiary Municipal Assurance Corp.

"With interest rates still well below historical norms and credit spreads near the tightest levels we have seen, we focused on protecting our long-term financial strength and profitability by maintaining disciplined credit selection and pricing," said Robert Tucker, managing director communications and investor relations at Assured. "We also benefited from our ability to assist the larger transactions that typically interest institutional investors, insuring five transactions with insured par amounts exceeding $100 million each. Our aggregate primary and secondary insured par totaled $3.4 billion for the first quarter of 2016."

Tucker also said Assured made significant gains in secondary market activity, in an indicator of the growing institutional demand for the product. In first quarter 2016, Assured guaranteed more than twice the secondary market par they insured in the fourth quarter of 2015 and three times more than in the first quarter of last year.

"Additionally, we maintain a database of pre-qualified credits on our website, and purchases can be made by calling our secondary market desk or over the TMC electronic trading platform," Tucker said.

Build America Mutual reported improvements in principal amount insured and market share, as the mutually owned company insured $2.47 billion in 216 transactions or 43.9% market share, compared with $2.36 billion in 238 transactions or 39.4% market share in the comparable time period.

"It was a strong start to the year for BAM and the insurance industry generally," said Séan McCarthy, chief executive officer of BAM. "The small- and medium-sized issuers that are at the core of BAM's target market continued to benefit most from credit enhancement, and that kept penetration stable despite the volatile interest rate environment."

McCarthy said that BAM insured the majority of the transactions in the primary market in the quarter, and had more opportunities to deliver savings to larger issuers.

"BAM's average transaction size was up 15%, which reflected growth in demand for insured bonds from institutional investors who prefer larger issues for their liquidity. We expect that trend to continue, especially now that the Federal Reserve has concluded that insured bonds can qualify as high quality liquid assets for large bank investors," McCarthy said.

McCarthy also said BAM continued to build a library of Credit Profiles as a continuing disclosure resource for our member issuers and investors. He said BAM has published 2,700 Credit Profiles, which are available for free on BAM's website and a variety of industry trading platforms. He also noted that downloads were up more than 40% from the same period in 2015.

National Public Finance Guarantee, the municipal arm of MBIA Inc., wrapped $110 million over 12 deals, compared with $239 million in five deals during the first quarter of 2015.

"We are very pleased with the growing market acceptance of bond insurance both on an industry basis and from National," said Tom Weyl, head of new business development at National. "While the first quarter of the year is typically the lightest volume quarter, National was able to insure more primary market deals in the first quarter than we insured in fourth quarter of 2015."

Weyl added that National was able to do that in spite of additional challenges created by lower interest rates and that the company ended the quarter strong, winning awards for several deals that will close in the second quarter.

"We are also pleased with the progress that we've made with insuring secondary market business, where our first quarter 2016 activity was nearly equal to our fourth quarter 2015 activity. Between our primary and secondary markets business, our second quarter is already shaping up to be our best quarter yet," Weyl said.

Orrick Retains Top Spot for Bond Counsel

The drop in volume also cut into business for law firms, as the par amount of deals fell from the first quarter of 2015. The top 15 firms accounted for $95.54 billion in 2,767 deals versus $102.01 billion in 3,040 deals a year earlier.

Only 6 firms had a higher par amount this quarter than they did in the first quarter of 2015, and those firms ranked fourth, fifth, sixth, 8th, 9th, and 16th.

Orrick retained the top spot with $9.41 billion of par amount in 81 issues, down from $11.24 billion in 74 issues in the first quarter of 2015.

"Total market activity was down in dollar amount and number of transactions and has been off compared to 2015 for seven straight months, as the refundings are way off and new money issues increasing but not enough to replace the refundings," said Roger Davis, chair of Orrick's public finance practice. "Our numbers were down in dollar amount but our market share increased, and we are also up in number of issues. We have been very busy and recruiting new associates for several offices. Most importantly, we opened an office in Houston in mid-January with six Texas public finance attorneys. Of course not much of their activity has had time to show up in our statistics yet."

Hawkins Delafield & Wood LLP came in second with $5.07 billion, while Norton Rose Fulbright finished third $3.69 billion.

The two biggest movers finished in fourth and fifth place, respectively. Sidley Austin LLP jumped from eighth place in the first three months of 2015, to fourth place this past quarter with a par amount of $3.11 billion, in just 13 deals. Gilmore & Bell PC jumped from the 11th spot last year to fifth this time around with a par amount of $2.59 billion.

Sidley Austin "has a core group of large, sophisticated clients who can count on getting high quality legal advice from us," said Eric Tashman, a co-leader of the firm's Public Finance practice. "These clients include states and municipalities as well as large multi-state hospital systems. When these clients are active, our numbers go up."

Tashman also said that structured finance and restructurings (including restructurings in bankruptcy) also play to the firm's strength.

"While these financings are less frequent, when they come, they are large and command our attention. Overall, the number of financings is less important to us than the nature of the client and its particular needs," Tashman said.

Rounding out the top ten are Andrews Kurth LLP, Kutak Rock LLP, Bracewell LLP, Dinsmore & Shohl LLP and Foster Pepper PLLC.