Top shelf municipal bonds were weaker at mid-session, according to traders, ahead of a hefty new issue calendar for a holiday-shortened week. Markets will be closed on Monday for the Rev. Martin Luther King, Jr. holiday.

Ipreo estimates volume for the week at $8.9 billion, up from a revised $8.2 billion of supply in the prior week, according to updated figures from Thomson Reuters. The calendar is composed of about $7.4 billion of negotiated deals and around $1.5 billion of competitive sales.

Secondary Market

The 10-year benchmark muni general obligation yield rose as much as one basis point from 2.15% on Thursday, while the yield on the 30-year GO increased one to three basis points from 2.88%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were also weaker on Friday. The yield on the two-year Treasury rose to 1.21% from 1.17% on Thursday, while the 10-year Treasury yield increased to 2.42% from 2.35%, and the yield on the 30-year Treasury bond gained to 3.01% from 2.95%.

On Thursday, the 10-year muni to Treasury ratio was calculated at 91.2% compared to 92.5% on Wednesday, while the 30-year muni to Treasury ratio stood at 97.5%, versus 98.8%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 44,296 trades on Thursday on volume of $15.68 billion.

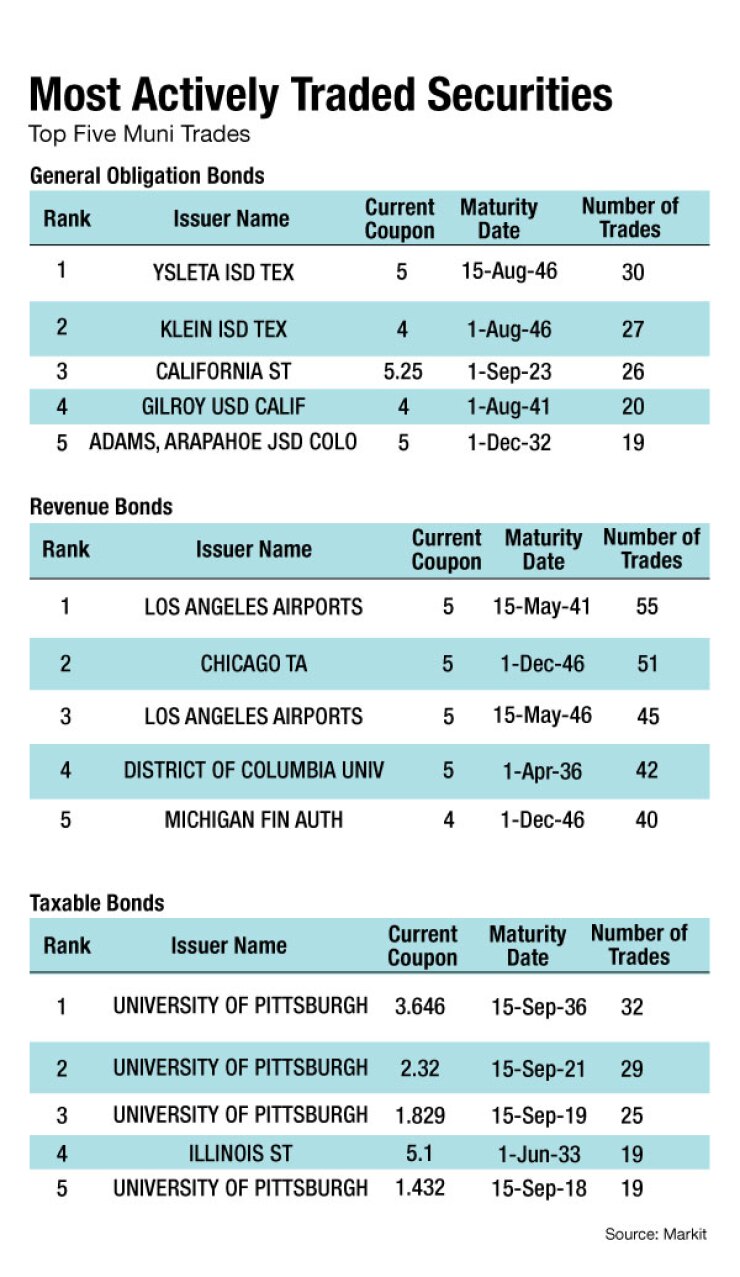

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Jan. 13 were from Texas, California and Pennsylvania, according to

In the GO bond sector, the Ysleta ISD, Texas, 5s of 2046 were traded 30 times. In the revenue bond sector, the Los Angeles Department of Airports 5s of 2041 were traded 55 times. And in the taxable bond sector, the University of Pittsburgh 3.646s of 2036 were traded 32 times.

Week's Most Actively Quoted Issues

Illinois, Pennsylvania and New Jersey names were among the most actively quoted bonds in the week ended Jan. 13, according to Markit.

On the bid side, the Illinois taxable 6.63s of 2035 were quoted by 38 unique dealers. On the ask side, the Pennsylvania GO 4s of 2034 were quoted by 229 unique dealers. And among two-sided quotes, the New Jersey Transportation Trust Fund taxable 5.754s of 2028 were quoted by 18 unique dealers.

Week's Primary Market

Goldman Sachs priced the Triborough Bridge and Tunnel Authority's $1.2 billion bond sale. The deal for the N.Y. MTA's bridges and tunnels, consisted of $300 million of Series 2017A general revenue bonds and $903.39 million of Series 2017B general revenue refunding bonds. The deal is rated Aa3 by Moody's Investors Service, AA-minus by S&P Global Ratings and Fitch Ratings and AA by Kroll Bond Rating Agency.

Jefferies priced TSASC, Inc.'s $653.07 million of tobacco settlement senior and subordinate bonds. In conjunction with the sale, TSASC said it also placed $450 million of subordinate turbo term bonds with holders of existing TSASC bonds. The senior bonds carry ratings from S&P that range from A in 2017 to BBB-plus in 2041 while the subordinate bonds carry ratings from S&P that range from BBB-plus in 2018 to BBB in 2025.

Bank of America Merrill Lynch priced the New Jersey Economic Development Authority's $621.54 million of Series 2017 transportation project sublease revenue and revenue refunding bonds for New Jersey Transit Corp. project. The deal is rated A3 by Moody's, BBB-plus by S&P and A-minus by Fitch.

Morgan Stanley priced the Regents of the University of Michigan's $469.03 million of Series 2017A general revenue bonds. The deal is rated triple-A by Moody's and S&P.

Ramirez & Co. priced Wisconsin's $427 million of taxable Series 2017A general fund annual appropriation bonds. The deal is rated Aa3 by Moody's and AA-minus by S&P and Fitch.

Citigroup priced the Board of Regents of the Texas A&M University System's $388.71 million of Series 2017A taxable revenue financing system bonds. The deal is rated triple-A by Moody's, S&P and Fitch.

Piper Jaffray priced the University of Connecticut's $345.15 million of general obligation bonds. The deal is rated Aa3 by Moody's, AA-minus by S&P and A-plus by Fitch.

Goldman Sachs priced the Trinity Health Credit Group's $333.87 million composite bond offering from four conduit issuers in states with Trinity facilities, consisting of The Michigan Finance Authority's $162.06 million of Series 2017MI hospital revenue and refunding bonds; the Idaho Health Facilities Authority's $54.87 million of Series 2017ID hospital revenue bonds; the Maryland Health and Higher Educational Facilities Authority's $29.44 million of Series 2017MD revenue bonds and Franklin County, Ohio's $87.52 million of Series 2017OH bonds. The Trinity offering is rated Aa3 by Moody's and AA-minus by S&P and Fitch.

Loop Capital Markets priced the Chicago Transit Authority's $296.94 million of Series 2017 second lien sales tax receipts revenue bonds. The deal is rated A-plus by S&P and AA-minus by Kroll.

RBC priced the Pennsylvania Housing Finance Agency's $239.65 million of Series 2017-122 single-family mortgage revenue bonds, not subject to the alternative minimum tax. The deal is rated Aa2 by Moody's and AA-plus by S&P.

RBC Capital Markets priced $203.67 million Aurora Public Schools, Joint School District No. 28J in Adams and Arapahoe Counties, Colo., Series 2017A GOs and Series 2017B GOs. The deal, backed by the Colorado state intercept program, is rated Aa2 by Moody's and AA by Fitch.

BAML priced the Illinois Finance Authority's $197.49 million of Series 2017A revenue bonds for Edward-Elmhurst Healthcare. The deal is rated A by S&P and Fitch.

Barclays Capital priced the Miami University of Ohio's $154.97 million of Series 2017 general receipts revenue and refunding bonds. The deal is rated Aa3 by Moody's and AA by Fitch.

Raymond James priced the Klein Independent School District, Texas' $145.89 million of Series 2017 unlimited tax schoolhouse bonds. The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody's and S&P.

Barclays Capital priced the California Statewide Community Development Authority's $135 million of Series 2006 C&D pollution control refunding revenue bonds as a remarketing. The deal is rated Aa3 by Moody's, A by S&P and A-plus by Fitch.

BAML priced the Orange County Water District, Calif.'s $118.62 million of Series 2017A tax-exempt and Series 2017B taxable refunding revenue bonds. The deal is rated triple-A by S&P and Fitch.

Citigroup priced Rochester, Minn.'s $109.13 million of Series 2017A electric utility revenue and refunding bonds. The deal is rated Aa3 by Moody's and AA-minus by Fitch.

In the competitive arena, Washington state sold about $649.09 million of bonds in three separate offerings. Wells Fargo Securities won the $462.76 million of Series 2017D various purpose general obligation bonds with a true interest cost of 3.51%. Citigroup won the $137.1 million of Series R-2017C various purpose GO refunding bonds with a TIC of 1.92%. BAML won the $49.23 million of Series 2017E motor vehicle fuel tax GOs and Series R-2017D motor vehicle fuel tax refunding GOs with a TIC of 3.14%. All three deals are rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Ohio competitively sold $350 million of bonds in two separate deals. Citigroup won the $300 million of Series 2017A common schools general obligation bonds with a TIC of 3.35%. Robert W. Baird won the $50 million of Series 2017A conservation projects GOs with a TIC of 2.96%. The deals are rated Aa1 by Moody's and AA-plus by S&P and Fitch.

The Highline School District No. 401, Wash., sold $212.69 million of Series 2017 unlimited tax general obligation bonds. BAML won the bonds with a TIC of 3.29%.The deal, backed by the Washington state credit enhancement program, is rated Aa1 by Moody's and AA-plus by S&P.

Seattle, Wash., competitively sold $189.67 million of Series 2017 water system improvement and refunding revenue bonds. Citigroup won the bonds with a TIC of 3.28%.The deal is rated Aa1 by Moody's and AA-plus by S&P.

The Alpine School District Board of Education, Utah, competitively sold $150.43 million of Series 2017 GO school building and refunding bonds under the Utah school bond guaranty program. Citi won the bonds with a TIC of 2.61%. The deal is rated triple-A by Moody's and Fitch.

Hennepin County, Minn., competitively sold $116.89 million of Series 2017A first lien sales tax revenue refunding bonds. BAML won the bonds with a TIC of 2.80%. The deal is rated triple-A by S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $854.8 million to $13.70 billion on Friday. The total is comprised of $3.04 billion of competitive sales and $10.66 billion of negotiated deals.

Lipper: Muni Bond Funds Report Inflows

Municipal bond funds saw inflows for the first time in eight weeks as investors returned to the market, according to Lipper data released late Thursday. The weekly reporters saw $974.172 million of inflows in the week ended Jan. 11, after outflows of $911.938 million in the previous week.

The four-week moving average remained in the red at negative $890.596 million after being negative $1.632 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $982.916 million in the latest week after losing $226.857 million in the previous week. Intermediate-term funds had inflows of $61.462 million after outflows of $636.984 million in the prior week.

National funds had inflows of $933.337 million after outflows of $613.824 million in the previous week. High-yield muni funds reported inflows of $796.091 million in the latest reporting week, after outflows of $244.713 million the previous week.

Exchange traded funds saw inflows of $183.828 million, after inflows of $607.714 million in the previous week.

Wells Fargo Negative Short-Term on NFP Hospitals

Wells Fargo Securities now has a more negative view in the short-term on not-for-profit hospitals.

"We revised our short-term outlook for not-for-profit hospitals to negative from stable, following the election, to reflect elevated health care sector uncertainty due to the expected repeal and replacement of the Affordable Care Act and greater downside financial risk for NFP hospitals," George Huang Wells Fargo's director of Municipal Securities Research wrote in a Friday market comment.

"Our short-term outlook is now back in line with our negative medium-term outlook, which had already anticipated a slowing of the beneficial effects of the ACA's access to care provisions," Huang wrote.

Kroszner: Tax-Exempt Revs Good for Infrastructure

Former Federal Reserve Gov. Randall Kroszner said he is wary of a proposal for a national infrastructure bank.

"We've seen these kind of things play out very badly in other countries," he said in comments to the media after the University of Chicago Booth School of Business's Economic Outlook 2017 conference in New York on Thursday night, citing problems with such banks in Germany.

He said rather the new administration and Congress should first look at prioritization.

"You'd like to have a consistent way of looking across all the projects in the U.S. and try to say 'Which ones are really the highest priority?' … So I think that would be the most valuable thing for trying to figure out where to do the allocations."

He was generally supportive of using tax-exempt revenue bonds for infrastructure financing.

"For example, I grew up in New Jersey and the New Jersey Turnpike was financed through bond issuance and they were very successful in repaying the debt," he said, adding, he thinks it would be best to use that model as much as possible.