Top-quality municipal bonds were unchanged at mid-session, traders said, ahead of a moderately sized supply calendar for the week, with volume estimated at around $5.95 billion.

Secondary Market

The yield on the 10-year benchmark muni general obligation was unchanged from 1.45% on Thursday, while the yield on the 30-year muni was flat from 2.15%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Monday. The yield on the two-year Treasury rose to 0.72% from 0.70% on Friday as the 10-year Treasury yield gained to 1.57% from 1.56% and the yield on the 30-year Treasury bond decreased to 2.28% from 2.29%.

On Friday, the 10-year muni to Treasury ratio was calculated at 92.6% compared to 91.9% on Thursday, while the 30-year muni to Treasury ratio stood at 94.1% versus 92.4%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 26,950 trades on Friday on volume of $9.59 billion.

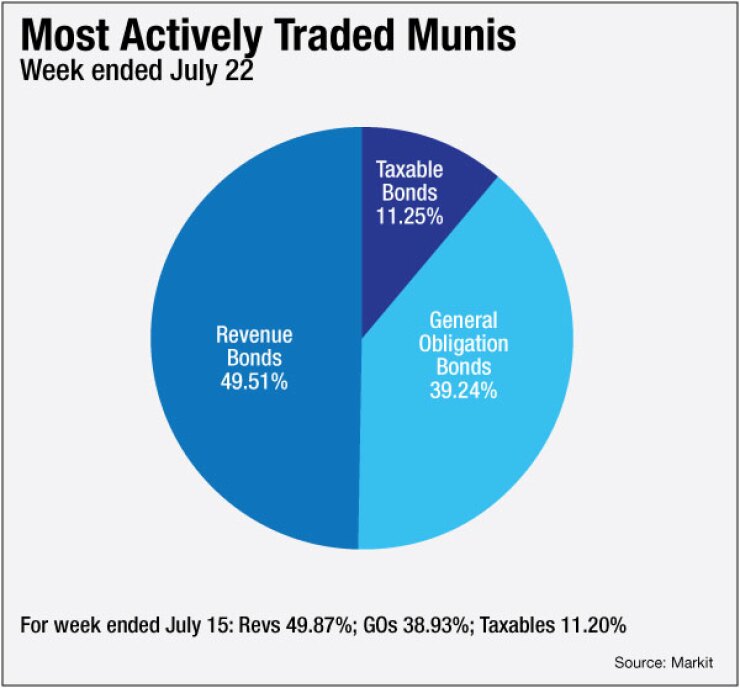

Prior Week's Actively Traded Issues

Revenue bonds comprised 49.51% of new issuance in the week ended July 22, down from 49.87% in the previous week, according to

Some of the most actively traded issues by type in the week ended July 22 were from Connecticut, New York and California issuers. In the GO bond sector, the Greenwich, Conn., 2s of 2017 were traded 22 times. In the revenue bond sector, the NYC MTA 5s of 2056 were traded 39 times. And in the taxable bond sector, the California 7.6s of 2040 were traded 33 times.

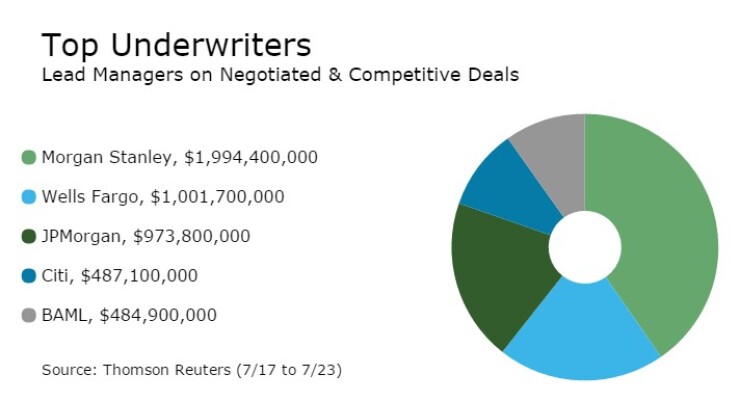

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Morgan Stanley, Wells Fargo Securities, JPMorgan Securities, Citigroup and Bank of America Merrill Lynch, according to Thomson Reuters data. In the week of July 17-23, Morgan Stanley underwrote $1.99 billion, Wells Fargo $1.00 billion, JPMorgan $973.8 million, Citi $487.1 million, and BAML $484.9 million.

Primary Market

The primary will be continuing to issue bonds in this low rate environment even as the Federal Open Market Committee gathers in Washington for its two-day monetary policy meeting. The Federal Reserve is expected to stand pat when it announces its decision of Wednesday, leaving any interest rate hike until a future meeting.

This week's calendar is made up of $5.03 billion of negotiated deals and $910.5 million of competitive sales.

A few deals are coming on Monday as Citigroup is expected to price the Alabama Federal Highway and Finance Authority's $550 million of special obligation revenue bonds.

Bank of America Merrill Lynch is set to price the Indiana Finance Authority's $474 million of Series 2016C highway revenue refunding bonds. The deal is rated Aa1 by Moody's Investors Service, and AA-plus by S&P Global Ratings and Fitch Ratings.

RBC Capital Markets is expected to price Wisconsin's $317.13 million of general obligation refunding bonds of 2016, Series 2. The deal is rated Aa2 by Moody's and AA by S&P and Fitch.

On Tuesday, JPMorgan Securities is expected to price the Illinois Finance Authority's $972.58 million of Series 2016C revenue bonds for the Presence Health Network. The deal is rated Baa3 by Moody's, BBB-minus by S&P and BBB by Fitch.

Also on Tuesday, Citigroup is set to price Tennessee's $363 million of taxable and tax-exempt general obligation bonds. The deal is rated triple-A by Moody's and S&P.

Morgan Stanley is expected to price the Rhode Island Health and Educational Building Corp.'s $266.82 million of Series 2016 hospital financing revenue refunding bonds for the Lifespan Obligated Group.

And Goldman Sachs is set to price Ohio's $217.19 million of major new state infrastructure project revenue bonds. The deal is rated Aa2 by Moody's and AA by S&P.

In the competitive sector on Tuesday, Miami Dade County, Fla., is selling two separate issues totaling $212.99 million.

The deals consist of $185.37 million of Series 2016B capital asset acquisition special obligation refunding bonds and $27.62 million of Series 2016A capital asset acquisition special obligation bonds.

Both deals are rated Aa3 by Moody's and AA-minus by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $864.8 million to $11.80 billion on Monday. The total is comprised of $4.23 billion of competitive sales and $7.57 billion of negotiated deals.