Top-shelf municipal bonds remained stronger at mid-session, according to traders, as the last of the week’s new big issues were coming to market.

Secondary Market

The yield on the 10-year benchmark muni general obligation was one to three basis points weaker from 1.65% on Wednesday, while the 30-year muni yield was one to three basis points weaker from 2.61%, according to a midday read of Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Thursday. The yield on the two-year Treasury fell to 0.82% from 0.86% on Wednesday, while the 10-year Treasury yield dropped to 1.86% from 1.87% and the yield on the 30-year Treasury bond decreased to 2.70% from 2.72%.

The 10-year muni to Treasury ratio was calculated at 88.5% on Wednesday compared with 86.0% on Tuesday, while the 30-year muni to Treasury ratio stood at 96.5% versus 95.4%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 40,251 trades on Wednesday on volume of $14.07 billion.

Primary Market

In the competitive arena on Thursday, Rhode Island sold a total of $125.99 million of general obligation bonds in two separate sales.

Wells Fargo Securities won the $112.82 million of tax-exempt Series A consolidated capital development loan of 2016 bonds and tax-exempt Series C 2016 refunding bonds with a true interest cost of 2.39%.

The $58.84 million of Series A bonds were priced to yield from 0.59% with a 2% coupon in 2017 to approximately 3.10% in 2036 with a 3% coupon. The $53.99 million of Series C bonds were priced as 5s to yield from 0.61% in 2017 to 1.34% in 2022.

JPMorgan Securities won the $13.17 million of taxable consolidated capital development loan of 2016 Series B with a TIC of 1.39%. Pricing information was not immediately available.

Both sales are rated Aa2 by Moody’s Investors Service and AA by Standard & Poor’s and Fitch Ratings.

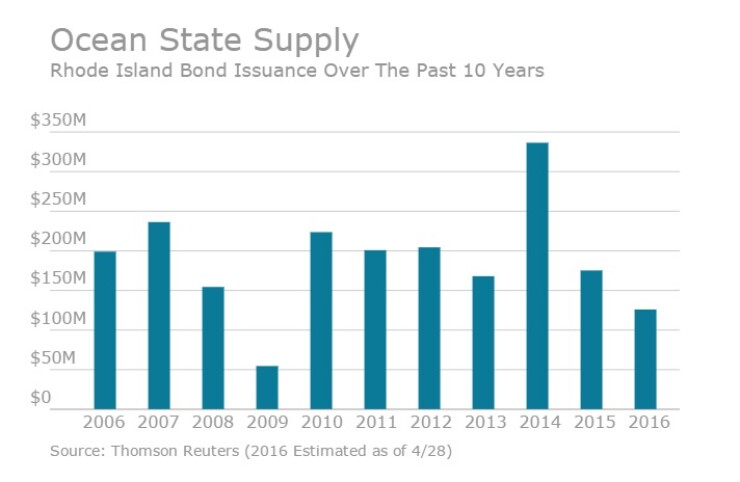

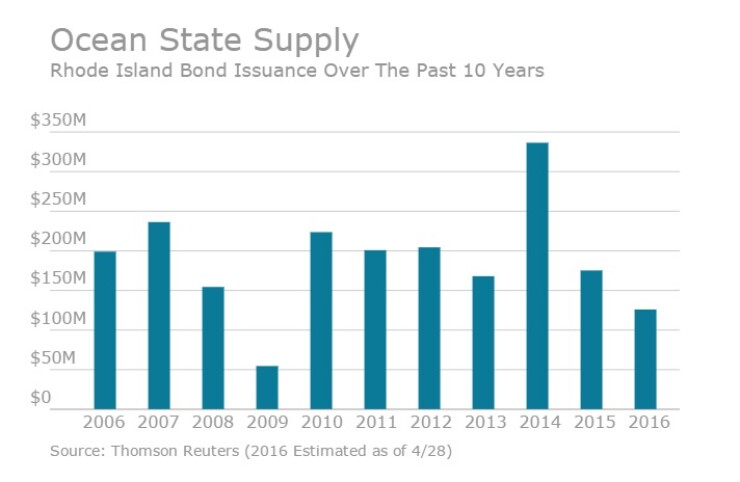

Since 2006, the Rhode Island has sold about $2 billion of debt with the most issuance occurring in 2014 when it issued $336.4 million of bonds. The state sold the least amount of bonds in 2009 when it offered $54.6 million of debt.

Bank of America Merrill Lynch priced the Public Power Generation Agency, Neb.’s $136 million of Series 2016A revenue refunding bonds for the Whelan Energy Center’s Unit 2.

The issue was priced as 5s to yield from 2.77% in 2032 to 3.10% in 2039. The deal is rated A2 by Moody’s and A-minus by Fitch.

Citigroup is expected to price the Mission Economic Development Corp., Texas’ $198 million of Series 2016B senior lien revenue bonds for the Natogasoline project. The deal is rated BB-minus by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $968.8 million to $10.30 billion on Thursday. The total is comprised of $5.46 billion of competitive sales and $4.84 billion of negotiated deals.

Tax-Exempt Money Market Funds See Outflows

Tax-exempt money market funds experienced outflows of $3.85 billion, bringing total net assets to $217.75 billion in the week ended April 25, according to The Money Fund Report, a service of iMoneyNet.com. This followed an outflow of $2.73 billion to $221.60 billion in the previous week.

The average, seven-day simple yield for the 315 weekly reporting tax-exempt funds was unchanged from the previous week at 0.05%.

The total net assets of the 909 weekly reporting taxable money funds increased $18.87 billion to $2.476 trillion in the week ended April 26, after an outflow of $31.82 billion to $2.457 trillion the week before.

The average, seven-day simple yield for the taxable money funds dipped to 0.10% from 0.11% in the prior week.

Overall, the combined total net assets of the 1,224 weekly reporting money funds increased $15.02 billion to $2.694 trillion in the period ended April 26, which followed an outflow of $34.55 billion to $2.679 trillion.