Picking up where they left off on Friday, municipal bonds continued to rally on Monday with Treasuries in the wake of the British vote to leave the European Union.

At midday, the yield on 10-year benchmark muni general obligation was five to seven basis points lower from 1.36% on Friday, while the 30-year muni yield declined seven to nine basis points from 2.08%, according to a read of Municipal Market Data's triple-A scale. Friday's reads were the lowest for munis since MMD began calculating them in 1980.

U.S. Treasuries continued to rally on Monday. The yield on the two-year Treasury dropped to 0.58% from 0.65% on Friday, while the 10-year Treasury yield declined to 1.46% from 1.57% and the yield on the 30-year Treasury bond decreased to 2.29% from 2.42%.

On Friday, the 10-year muni to Treasury ratio was calculated at 86.3% compared to 88.1% on Thursday, while the 30-year muni to Treasury ratio stood at 85.8% versus 87.3%, according to MMD.

"U.S. municipal bonds tracked in the

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 25,000 trades on Friday on volume of $10.65 billion.

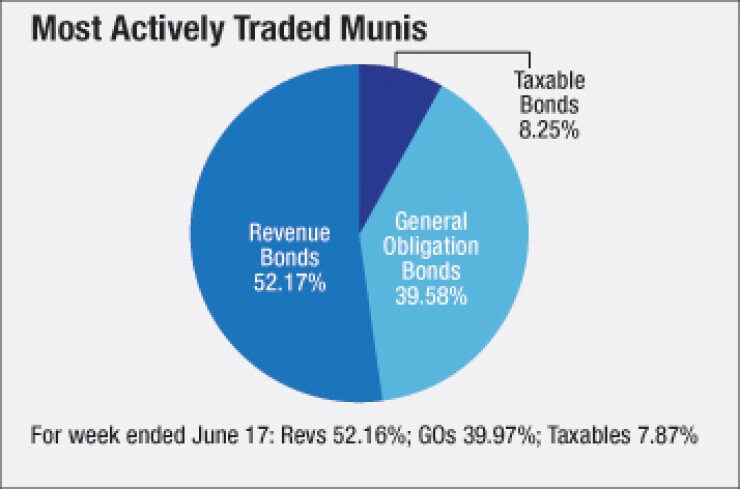

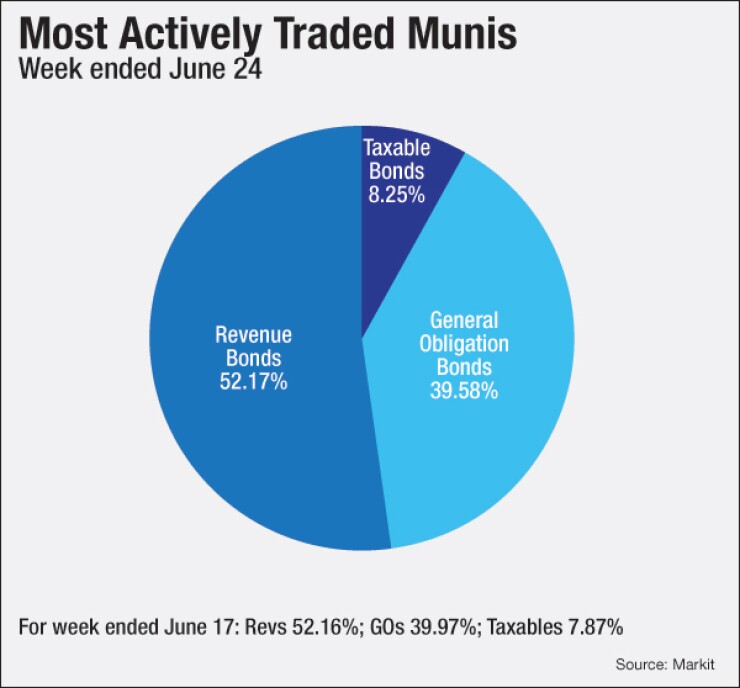

Prior Week's Actively Traded Issues

Revenue bonds comprised 52.17% of new issuance in the week ended June 24, up from 52.16% in the previous week, according to

Some of the most actively traded issues by type were from California, New York and Oregon. In the GO bond sector, the Los Angeles 3s of 2017 were traded 177 times. In the revenue bond sector, the N.Y. MTA 4s of 2036 were traded 81 times. And in the taxable bond sector, the Port Morrow, Ore., revenue 1.782s of 2021 were traded 14 times.

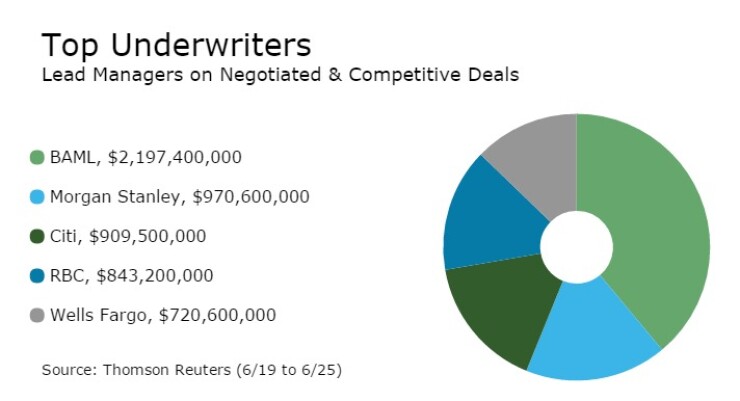

Previous Week's Top Underwriters

The top negotiated and competitive underwriters of last week included Bank of America Merrill Lynch, Morgan Stanley, Citigroup, RBC Capital Markets and Wells Fargo Securities, according to Thomson Reuters data. In the week of June 19-June 25, BAML $2.20 billion, Morgan Stanley did $971 million, Citi had $910 million, RBC did $843 million and Wells Fargo had $721 million.

Muni Volume Estimated at $8.2B

Total volume for this week is estimated by Ipreo at $8.18 billion, down from a revised total of $9.28 billion sold last week, according to data from Thomson Reuters.

There are $5.92 billion of municipal bond deals and $2.26 billion of competitive sales on the calendar for this week.

Primary Market

On Monday, Washington County, Tenn., competitively sold over $118 million of general obligation bonds in two issues.

Citigroup won the $113.82 million of Series 2016A GO refunding bonds with a true interest cost of 2.45%. The issue was priced to yield from 0.80% with a 4% coupon in 2017 to 2.86% with a 3.125% coupon in 2037.

Robert W. Baird won the $4.46 million of taxable Series 2016B GO refunding bonds with a TIC of 1.43%. Both deals are rated Aa2 by Moody's Investors Service and AA by S&P Global Ratings.

On Tuesday, Washington State is selling four separate competitive sales totaling $1.3 billion.

The largest deal of the series is $535.125 million of various purpose general obligation refunding bonds. Also going out for bid are $392.27 million of various purpose GOs, $272.47 million of motor vehicle fuel tax GO refunding bonds and $101.35 million of GO taxables.

All of the deals are rated Aa1 by Moody's and AA-plus by S&P and Fitch Ratings.

In the negotiated sector on Tuesday, Bank of America Merrill Lynch is slated to price San Antonio, Texas' $564 million of Series 2016 electric and gas system revenue refunding bonds. The deal is rated Aa1 by Moody's, AA by S&P and AA-plus by Fitch.

"The system has an almost monopolistic hold on energy production and distribution in San Antonio, the nation's seventh largest city, and parts of Bexar County," Janney Municipal Credit Analyst Eric Kazatsky wrote in a Monday market comment. "With many energy systems turning to renewable sources of energy, it is worth noting that in 2015, 42% of energy for the system was generated from coal fired plants. This percentage should decline after 2018 as CPS is in plans to deactivate its oldest coal plant and shift production toward gas-fired systems."

He added that income inequality could be a negative factor ahead.

"Acting as a counter balance to improving debt service coverage and an almost 85% funded pension is the large amount of the service area which is below the poverty line, which could impact future rate increases," he wrote.

Also this week, the commonwealth of Massachusetts will be selling three separate negotiated deals, totaling roughly $891 million.

BAML is slated to price the state's $441 million of Series 2016B GO refunding bonds on Wednesday, following a one-day retail order period on Tuesday. BAML will also price $250 million of GO consolidated loan of 2016 Series F taxable GO green bonds on Wednesday.

Additionally, Barclays is scheduled to price Massachusetts' $200 million of GO consolidated loan of 2014 Series D multi-modal bonds and Subseries D-1 bonds on Wednesday. All three deals carry ratings of Aa1 by Moody's and AA-plus by Fitch.

On Tuesday, the Board of Regents of the Texas A&M University System is coming to market with two sales totaling $381.8 million.

Morgan Stanley is expected to price the board's $205.9 million of Series 2016C revenue financing system revenue bonds while Wells Fargo Securities is set to price the board's $175.9 million of Series 2016D taxable revenue financing system bonds.

JPMorgan Securities is set to price the state of Texas' $149.63 million of GOs in seven series of tax-exempt and taxable bonds. The deal is rated triple-A by Moody's, S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $362.1 million to $10.23 billion on Monday. The total is comprised of $3.16 billion of competitive sales and $7.08 billion of negotiated deals.