Munis were steady to end the week, as traders await another week of issuers coming to market with refundings to take advantage of low rates.

However, municipal investors and traders will have less volume and fewer larger deals to work with in the upcoming week.

Primary Market

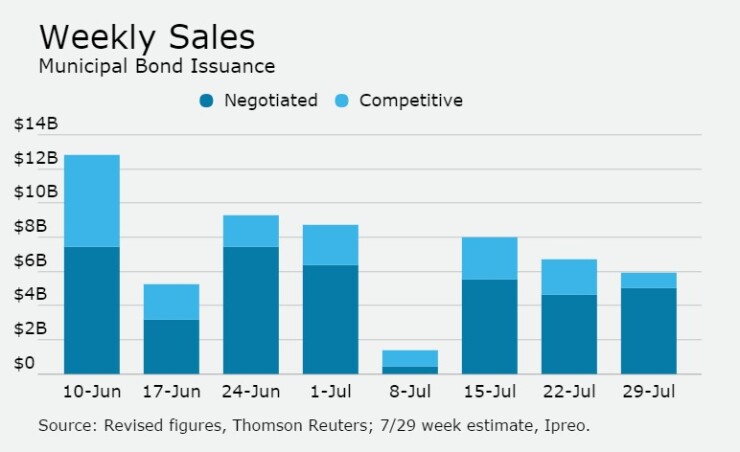

Total volume for the week of July 29 is estimated by Ipreo at $5.9 billion, down a bit from the revised total of $6.7 billion that was sold in the prior week, according to Thomson Reuters data. The calendar consists $5 billion of negotiated deals and $910 million of competitive sales.

Investors will not have a ton of inventory to choose from with only 10 deals scheduled for more than $100 million, though the week's slate is heavier at the very top.

"Although the volume for the upcoming week is not that much smaller than last week, it is chunkier and there are larger deals," said Dawn Mangerson, senior portfolio manager at McDonnell Investment Management. "It does drop off but once thing that jumped out at me was the highway financings, there are three more larger deals after seeing a few the past couple of weeks and it has me wondering if that has to do with the plan at the federal level for transportation."

Mangerson also said that recently, bonds maturing in 10 years or less, particular the 5-year part of the curve, has seen very strong demand. The long end, meantime, is seeing smaller, but still signficant, demand.

"Investors are willing to go out in the curve, as long as they can get paid for it by getting yield," she said. "We haven't seen much offered in the secondary, so that is not really an option."

JPMorgan is scheduled to price the largest deal of the week – a $973 million offering from the Illinois Finance Authority, for Presence Health Network. The revenue bonds are scheduled to price on Tuesday and to mature serially from 2020 through 2034 and with term bonds in 2036 and 2041.

The Chicago-based network said the sale is designed to overhaul its debt portfolio and provide some breathing room to help stabilize its balance sheet.

The deal leads a total of $1.6 billion of debt issuance that received approval from the Illinois Finance Authority board last week as borrowers rush to take advantage of the record low interest rates. Presence will use proceeds of deal, expected to sell as fixed rate, along with existing debt service reserve funds being freed up, to refinance all of its existing debt. The deal is rated Baa3 by Moody's Investors Service, BBB-minus by S&P Global Ratings and triple-B by Fitch Ratings.

Morgan Stanley is expected to price the California Health Facilities Financing Authority's $851 million of revenue bonds for Sutter Health on Wednesday. The deal is rated Aa3 by Moody's and AA-minus by S&P and Fitch.

Citi is slated to price the Alabama Federal Aid Highway Finance Authority's $550 million of special obligation revenue bonds on Monday.

The largest competitive sale will come from the State of North Carolina, as they will sell $200 million of GO public improvement bonds for 'Connect NC' on Wednesday.

The state recently signed the 2017 budget bill into law on July 15 when Gov. Pat McCrory put his John Hancock on the bill. This sale will be the first borrowing of the $2 billion in general obligation bonds voters approved in March.

Mangerson said that it is an issuer's market in some respects but hopes to see a backup in yields sooner rather than later.

"If we do see a backup in yields, it will be a buying opportunity but the market could definitely handle a decent amount of supply without a significant backup."

Jim Grabovac, senior portfolio manager at McDonnell added that we have seen a post Brexit corrective market and that the muni curve has steepened because short end demand remains strong and the Treasury curve is doing the opposite.

"As you look forward, the stronger case for pressure on growth rather than pressure on inflation to move higher, the more likely the Fed is reluctant to push the envelope," he said. "For the near term, the concern is rates going higher or losing total return if market backs up but the larger concern for investors is reinvestment, with yields as low as they are, if they do get a backup of yields, there will be significant demand."

Secondary Market

Top-quality municipal bonds were steady on Friday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.45% on Thursday, while the yield on the 30-year muni was flat from 2.15%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Friday. The yield on the two-year Treasury rose to 0.70% from 0.69% on Thursday as the 10-year Treasury yield was unchanged from 1.56% and the yield on the 30-year Treasury bond decreased to 2.29% from 2.30%.

The 10-year muni to Treasury ratio was calculated at 92.6% on Friday compared to 91.9% on Thursday, while the 30-year muni to Treasury ratio stood at 94.1% versus 92.4%, according to MMD.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended July 22 were from Connecticut, New York and California issuers, according to Markit.

In the GO bond sector, the Greenwich, Conn., 2s of 2017 were traded 22 times. In the revenue bond sector, the NYC MTA 5s of 2056 were traded 39 times. And in the taxable bond sector, the California 7.6s of 2040 were traded 33 times.

Week's Most Actively Quoted Issues

California issues were among the most actively quoted names in the week ended July 22, according

On the bid side, the California taxable 7.6s of 2040 were quoted by 15 unique dealers. On the ask side, the California taxable 7.6s of 2040 were quoted by 17 unique dealers. And among two-sided quotes, the California taxable 7.6s of 2040 were quoted by 10 unique dealers.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $864.8 million to $11.80 billion on Monday. The total is comprised of $4.23 billion of competitive sales and $7.57 billion of negotiated deals.

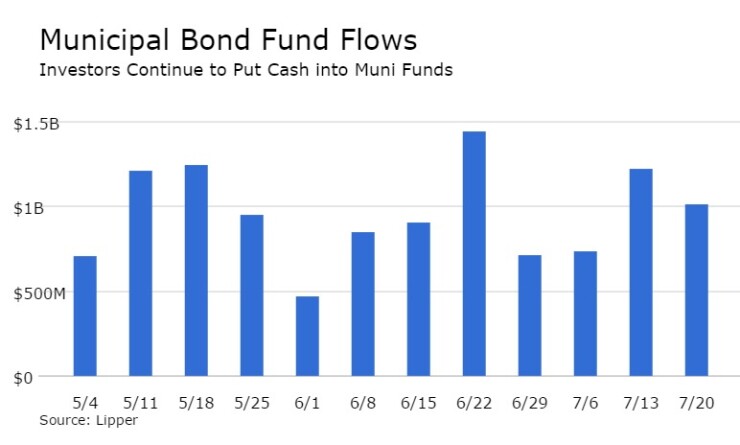

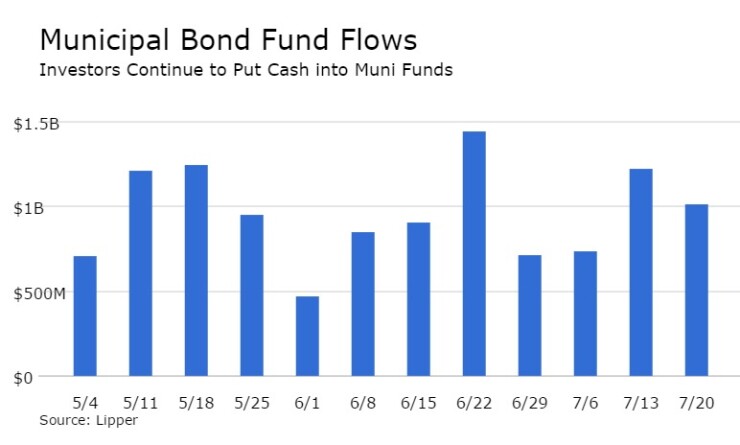

Lipper: Muni Bond Funds See Inflows

For the 42nd straight week, municipal bond funds reported inflows, according to Lipper data released on Thursday.

The weekly reporters saw $1.014 billion of inflows in the week ended July 20, after inflows of $1.222 billion in the previous week, Lipper said.

The four-week moving average remained positive at $922.446 billion after being in the green at $1.030 billion in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced inflows, gaining $671.101 million in the latest week after inflows of $762.527 million in the previous week. Intermediate-term funds had inflows of $254.709 million after inflows of $186.246 million in the prior week.

National funds had inflows of $882.469 million on top of inflows of $995.331 million in the previous week. High-yield muni funds reported inflows of $281.660 million in the latest reporting week, after inflows of $335.893 million the previous week.

Exchange traded funds saw inflows of $192.991 million, after inflows of $124.531 million in the previous week.