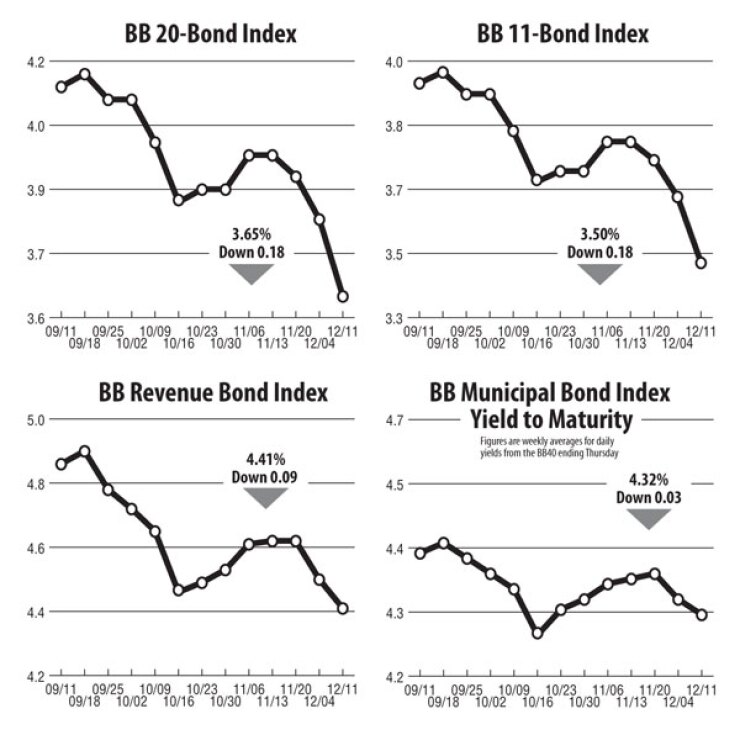

For the week ended Dec. 11, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, dropped three basis points to 4.32% from 4.35%.

The Bond Buyer's 20-Bond GO Index of 20-year general obligation yields dropped to its lowest level in more than a year as it fell 18 basis points in the week ended Dec. 11 to 3.65% from 3.83% in the previous week. The last time the index was lower was on May 16, 2013 when it stood at 3.61%.

The 11-Bond GO Index of higher-grade 20-year GO yields also lost 18 basis points, to 3.50% from 3.68% the prior week. It is also at its lowest level in over a year - it stood at 3.46% on May 23, 2013.

The Bond Buyer's 25-bond Revenue Bond Index dropped nine basis points to 4.41% from 4.50% the previous week. It is at its lowest level since May 30, 2013 when it was 4.39%.

The yield on the U.S. Treasury's 10-year note lost six basis points to 2.19%. The yield on the Treasury's 30-year bond fell 11 basis points to 2.84%.