BRADENTON, Fla. - In preparation for the first hearing in the appeal of Jefferson County, Ala.'s exit from bankruptcy, county attorneys say petitions filed by litigants fail to address required legal matters and are largely devoted to "completely tangential allegations."

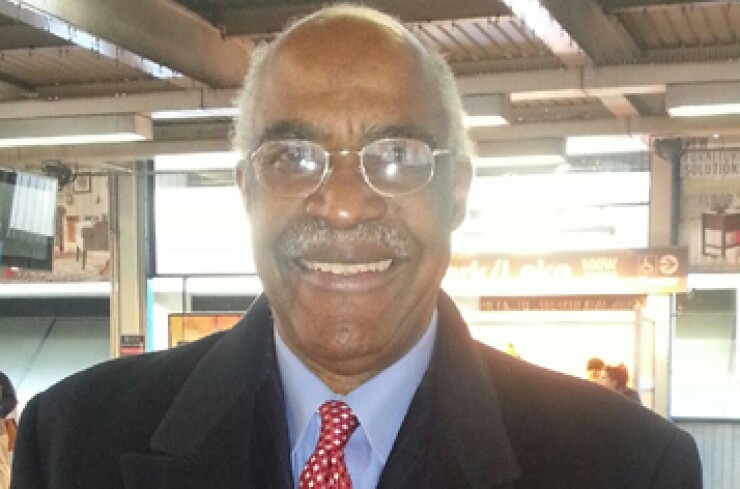

The hearing is May 15 on two of the three appeals filed by former broker-dealer Calvin Grigsby, an attorney representing 13 people known as the Bennett ratepayers whose lead plaintiff is Jefferson County Tax Assessor Andrew Bennett.

The group includes local residents and elected officials who are trying to unwind the bankruptcy exit deal that resolved the county's $3.1 billion of sewer debt with the sale of $1.8 billion in new sewer refunding warrants in December. The Bennett ratepayers filed a main appeal of the reorganization plan, which dismissed their claim for the return of sewer funds paid by the ratepayers.

The group also appealed rulings over their two adversary proceedings opened during the county's two-year stint in court. Adversary proceedings are complaints about specific claims, equitable relief, or other issues. The ratepayer's proceedings were dismissed as being moot when the Chapter 9 plan was confirmed.

County attorneys argued in a court filing Friday that they have shown through extensive evidence that the two appeals are moot under constitutional, equitable, and statutory doctrines, and are due to be dismissed.

The Bennett ratepayers do not have a viable response to the mootness doctrines, they did not contest the county's evidence, and they did not submit evidence of their own, county attorneys said.

"Perhaps recognizing that these efforts to evade the mootness doctrines cannot succeed, the Bennett ratepayers devote most of their submission to irrelevant and confusing detours into the merits of the appeal and completely tangential allegations," said the filing.

The county said it is not possible to legally vacate only a portion of the confirmation plan dealing with the sewer debt because the settlement is a cornerstone of the entire plan.

"Because the various elements of the county's substantially consummated plan are inextricably interwoven, the entire plan would have to be unwound in order to grant the Bennett ratepayers relief," said the brief. "While the Bennett ratepayers have suggested that funds distributed to the various retired sewer warrant holders can be pulled back and redirected to the Bennett ratepayers, that suggestion is pure folly."

Grigsby said that his appeals should go forward, in part, because during the bankruptcy the adversary cases were procedurally mishandled when he was denied the opportunity to have a trial, which would have allowed him to discuss the merits and call experts.

"This is a situation where the consumers don't seem to have a voice in what's going on, and they are the ones paying the bills," he told The Bond Buyer.

In an interview earlier this month, bankruptcy attorney James Spiotto said most Chapter 9 plans are upheld on appeal so Grigsby and his clients could face an uphill battle contesting Jefferson County's bankruptcy.

"Historically, unless you have some real clear issue, and it's generally decided at the lower court level, taxpayer lawsuits haven't gone very far," said Spiotto, managing director of Chapman Strategic Advisors LLC and co-publisher of Muninetguide.com.

Jefferson County filed for reorganization in November 2011, and exited bankruptcy Dec. 3, 2013 after implementation of its adjustment plan through the sewer refunding. The county also had $1 billion of other debt outstanding, and the plan made most of those creditors whole though the underlying debt was refunded in some cases to extend maturities or resolve non-payment defaults.