The Regents of the University of California is planning to sell $665 million of medical center pooled revenue bonds next week to finance medical center projects on four of its campuses.

Barclays and Citi, joint senior managers on the transaction, are scheduled to price the deal on Aug. 7, after a retail order period on Aug. 6. Orrick, Herrington & Sutcliffe LLP is bond counsel.

The deal will include $635 million of fixed rate bonds and $30 million of weekly variable rate demand bonds. The university anticipates its first rate reset the week of Aug. 19, according to Dianne Klein, a spokeswoman for the university.

Klein said the estimated final maturity for the fixed rate bonds is in 2048, and for the variable rate bonds, in 2047.

The proceeds will be used to finance the East Campus Bed Tower project, now called the Jacobs Medical Center, at the university's San Diego Medical Center. The new 10-story center will provide an expansion of Thornton Hospital on the university's La Jolla campus.

The total project is estimated to cost $700 million and will include 161 beds, five operating rooms, eight labor and delivery rooms, and a helicopter landing pad. It's scheduled to open in 2016.

Proceeds will also go toward financing other projects for the University of California's Irvine Medical Center, the Davis Medical Center, and the UCLA Medical Center, as well as toward refunding bonds issued in 2004.

The bonds are secured by a pledge of revenues derived from the operation of the university's five medical centers located at its Davis, Irvine, Los Angeles, San Diego, and San Francisco campuses. Revenues include any income received, proceeds from condemnation and insurance awards, investments, and gifts and donations.

The bonds are rated Aa2 by Moody's Investors Service, AA by Fitch Ratings, and AA-minus by Standard & Poor's.

Fitch and S & P assign a stable outlook, while Moody's holds a negative outlook.

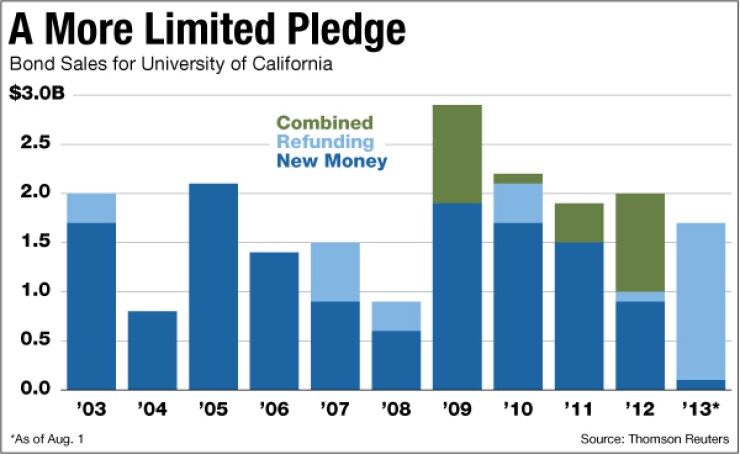

Moody's said its outlook reflects the university's five years of operating deficits, a reduction in cash flow and unrestricted financial resources driven primarily by mounting pension liabilities, and a capital plan that anticipates significant additional borrowing.

"The Aa2 rating on the medical center pooled revenue bonds reflects a more limited and less diversified revenue pledge and risks associated with the healthcare industry," analysts said in a report.

Moody's rates the university's general revenue bonds one notch higher at Aa1, which reflects its "premier international education, research, and clinical reputation and leading position as the largest single system of higher education in the United States."

The agency assigned the variable rate bonds a VMIG 1 rating, citing the university's adequate liquidity to cover put risk, together with documented procedures for liquidating securities to pay bondholders, if necessary.

S & P also said its AA-minus rating is due to a more limited security of revenues from the system's five medical centers.

"The system has weathered several years of increasingly difficult and complex fiscal pressures and while it has implemented numerous strategic initiatives to manage through these pressures, the benefits may not fully be realized for several years, which could pressure the rating," said credit analyst Jessica Matsumori.

S & P rates the variable rate bonds at A-1-plus and Fitch rates them at F1-plus.