DALLAS — Amid fears of rolling blackouts in Texas next summer, new municipal debt for electric power generation in the state has fallen sharply because of financing constraints and environmental litigation.

The largest issue this year, $590 million from the Lower Colorado River Authority, included $390 million to take out commercial paper for new transmission lines. The remainder was a refunding of previously issued bonds.

Aside from the LCRA transmission lines, there were no large bond issues for electric utilities, particularly for generation.

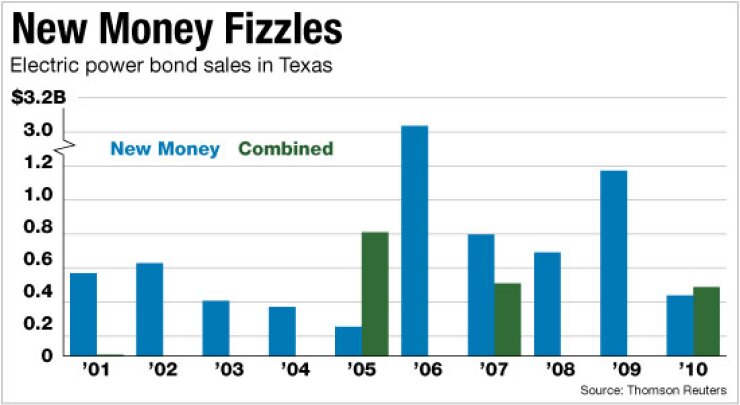

The low for electric utility bonds in Texas came in 2000, when none was issued. The peak was in 2006, when more than $3 billion was issued.

The trend in electric utilities parallels the nationwide decline in bond issuance, but is even more pronounced. For the year to date, new supply across all sectors nationally is down 32.3% at $264.7 billion, compared with $391.2 billion in 2010.

While new debt for public power has fallen to just 0.3% of the Texas bond market, the state’s electric grid has recently seen major projects worth several billion dollars.

San Antonio’s CPS Energy, the largest public utility in the nation, is operating the $1 billion Spruce 2, a 750-megawatt coal-fired plant that went into service in May 2010, providing power for the peak summer season.

The plant was estimated to have saved the Texas electric grid $45 million compared with the cost of power from existing generators but was taken off line last December for repairs under warranty.

Paula Gold-Williams, chief financial officer for CPS, said the recent drop-off in issuance is related to the Build America Bond program that ended Dec. 31.

“We actually pushed more issuance into 2010 to take advantage of the taxable BABs,” she said. “We participated in Build America Bonds in a pretty significant way.”

To the north, the LCRA, an Austin-based wholesale provider of water and power, is developing financing for a 540-megawatt, gas-fired power plant that is expected to cost between $520 million and $550 million.

The plant, expected to break ground next year near Marble Falls in Central Texas, will replace the 37-year-old, 420-megawatt Ferguson unit.

Even with those and other new units providing more efficient power, the Electric Reliability Council of Texas that operates the state’s electric grid reported last week that power reserves — the extra capacity used to avert rotating outages — will likely fall below the minimum target beginning next summer.

This month’s update of the capacity, demand, and reserves report showed a decrease in available resources of more than 2,600 megawatts for the summer of 2012 from the amount that was forecast in June.

The reduced capacity is primarily because of additional plans to mothball some generation units and several delays in planned generation, along with a higher load forecast, ERCOT said.

Reserve margins are projected to reach 12% at summer peak season in 2012 and 2013 — below the 13.75% target that was used in the ERCOT region to ensure reliable operation of the grid during higher-than-normal temperatures and generator outages.

“We are very concerned about the significant drop in the reserve margin,” said ERCOT chief executive Trip Doggett. “If we stay in the current cycle of hot and dry summers, we will be very tight on capacity next summer, and have a repeat of this year’s emergency procedures and conservation appeals.”

ERCOT is working with the Public Utility Commission on several rule changes, including resolution of pricing issues that may reduce incentives for new power plant capacity.

Though public power and investor-owned plants operate on different pricing models, the two come together on the ERCOT grid.

The LCRA, for example, has signed an agreement to buy 22% of the power produced by the new, investor-owned Sandy Creek Energy Station, a 900-megawatt coal-fired plant near Waco that has been delayed.

Under the agreement, the LCRA will hold an 11.14% equity ownership position in the new plant. Sandy Creek Energy Associates, the manager of the project, is jointly owned by affiliates of Dynegy Inc., LS Power Group, and the Brazos Electric Power Cooperative.

Sandy Creek was designed to replace generation from two older coal-fired power plants that are being mothballed because of environmental regulations, officials said. But problems during the startup of the plant damaged equipment, pushing the start date to the spring of 2013 from 2012, according to ERCOT.

One of the largest proposed investor-owned coal-fired plants, the White Stallion in Matagorda County, is on hold because it could not obtain adequate water supplies from the LCRA. The ongoing South Texas drought is a significant factor in power generation, because power plants require abundant water supplies for cooling.

The water issues have become so acute that CPS and San Antonio’s water utility held their first joint meeting this year to coordinate policies.

The water crisis in the state has also provided another front for opposition to coal-fired plants. Environmental organizations have aggressively fought coal plants in Texas through the courts.

A recent report from the Union of Concerned Scientists warns of possible rolling brown- or blackouts from lack of water or water returning to waterways at temperatures higher than those allowed by the Environmental Protection Agency. Unreliable reporting of actual water withdrawals complicates planning, according to the report.

A report from the Brattle Group estimated that tighter regulation could lead to retirement of more than 15% of ERCOT capacity by 2020.

While new bonds for power projects may be in short supply, public utilities did take advantage of low rates for refunding deals this year.

A $51 million refunding deal from CPS in October was oversubscribed seven times, providing savings of $7.7 million. Senior director of finance Linda Dzierzanowski credits the utility’s high ratings of AA from Standard & Poor’s, AA-plus from Fitch Ratings, and Aa1 from Moody’s Investors Service.