ALAMEDA, Calif. — Moody’s Investors Service upgraded Alaska to Aaa Monday, as the state prepares to sell $200 million of general obligation bonds.

“That triple-A is the big one for us,” said Deven Mitchell, Alaska’s debt management director. “We’re pretty happy to have the fresh look Moody’s was willing to give the credit.”

Alaska is now the 15th state with Moody’s gilt-edged rating, following a short stint at Aa1. Moody’s elevated Alaska to Aa1 from Aa2 in April, as part of its recalibration of municipal credits to a global scale.

“The upgrade is based on Alaska’s amassing of very large, available financial reserves in recent years, which has underscored the state’s conservative financial management practices and left Alaska well positioned to manage potential challenges,” Moody’s said in its ratings report.

The state government has $14 billion in reserves — enough to pay for almost three years of operating expenses, Moody’s noted. The state’s primary revenue source is oil taxes, and Moody’s credits Alaska for using recent windfalls to rebuild its budget reserves.

On Nov. 2, Alaska voters approved a $397 million GO bond measure, primarily for schools and universities. The first $200 million from the authorization is being sold next month.

“The structure is designed to take full advantage of the Build America Bond program that currently exists,” Mitchell said.

There will be three series. Traditional tax-exempt bonds will anchor the short end; there will be $45 million in taxable qualified school construction bonds, which qualify for a federal subsidy of up to 100%; and the longer maturities will be anchored by taxable BABs, which receive a 35% federal subsidy for interest payments.

The BAB and QSCB programs sunset at year-end without action from Congress.

“We wanted to take advantage of the taxable bond structure with the subsidy, pushing them to the long end,” Mitchell said.

No decision has been taken yet as to whether or not the BABs will carry a make-whole call provision versus the traditional municipal bond 10-year call provision.

“The current numbers would suggest it’s worth considering going with the make-whole, but that decision will be made closer to pricing, based on the market,” Mitchell said.

The deal is tentatively scheduled to price Dec. 7 following a retail order period Dec. 6, Mitchell said.

Citi is the senior manager, Scott Balice Strategies the financial adviser, and K&L Gates the bond counsel.

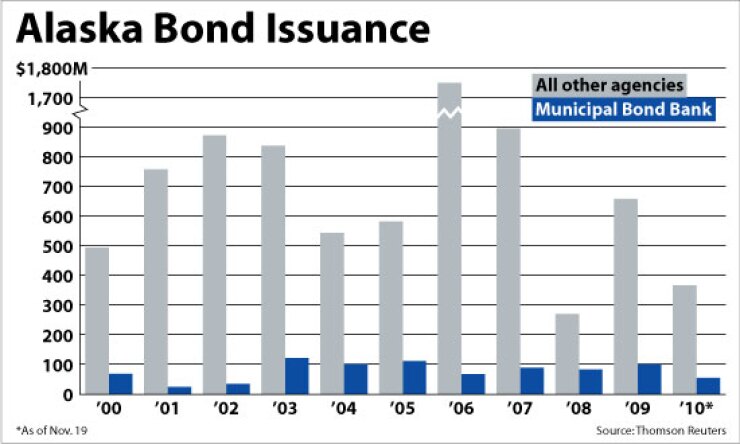

The upgrade affects about $475 million of outstanding GOs. Moody’s also upgraded about $76 million of certificates of participation and other subject-to-appropriation debt to Aa1 from Aa2, and upgraded to Aa2 from Aa3 debt for which the state provides a moral obligation guarantee to replenish debt-service reserve, including certain bonds issued by the Alaska Municipal Bond Bank and Alaska Energy Authority.

Ahead of next month’s deal, Fitch Ratings and Standard & Poor’s each affirmed their AA-plus ratings for Alaska GO bonds.