The Port Authority of New York and New Jersey plan to competitively sell $116.8 million of bonds on Wednesday to refund outstanding debt.

The deal comes after Moody’s Investors Service upgraded the agency’s debt and a tentative agreement was announced on the redevelopment of the World Trade Center site.

The consolidated bonds will be marketed as serials and term bonds with maturities out to 10 years, matching the maturities of the outstanding bonds that were issued in the 1980s.

Darrell Buchbinder is the authority’s in-house bond counsel.

The transaction will terminate a variable- to fixed-rate swap, costing the port approximately $14.2 million. The authority currently has swaps with a notional value of $717.2 million that had a negative mark-to-market value of $123.3 million as March 19.

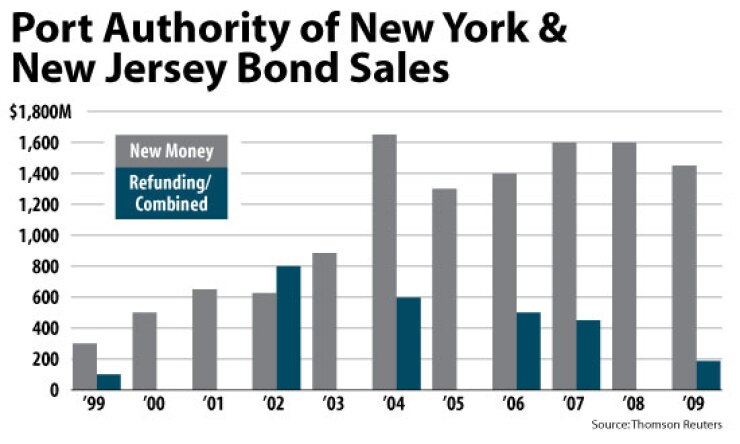

The issuer has sold $11.66 billion of new-money bonds and $2.53 billion of refunding bonds since 2000, according to Thomson Reuters.

Last week Moody’s upgraded the consolidated bonds to Aa2 from Aa3 and affirmed its rating on the subordinate-lien debt, known as versatile structure obligations, as A1. Both outlooks are stable. The upgrade affects $12.4 billion of outstanding debt.

Moody’s cited the authority’s favorable financial results in tough economic times as well as its near monopoly over critical transportation infrastructure in the New York metropolitan area. The agency has maintained a 3.95 times debt service coverage and built up reserves even in the weakened economy, Moody’s said.

Moody’s also noted as a positive the Port Authority’s willingness to use its independent rate-setting powers. Challenges include the impact of the economic slowdown and the cost and complexity of its capital plan, which includes long-delayed development at the World Trade Center site.

In December the authority passed an austere $6.3 billion operating and capital budget that kept growth of operating spending at zero in 2010. It also cut its 2007-2016 capital plan by $5 billion to $24.5 billion. Even during the downturn, the agency increased its reserves to $2.55 billion at the end of 2009 from $2.39 billion at the end of 2008.

The authority operates four airports in the metropolitan region, along with commuter rail, bridges, tunnels, maritime ports, and a bus terminal in Manhattan. It also owns the World Trade Center site.

A tentative deal with developer Silverstein Properties Inc. to redevelop the World Trade Center site announced last week puts more of the Port Authority’s resources into the development but so far has not had a credit impact.

“Overall the World Trade Center is a concern as is all subsidy of lesser performing assets,” said Moody’s analyst Chee Mee Hu. “Being involved in this is not a credit positive.”

However, the potential revenue outflow at the World Trade Center has been acknowledged for a long time, she said.

Fitch Ratings analyst Michael McDermott said it’s too soon to tell what the impact of the agreement will be.

“We don’t view it as a credit positive or a credit negative,” he said. “In the end it looks like they’ve nailed down things and they’re moving forward, which is good.”

Fitch and Standard & Poor’s rate the authority’s outstanding consolidated debt AA-minus. Neither Fitch nor Standard & Poor’s had issued ratings on this week’s deal by press time.

The authority has a mix of revenue generating and non-revenue generating assets, he said.

“The PATH [commuter rail] system loses money every year, the ports slightly break even and the airport and the bridge and tunnels generate a fair amount of the total revenue of the system,” McDermott said.

Development at the WTC stalled in part because the Port Authority was late delivering sites for development to Silverstein Properties, and because the downturn in the economy made financing three towers more difficult. Silverstein leases the site from the Port Authority.

In December, the New York Liberty Development Corp. sold $2.59 billion of escrow bonds on behalf of Silverstein to develop the World Trade Center site. The bond proceeds were escrowed because the authority and Silverstein were still in talks about a revised development agreement and the authorization for the federal Liberty bond program expired on Dec. 31.

The bonds were issued as mandatory tender bonds that all can be called on Oct. 12, 2010. The tender would allow for the debt to be remarketed as variable or fixed bonds with proceeds used for construction or as new escrow bonds if necessary.

Congress created the Liberty bond program following the Sept. 11, 2001, terrorist attacks that destroyed the original World Trade Center. Liberty bonds are tax-exempt debt not subject to New York State’s private-activity bond volume cap.

Silverstein plans to use the Liberty Bonds to partially finance two towers. To use the bond proceeds, they have to be remarketed.

The authority and New York City have already agreed to lease 60% of Tower 4, which is already under construction and due to be completed in 2013.

Under last week’s tentative agreement, the Port Authority would agree to provide a lease on the currently unrented 40% of the tower that would serve as security on the remarketed Liberty bonds if Silverstein was unable to fully rent up the building.

Tower 3 would also use Liberty bond proceeds, but its construction would progress only if Silverstein met certain targets. New York City, the state, and the Port Authority would agree to act as a guarantors of the bonds for up to $390 million if Silverstein were unable to make debt service payments.

The city, state and authority would also contribute $210 million to the project. The city’s portion would be in the form of $130 million of forgiven payments in lieu of taxes that Silverstein would otherwise have to make.

Silverstein would be required to raise $300 million of private unsupported equity, pre-lease 400,000 square feet of the tower, and obtain private financing.

Neither the authority, which is building Tower 1, nor the city will sell bonds to support Silverstein’s towers, city and authority spokesman said.

Plans for Tower 2 would be put on hold.

The agreement is expected to be finalized within 120 days and brought to the authority board for final approval.

The Port Authority still expects to use $701.6 million of Liberty bonds allocated to finance its tower, assuming Congress passes a retroactive extension of the bond program.