Build America Bonds continued to reshape public finance last month, shifting more than a quarter of state and local government debt into the taxable bond market.

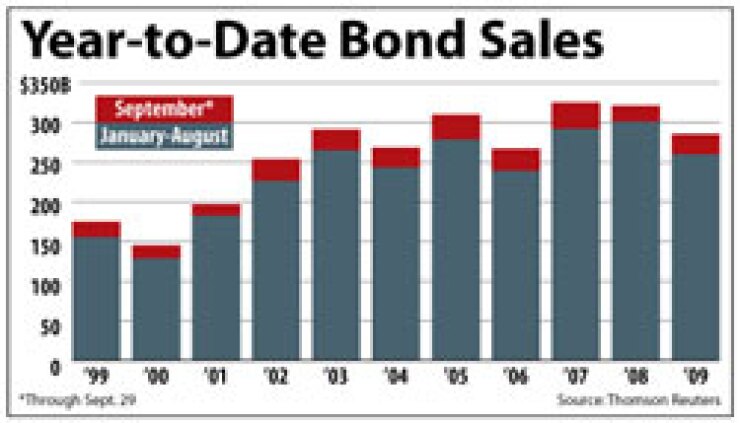

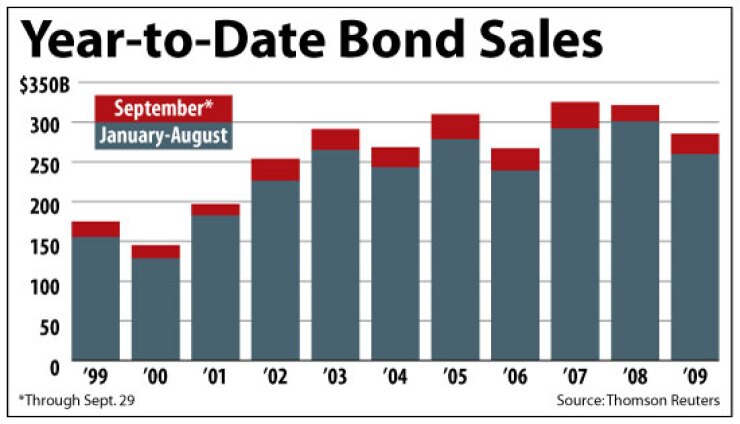

Municipal governments sold $25.45 billion of bonds in September, according to Thomson Reuters, up from $20.19 billion in September last year.

The comparison is to a month that seems like a long time ago. September 2008, which featured the Lehman bankruptcy, was the first month in which municipal issuance was decimated by the financial crisis.

The story line developing in 2009 has been an evolution in municipal finance from tax-exempt debt to taxable bonds.

Municipalities sold $7.18 billion of taxable bonds in September, fueled by $5.61 billion of BABs.

Taxable bonds represented 28.2% of municipal issuance in September. While shy of last month’s record, taxable bonds commanding such a mighty share of the municipal market has no precedent prior to 2009.

The highest share of municipal issuance taxable bonds have had in a year is 10.7%, according to Thomson Reuters.

“We’re in a sea change here for the municipal bond industry,” said Richard Ciccarone, director of research at McDonnell Investment Management.

While BABs have been the hottest topic in municipal finance for five months, Ciccarone said the difference lately is smaller issuers are now using them too.

“You can see the diverse list of different kinds of governmental borrowers that are using them now,” he said. “That’s likely to continue as long as the math works.”

Many of the biggest deals in September had BAB components, including Utah’s $982.2 million general obligation sale, the Missouri Highway and Transportation Commission’s $600 million sale, and the Chicago Board of Education’s $547.3 million deal.

The surge in taxable bond issuance compensates for sharp declines in moribund or bygone categories, such as variable-rate debt.

Variable-rate bonds, which pay interest rates that reset regularly, typically need letter-of-credit backing from a bank.

Because many banks’ credit ratings were pummeled during the financial crisis, this backing has become more expensive and difficult to find.

As a result, issuance of variable-rate debt with a short put option in September was just $1.7 billion, down from $6 billion in September last year.

There are two ways of looking at the shift toward taxable bonds in public finance.

From the issuers’ perspective, the BAB program has unlocked new channels of financing, especially for often-elusive long-term financing.

Enacted through the American Recovery and Reinvestment Act in February, the program enables issuers to forego the tax exemption on their debt and instead sell taxable bonds and collect a federal subsidy equal to 35% of the interest costs.

By selling taxable bonds, municipalities have accessed an array of new types of investors, including European investors and pension funds.

Issuers have sold $34.42 billion of BABs since they first hit the market in April, according to Thomson Reuters, relying on the taxable market for more than 17% of total municipal borrowing from April through September.

In a year in which tax-exempt issuance is down more than 15%, state and local governments have found an alternative source of money.

In many cases, issuers are structuring deals with tax-exempt debt for short-term borrowing and taxable bonds for long-term borrowing.

From the investors’ perspective, the BAB program has created, or at least exacerbated, a scarcity of tax-exempt bonds.

It is impossible to tell how many BAB deals are replacing tax-exempt issuance as opposed to supplementing it.

Still, analysts believe most BABs are siphoning to the taxable market deals that otherwise would have been tax-exempt. Couple this with $57 billion in new cash bequeathed to municipal bond mutual funds this year, and a lot more money is chasing a lot less supply.

The result has galvanized municipal bond values.

The yield on the 10-year triple-A muni, according to the Municipal Market Data curve, plunged almost 40 basis points in September.

The yield continues to set new lows on a near-daily basis, and ticked up only one day in all of September.

Faced with such meager yields, investors have begun snapping up lower-quality bonds, many analysts say. The spread of the single-A 10-year over the triple-A 10-year compressed 35 basis points in September.

The biggest municipal bond mutual funds are at their richest asset values in at least a year. The First Trust Advisors index tracking municipal closed-end funds is up 37% in 2009.

Phil Condon, head of muni portfolio management at DWS Investments, worries that if BABs keep supplanting tax-exempt issuance, rates on tax-exempt bonds may fall too far and retail investors might lose interest.

Condon does not like the program. After nearly a decade in which hedge funds dominated the long end of the municipal market, retail investors are finally coming back.

By pushing tax-exempt rates down, the program might “interrupt an otherwise rejuvenated” retail interest in munis, he said.