DALLAS - The Cypress-Fairbanks Independent School District in Texas will issue one of the year's largest school bond issues this week - an anticipated $410 million - including $185 million of taxable Build America Bonds.

The negotiated deal is just the second BAB issue from a Texas district but more than three times larger than last week's deal from the Carroll Independent School District in the Dallas-Fort Worth area.

While BABs trade in step with Treasuries, the combination of taxable and tax-exempt debt broadened the investor pool for Carroll ISD, according to trading desks. The tax-exempt refunding bonds with 4.70% coupons drew yields of 4.78% with maturities of 2030.

Merrill Lynch & Co. is senior manager for the Cy-Fair deal, with seven co-managers. RBC Capital Markets is financial adviser, with Vinson & Elkins as bond counsel.

Stuart Snow, associate superintendent of business services for the district, said using the BABs should help lower the costs of issuance.

"From what we're seeing in the market right now, the BABs are pricing 70 to 80 basis points better, at least on the back end, than normal tax-exempt bonds," Snow said. "Plus we were able to put a 10-year call on the BABs."

He also said more Texas school districts may start including BABs in future debt issuances.

"As long as the market continues to be where it's at now and the Feds continue to provide this type of structure, I believe you will see more of these types of deals," he said.

The $225 million of Series 2009A tax-exempt bonds and $185 million of Series 2009B BABs included in the Cy-Fair issue are both structured as serials reaching final maturity in 2038.

Snow said the bonds won't be insured and will come to market on the strength of the district's underlying credit, which is in the double-A category that has proven to be a make-or-break threshold for school districts in a risk-averse market.

The state's triple-A rated school bond-guarantee program - the Permanent School Fund - has not been providing guarantees since March due to declining investment results and capacity limits. Nevertheless several Texas school districts are in the market this week. Houston and the Texas Water Development Board are other Texas issuers selling bonds this week.

Fitch Ratings assigned a AA-minus rating to both portions this week's Cy-Fair sale, citing the district's "solid tax base, sound management practices, historically healthy financial position, and operating and capital pressures associated with rapid enrollment growth."

Fitch analysts Gabriela Gutierrez and Rebecca Moses pointed out that the district's high debt burden "is expected to remain elevated given its substantial capital needs and slow principal amortization."

The fast-growing district in suburban Houston has also seen its enrollment pace slacken and economic pressures increase under the state's new funding formula.

"Further significant declines in the district's fund balance reserves will likely put downward pressure on the district's underlying long-term bond rating," Fitch analysts noted.

Standard & Poor's assigned a AA-minus rating to the tax-exempt and BAB portions of the sale, according to Snow, while Moody's Investors Service gave a Aa3 rating to both series of bonds yesterday and affirmed the rating on Cy-Fair's outstanding debt."

Analysts said the rating reflects the district's "substantial suburban tax base that is expected to remain stable despite a slowdown in growth; adequate financial position, with fiscal demands associated with rapid enrollment growth; high but manageable debt ratios, and limited taxing flexibility."

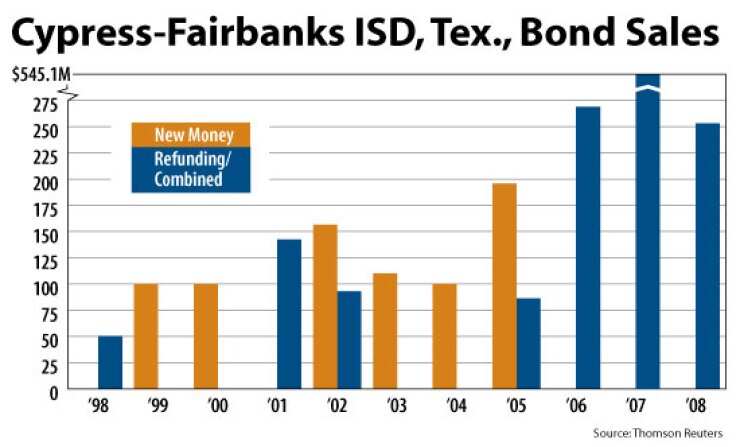

The district has $1.6 billion of general obligation bonds outstanding, including Series 2002B and Series 2005 adjustable-rate bonds that will be converted to fixed rate as part of this week's deal. Those bonds are rated triple-A because they still carry the PSF backing. With the conversion of that series, the district's entire debt portfolio will be in fixed-rate mode.

Proceeds from the new-money component of this week's sale will fund new schools and maintenance at existing facilities The deal includes about $125 million from a 2004 bond program and $100 million from an $807 million bond authorization passed by voters in November 2007 to build 14 new schools, renovate others, buy land for up to 10 more sites, acquire new buses, and upgrade technology.

The district will have about $360 million of authorized but unissued debt following the sale.

Now with nearly 101,000 students, Cy-Fair is the state's third-largest school district behind Houston and Dallas.

Snow said enrollment growth has slowed somewhat and officials are scaling back plans for when some of the new schools will open, but Cy-Fair is still adding 3,000 to 3,500 students annually.

He expects the district to be back in the market again next year with a sale that will exhaust the $36 million remaining from the 2004 authorization and include about $125 million or so from the more recent bond package.

The district covers 186 square miles, including the unincorporated communities of Cypress and Fairbanks, as well as the city of Jersey Village. Enrollment grew at more than 5% annually the last five fiscal years, but the slowdown of single-family home construction in the past two years resulted in lower than previously projected enrollment growth.

Although the district's tax base is primarily residential, commercial property represents about a quarter of the tax base. The taxable assessed value of the district averaged more than 10% annual growth the past five years, including a $3.5 billion increase for fiscal 2009 to $31.4 billion.

In the last fiscal year, Cy-Fair faced a $24 million deficit that dropped its total fund balance levels to $55 million, or 9% of operations, down from $79 million, or 14% in fiscal 2007, according to analysts. The district adopted a balanced budget for fiscal 2009 and expects to add an estimated $4 million to its fund balance, analysts said.

To stay in balance, district officials froze payrolls and cut about 450 teaching positions as well as support staff. The 2010 budget includes a $9.5 million general fund surplus, despite the opening three new campuses.