WASHINGTON - President Bush is expected to sign new legislation as early as today that will allow the Department of Education to temporarily purchase loans held by student loan lenders, a move that supporters of the legislation said would help mitigate a looming student lending crisis.

But market participants involved in financing the loans, which are issued through the Federal Family Education Loan program, said yesterday that there are still several remaining questions about how the department will purchase them, including whether it would issue standby purchase agreements to buy student loan bonds in the secondary market. Until those questions are answered, it is not clear how effective the legislation, which was quickly shepherded through Congress last week, will be at staving off a potential crisis, they said.

"This new authority should be the first line of defense," said one source who did not want to be identified. "But [the Department of Education] still has to announce how much they will pay for the loans and how they want the loans structured."

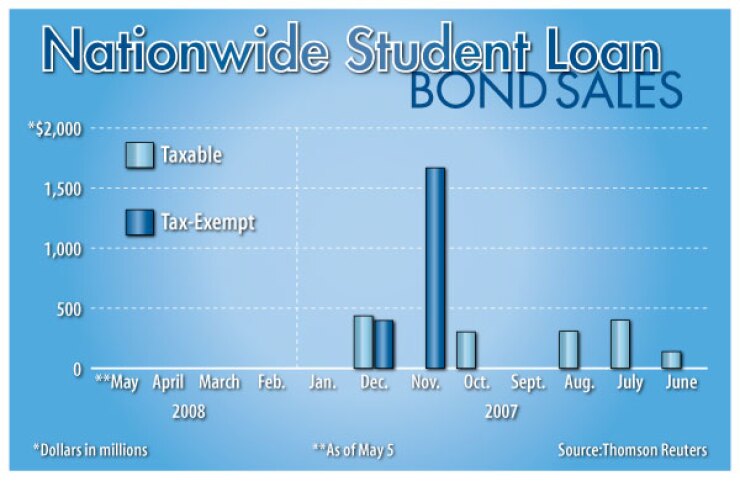

Last year, student lenders sold about $60 billion of student-loan related securities, of which roughly 20% were tax-exempt and issued by state-level agencies and nonprofits. But since the beginning of the year, new issuance has evaporated as more than 50 lenders have suspended their lending activities, raising questions about the availability of loans for students planning to enroll in school in the fall.

About 80% of schools participate in the FFEL program, but a new law that went into effect Oct. 1 that favors direct federal loans, which are financed with Treasury securities, essentially halved the interest rates on certain FFEL program loans. The lower yields FFEL lenders receive on their loans combined with the ongoing market turmoil, which has sharply raised borrowing costs, has squeezed many issuers out of the market.

As if this wasn't reason enough for some sort of federally-led bailout, the Federal Reserve Board on Monday released a bleak survey of 29 domestic banks that had originated FFEL program loans in last fall. Of the banks, which account for about 60% of the assets on the books of all the domestic commercial banks, about 40% expect that they will decrease the amount of FFEL program loans they originate for the fall of 2008 compared to the previous year.

In addition, about 45% of the banks forecast the number of schools for which they will provide financing under the FFEL program to decline, and about 60% expect to reduce the amount of borrower benefits on the loans that they originate. The report also indicated that several banks that originate private, non-FFEL program loans expect a decline in business for the coming academic year.

A spokeswoman for the Department of Education said officials there are still reviewing the scenarios under which they would purchase FFEL program loans. She noted that the department is working to implement its separate "lender of last resort" program that will allow the department to provide FFEL loans to individual students and schools that can demonstrate they are unable to otherwise secure lending. Though Congress authorized the LLR program several years ago, it has never been widely used before.

As the department considers the situations in which it will purchase FFEL program loans, sources outside the department said yesterday that there are three approaches the department may take to purchasing the loans or student loan bonds.

In one scenario that most applies to municipal securities and assumes that the lenders will have access to the capital markets, FFEL lenders, including the state-level agencies and nonprofits that issue tax-exempt debt backed by the loans, would sell student loan-related securities with standby purchase agreements from the Education Department. In the event that the buyers of the securities want to sell them but were unable to, the department would agree to purchase them.

"That's something that could be useful, especially to some of the smaller bond issuers, because it would enable lenders to raise money in the private sector. The investors in all likelihood would not shun the bonds because they would know they were liquid," said the source, adding that the option would be attractive because the education department would just be providing interim liquidity without jettisoning the existing lending system altogether.

The source also said that the legislation appears to specifically reference the option of a standby agreement because it says that the department can "purchase or commit to purchase" student-loan securities.

Under another possible option, the Education Department could purchase the loans only after a lender is able to borrow money and originate new loans. But in such a scenario, banks may quickly be overwhelmed by loan requests, given the current credit crisis, the source said.

"Obviously banks have less money to lend than usual and they're more reluctant to lend," he said.

A third option that sources speculate Education Department officials are likely considering entails essentially advancing the money to the lenders ahead of the origination of the loans.

But one of the sources said that such a scenario is a bit of a stretch because it involves "technical and operational as well as philosophical problems."

"What's the threshold by which you say, 'OK, there isn't private capital and I need the federal government to step in?' " he asked. "Putting the money up front arguably undercuts the market, and some may say it even introduces the possibility of fraud. Normally you would have to demonstrate that there isn't a market, and the government would probably want some type of evidence that they needed to act."

"Would the bank have to show that it attempted to securitize loans before the federal government interceded?" he asked.

White House and Treasury Department officials did not return calls or e-mails.