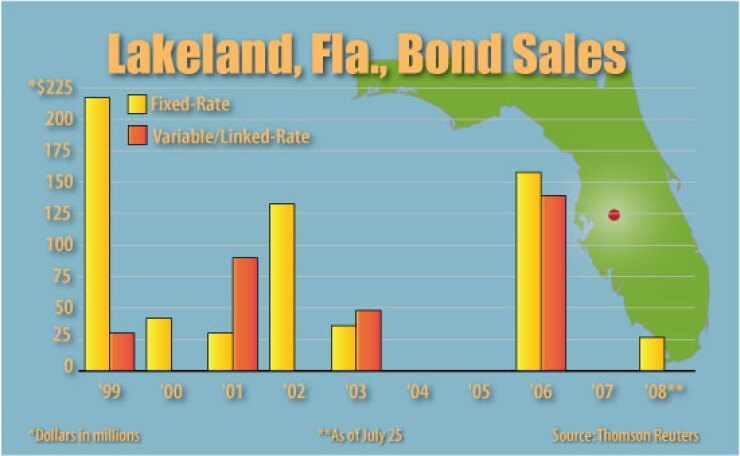

BIRMINGHAM, ALA. - Lakeland, Fla., officials, who hedged their exposure in the auction-rate market by buying other issuers' troubled securities at penalty interest rates, today expect to sell $200 million of variable-rate revenue and refunding energy bonds.

Some $140 million of the proceeds will be used to repay a repurchasing agreement that enabled the city to retire its auction-rate securities and another $60 million of proceeds will provide new money for construction projects for Lakeland's energy system.

The deal is structured as $100 million of Series 2008A and $100 million of Series 2008B variable-rate energy system revenue and refunding bonds secured by a senior-lien pledge on the system's net revenues.

The 2008A bonds will receive credit enhancement with a liquidity facility from BNP Paribasand the liquidity facility on the 2008B bonds will come from SunTrust Bank. Both will expire on July 29, 2011, unless renewed or extended.

The deal itself is straightforward, except that it's refunding repurchasing agreements the city entered into with Goldman, Sachs& Co., allowing officials to retire $140 million of troubled auction-rate securities in April.

"This is a roundabout refunding of a refunding to solve the auction-rate problem when the market blew up," said Lakeland finance director Greg Finch.

While the ARS were outstanding, the city experienced interest rates as high as 10% and 12%. Finch said he and treasury manager Jeff Stearns devised a way to limit the city's exposure to the high interest rates.

"We were hedging our exposure on higher interest rates by buying auction-rate paper of other issuers," Finch explained. "For a while when we were paying 10% to 12% interest rates, we were also investing in other people's auction-rate securities paying 10% to 12%. We did offset a substantial portion of the cost."

Lakeland had unrestricted funds it could pledge to the Goldman repurchase agreement, which eventually took out the troubled securities, Finch said. Today's transaction will take out that repurchase agreement and provide new money for the electric system.

The 2008 bonds received underlying ratings of A-plus from Fitch Ratingsand Standard & Poor's and A1 from Moody's Investors Service. All three agencies have a stable outlook on the electric system's debt.

With credit enhancement, bond documents said, the 2008A bonds are expected to receive ratings of AAA/F1-plus from Fitch, Aa1/VMIG1 from Moody's, and AA-plus/A1-plus from Standard & Poor's. The 2008B bonds are expected to receive ratings of AA/F1-plus from Fitch, Aa2/VMIG1 from Moody's, and AA-minus/A1-plus from Standard & Poor's.

Goldman Sachs is the underwriter on the 2008A bonds, while SunTrust Robinson HumphreyInc. is underwriting the Series 2008B.

Holland & KnightLLP is bond counsel, and Nabors, Giblin & Nickerson PA is underwriters' counsel.