-

Foothill Gold Line Construction Authority had to rethink the final leg of a 60.2-mile light rail line when the contractor's final bid came in 50% higher than its estimated project costs.

March 31 -

"It seems like hitting last year's volumes should be within the strike zone for the marketplace," said Kyle Javes, a managing director and head of municipal fixed income at Piper Sandler.

March 31 -

Higher borrowing costs without the tax exemption could force public water, sewer and power providers to raise rates, neglect infrastructure, or sell systems.

March 31 -

Issuance for the week of March 31 is at $9.29 billion, with $8.011 billion of negotiated deals and $1.28 billion of competitive deals on tap.

March 28 -

An Illinois park district became the only local general obligation credit to default in 2024, according to Municipal Market Analytics.

March 28 -

California's High Speed Rail Authority has until June 2026 to figure out how to close a $7 billion budget hole, said the LAO's principal fiscal and policy analyst at a budget hearing.

March 28 -

Washington, D.C. Mayor Muriel Bowser is delaying submitting her 2026 budget while unresolved budget cuts passed by the House in the continuing resolution and then amended by the Senate to repair the damage remain in limbo.

March 28 -

These institutions will see increased usage if some threats to the market come to fruition.

March 28 -

California plans to price $2.5 billion in new money and refunding general obligation bonds next week, with retail orders Tuesday and final pricing Wednesday.

March 28 -

Following Wednesday's selloff, muni yields were cut even further, with yields rising up to six basis points, depending on the scale. Meanwhile, UST yields rose two basis points out long.

March 27 -

Mary Simpkins, who joined the SEC's Office of Municipal Securities in November 1997, is retiring.

March 27 -

As muni advocates fight for the preservation of tax exemption, foreign investors are using the ASCE Infrastructure Report Card as evidence that increased privatization of assets is needed to improve the grades.

March 27 -

The departures happened around the time Barclays handed out companywide bonuses and coincided with the firm in the process of shrinking its muni footprint in the regions, according to sources.

March 27 -

Only Georgia has a higher state-level infrastructure grade from the ASCE than the the C the U.S. received this week. More in the Southeast are C-minus or lower.

March 27 -

The S&P issuer rating upgrade marks the second for Oklahoma since September when Moody's raised its rating a notch to Aa1.

March 26 -

"We're navigating a crosscurrent of macro risks — tariffs, tax policy proposals, DOGE cuts, and evolving economic data — layered on top of a broader risk-off tone," said James Pruskowski, CIO of 16Rock Asset Management.

March 26 -

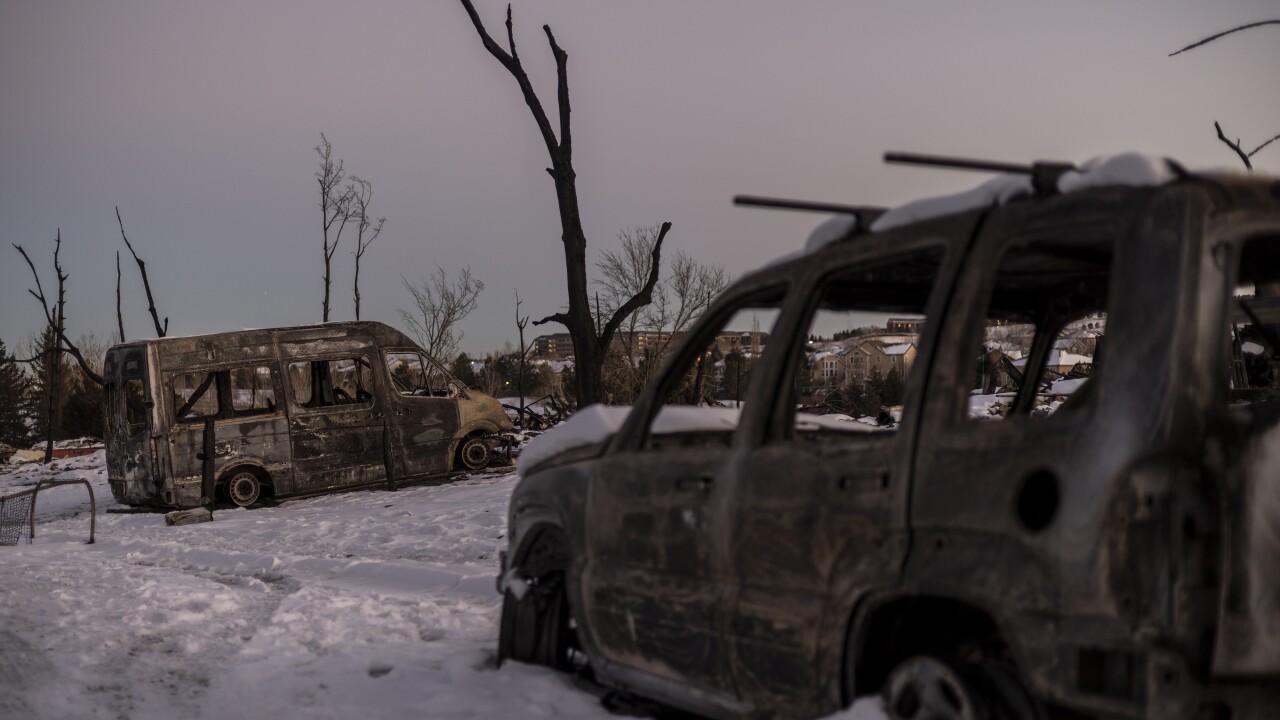

The Los Angeles Legislative Delegation penned a letter to state budget leaders asking for $1.9 billion in fire recovery aid for the city after meeting with city leaders.

March 26 -

The effects of infrastructure spending and the need for more are coming into focus as the municipal bond community is dealing with a Congressional threat to eliminate the tax-exempt status of munis.

March 26 -

The legislation would create a bond-financed reinsurance program to stabilize the homeowner's insurance market, which has been impacted by wildfires.

March 26 -

United First Partners was fined for reporting and supervisory rule violations as part of a wider FINRA disciplinary action involving the firm.

March 26