BRADENTON, Fla. – West Virginia voters go to the polls Saturday to decide whether to issue $1.6 billion in general obligation bonds as part of Gov. Jim Justice’s “Roads to Prosperity Program.”

If voters approve the constitutional amendment, state officials will be authorized to issue 25-year GOs in four series: up to $800 million within a year; $400 million in 2018; $200 million in 2019; and $200 million in 2020.

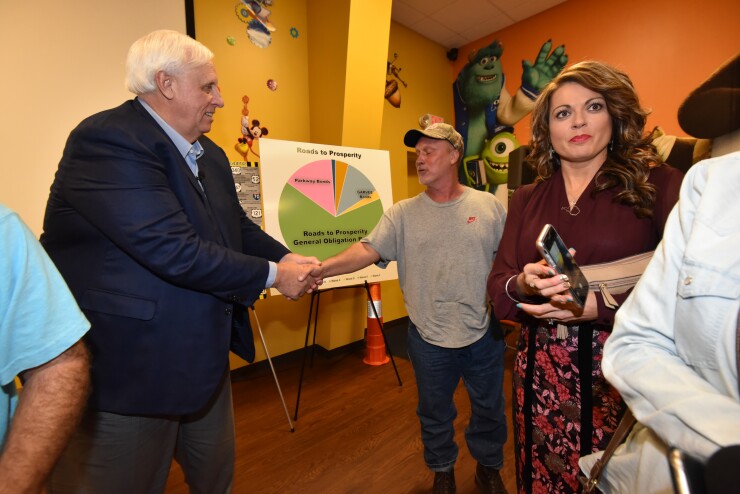

“This is the most important election in our state's history,” Justice

For months, Justice has traveled the state speaking about the financing plan that he has called the “Roads to Prosperity Program,” mostly discussing the GO referendum on Saturday.

The road program also includes an increase in federal authority to issue about $440 million of grant anticipation revenue vehicle bonds and an increase in the amount of toll revenue bonds that could be as high as $500 million.

Justice has said the overall program will create “tens of thousands of good paying jobs” and that it will launch the state into an economic recovery.

West Virginia’s credit rating has suffered because of its deteriorating economy, and budget problems. On Feb. 21, Moody's Investors Service downgraded the state’s GOs to Aa2 from Aa1, citing its multiyear structural budget imbalance.

Last year, budget problems fueled by sharp declines in demand for coal products that support the state’s economy and high unemployment led S&P Global Ratings to downgrade the state’s GOs to AA-minus from AA. Fitch Ratings had similar concerns in 2016 when it lowered the GOs to AA from AA-plus.

About $322.8 million of GOs were outstanding as of March, according to a state debt report.

The governor has repeatedly said that the GO bonds will not require raising property taxes or any other taxes. Earlier this year lawmakers passed a series of bills championed by Justice to raise revenues that will support the road bonding program.

The new fees took effect July 1, and some of the revenue will go toward backing the GO bonds, according to Mark Muchow, the deputy secretary of the West Virginia Department of Revenue.

Senate Bill 1006 increased numerous license and registration fees in the Division of Motor Vehicles and raised various state and excise fees, including a 3.5-cent-per-gallon retail tax on motor fuel and a 5% whole sales tax on motor fuel. The sales tax on vehicle purchases was also increased to 6% from 5%.

SB 1003 prevented the expiration of tolls levied by the West Virginia Parkways Authority on state’s 88-mile turnpike that were scheduled to cease after current bonds are paid off in May 2019. The bill also gave the authority the ability to issue revenue bonds to finance new projects, to issue refunding bonds, and to increase tolls.

Depending on the outcome of ongoing studies, the parkways authority could have the capacity to issue as much as $500 million of toll revenue bonds. Bond proceeds could be used on the turnpike or on road projects in counties adjacent to the turnpike.

The turnpike authority had about $29.4 million of outstanding revenue bonds as of March 31, the state debt report said. The bonds are rated Aa3 by Moody's Investors Service and AA-minus by S&P Global Ratings. Both have stable outlooks.

Muchow said the building program calls for road and bridge projects to be done in nearly all of the state’s 55 counties.

“We’ll count everything Saturday night and hopefully the vote will go in the direction of approving the bonds,” he said. “This is a good time to go to the bond market. Interest rates are historically low.”