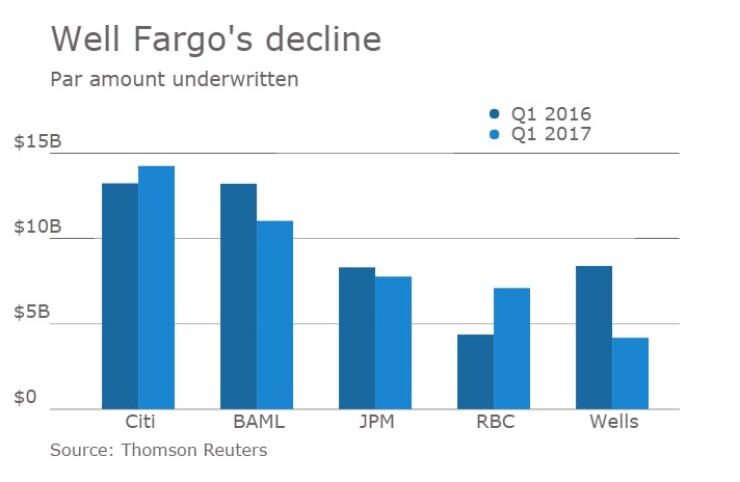

Wells Fargo dropped to eighth place among municipal underwriters in the first quarter, from third a year earlier, after a fake accounts scandal prompted some issuers to suspend business with the bank.

Citi and Bank of America Merrill Lynch maintained the top two positions in the ranking, while JP Morgan and RBC Capital Markets moved up to the third and fourth positions respectively. Public Financial Management Inc. led the financial advisor league table and the state of California was the largest municipal issuer.

Wells was fined $185 million last year by the Consumer Financial Protection Bureau, and more than 5,000 employees were fired over business practices that drove employees to create more than two million new accounts without customers' knowledge or authorization, in order to generate new fee revenue. Major municipal bond issuers such as California, Chicago, Illinois, and Ohio have suspended the firm from doing state and state agency bond and financial services business.

Wells' par amount was down by more than 50%, to $4.19 billion from $8.39 billion a year earlier.

A Wells spokesman declined to comment, saying it was in a quiet period before the release of its first quarter earnings on April 13. In the past the bank has stressed that there's a separation between its commercial bank and government services groups.

It was announced Monday that former Wells Fargo CEO John Stumpf will lose an additional $28 million in incentive pay, on top of $41 million in unvested equity awards that he previously forfeited. His ex-deputy Carrie Tolstedt will have to forfeit stock options worth roughly $47 million, according to a new report by the firm’s board of directors.

Overall volume fell in the first quarter of 2017, compared with the first quarter of 2016, as only four of the top 10 firms increased par amount underwritten from a year earlier. Those four are Citi, RBC, Goldman Sachs and Piper Jaffray.

Citi finished the first three months of the year with a par amount of $14.26 billion in 123 deals, or a 16.5% market share. It finished the same period of 2016 with $13.24 billion in 125 transactions, good for a 13.9% market share.

Citi was the lead manager on five deals greater than $500 million, including two that were $1 billion or greater.

The largest deal it priced was the mammoth $2.79 billion of various purpose general obligation and refunding bonds for the State of California on March 7. The firm also priced the $1 billion of airport revenue bonds for Salt Lake City, for the SLC international airport, on Feb. 8. Some other larger deals were: $900 million of GO bonds for New York City on Feb. 8; $624 million of airport revenue refunding bonds for the City of San Jose, Calif. on March 28; and $747 million of GO and GO refunding bonds for the State of Connecticut.

Bank of America Merrill Lynch finished the first quarter with $11.04 billion in 118 deals and a 12.8% market share, compared with $13.22 billion in 122 deals and a market share of 13.8% a year earlier.

JP Morgan moved up one spot from a year earlier to third place, even as its par amount slipped to $7.77 billion, from $8.32 billion. Its market share rose to $9% from 8.7%.

The biggest mover of the quarter was RBC, which cracked the top four with a par amount of $7.10 billion or 8.2% market share, after being seventh place in the first quarter of last year with $4.38 billion.

"We have a strategic, long-term approach to expanding market participation, which is evident in the strong start to the year,” said Chris Hamel, head of municipal finance, at RBC. “We are grateful to the many clients who entrusted their bond issuance to RBC. We continue to monitor the broader infrastructure discussions in Washington and believe we are well-positioned to serve our municipal clients' needs now and in the future."

RBC was lead manager on 19 deals that were $100 million and larger. The largest RBC deal in the first quarter was the Jan. 18 sale of $500 million of power system revenue bonds, 2017 Series A for the Department of Water and Power of the city of Los Angeles, Calif.

Morgan Stanley rounds out the top five, finishing with $6.17 billion, compared with $6.99 billion. Goldman jumped two spots to sixth, increasing its par amount to $4.97 billion from $3.78 billion. Stifel finished with the most deals at 215, for a total of $4.25 billion, good for seventh place.

After Wells in eighth place, Piper came in ninth with $3.49 billion and Raymond James rounded out the top 10 with $3.22 billion.

Financial Advisors

Public Financial Management finished the quarter with a par amount of $15.44 billion in 260 deals, good for a 21.1% market share. That compares with $19.05 billion in 346 deals or 23.3% market share during the same time period of 2015.

“What we have seen in Q1 and see continuing over the near-term is a mixture of savings-driven refinancings and a growing focus on infrastructure funding," said John Bonow, chief executive officer and managing director for the PFM Group. "The developing situation among the policy and budget folks in the new Administration means that, on the program and funding fronts, local and state officials are increasingly moving forward to address the backlog of infrastructure needs while awaiting more definitive word from Washington."

Bonow also talked about how pension related funding concerns and other budgetary sustainability concerns are also top of mind.

"We expect to be very busy building on the trust we have earned with clients in helping them develop the policies, funding plans and capital market strategies necessary to address these vexing challenges,” he said.

Public Resources Advisory Group ranked second with $11.27 billion and Hilltop Securities was third with $8.69 billion, as the two firms retained their respective positons from the first quarter of 2015. Acacia Financial Group also held its spot in fourth, even as its par amount decreased to $2.51 billion from $3.21 billion.

The three biggest movers in the ranking were KNN Public Finance, Kaufman Hall and Associates Inc., and Lamont Financial Services Corp.

KNN movesd up to fifth from No. 13 with $2.17 billion from $978 million, Kaufman jumped to sixth from 17th with $1.67 billion from $841 million and Lamont climbed to seventh place from 16th with $1.45 billion, up from $877 million.

Municipal Issuers

California finished the first quarter with the most issuance of the thousands of municipal issuers countrywide. The state also finished the year of 2016 as the top issuer.

The Golden State leads the ranking with a par amount of $2.79 billion, which is made up of the one mega deal that priced in early March.

The Empire State Development Corp. finished second for the quarter with $1.84 billion, followed by the Triborough Bridge and Tunnel Authority with $1.20 billion. The Trustees of California State University were in fourth with $1.19 billion and the city of Chicago was fifth with $1.16 billion.

Rounding out the top 10 were: The State of Maryland with $1.14 billion; the Tobacco Settlement Asset Securitization Corp. with $1.10 billion; the city of Salt Lake City, Utah, with $1.07 billion; New York City with $900 million; and the State of Wisconsin with $865 million.