UBS Wealth Management Americas is looking to revive its capital markets and public finance businesses, hiring Peter Hill from Wells Fargo and Steven Genyk from Janney Montgomery Scott and reassigning Chief Risk Officer Mark Sanborn to head capital markets and sales.

The staffing changes were announced Wednesday in an internal memo from Tom Naratil, president of UBS Amercias and Wealth Mangement Americas. UBS, which exited municipal underwriting after the financial crisis, now expects to capitalize on increased demand for double and triple tax exempt securities in the current rising interest rate environment.

“Paramount to our success is our ability to provide ultra-high net worth and high net worth clients with best-in-class products and solutions that meet their growing, sophisticated needs,” Naratil wrote in the memo. “Equally important is ensuring that we have the strength and agility to adapt our business and capitalize on market conditions and secular trends for the benefit of our clients and our company. To that end, and in response to some of the attractive shifts we see taking place in public finance and across the industry, WMA is making some enhancements and changes to its capital markets and municipal businesses, including the addition of several new industry leaders.”

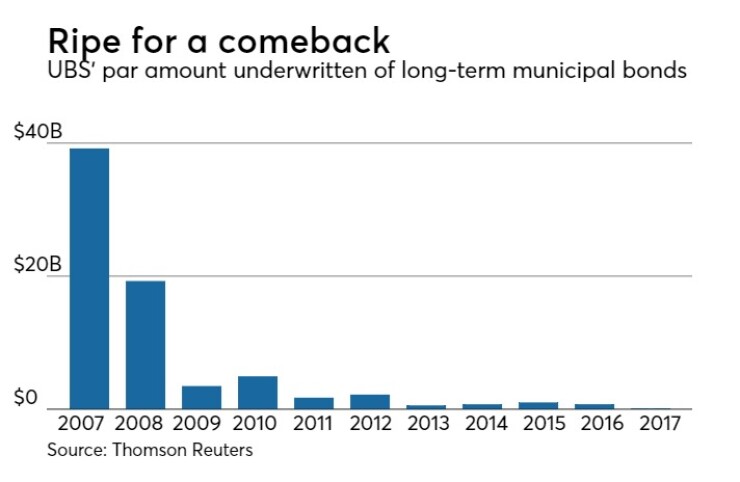

UBS placed 38th in the lead manager ranking last year, underwriting $750.6 million of par amount, down from $39.22 billion in 2007 and $19.28 billion in 2008. The business plunged the following year, and bottomed at $578 million in 2013. Market participants said the bank's return will strengthen the municipal market.

“Having UBS back in the business only helps issuers insure more competition among Wall Street banks and provide the markets some added liquidity and support,” said Noe Hinojosa, president and chief executive officer of Estrada Hinojosa & Co.

Stephen Winterstein, managing director of research & chief strategist at Wilmington Trust Investment Advisors, Inc., said the entry, or in this case, re-entry of a major investment bank in the industry, is good for the asset class.

“We have seen folks exit public finance over the years and this may be the first winds of change," Winterstein said. "They will face challenges such as decline in supply, with less deals and lower spreads, but both Peter and Steve bring a terrific network of issuers along with them and they are well known in the industry. Steve and Peter are two first class guys and if anyone can do it, they can do it. UBS is putting together a strong team.”

Hill will be joining UBS WMA as the head of public finance, after serving as U.S. head of public finance at Wells, a role he's held since 2009. During his tenure at Wells, he revamped the firm's public finance platform, making it a top five player in the Northeast, Texas, Southeast, West and Mountain regions. It was also ranked no lower than No. 8 in healthcare, higher education, public power, transportation and housing.

Hill is a 35-year industry veteran and has spent the bulk of his career helping a number of firms build out their public finance businesses, including Smith Barney, JP Morgan, ACA Capital and Banc of America Securities and is set to join UBS later this quarter after his garden leave.

He is being replaced on an interim basis at Wells by Nancy Feldman, according to Phil Smith, head of government and institutional banking at Wells.

Naratil said Sanborn, who is currently Chief Risk Officer of UBS’ investment bank, will succeed Tom Troy as head of capital markets & sales. Troy informed Naratil about a year ago of his desire to retire after 30 years in the financial services industry to spend more time with family and charitable endeavors.

“Tom's deep knowledge of the capital markets and related risk management, along with his tireless work ethic and commitment to developing talent, have earned him the respect and admiration of colleagues across our industry and beyond,” Naratil said. “Since joining UBS, he's been instrumental in building out our sales and trading functions within WMA, bringing together world-class capabilities from across our company and the Street, and developing top talent and business processes for the benefit of our clients and advisors. Over the past several months, Tom has also been deeply involved in developing the growth strategy for our muni business and I am grateful that he has agreed to stay on until later this year to ensure a smooth transition.”

Sanborn joined UBS in 2011 from Beacon Financial Corp where he was executive vice president and CEO of Beacon Asset Management. He has over 20 years of experience in financial services, and prior to Beacon held senior positions focused on trading and risk management. He was previously responsible for global equity trading at Lehman Brothers. After departing Lehman in 2003, he ran two separate hedge funds that invested in equity and quantitative trading strategies. He will transition to his new role later this summer.

Genyk will join WMA as head of municipal trading. Previously, he led the fixed income capital markets group at Janney, which included institutional municipal sales, trading and underwriting, taxable institutional sales and trading, retail municipal and retail taxable, public finance, CD trading and underwriting and fixed income research and strategy. Under his leadership, Janney has become a top ten competitive municipal underwriter and small issue underwriter. Prior to Janney, Genyk held a number of senior positions within the public finance space to include co-head of public finance at Legg Mason, managing director of public finance at Bear Stearns and head of financing services for the Philadelphia Industrial Development Corporation. He is scheduled to join UBS within the next couple of weeks.

“I'm confident that by strategically investing in key talent and capabilities, we can build on WMA's strong legacy in the municipal business and position our clients to take advantage of the opportunities ahead,” Naratil said.

Bill Hogan, senior managing director of public finance at Assured Guaranty congratulated Hill.

“Peter’s long-standing experience and leadership in the industry shows UBS’ commitment to growing their presence in the municipal space. We look forward to continuing to work closely with Peter and his colleagues at UBS,” said Hogan.

“I would say generally this is good news for issuers, while not necessarily good news for the street, as it is producing more competition in an environment of ever decreasing underwriting spreads,” said Nat Singer, senior managing director at Swap Financial Group and past chair of the Municipal Securities Rulemaking Board. “I think they will encounter two mains challenges; the first is getting issuers to accept doing business once again with UBS, after leaving the industry eight years ago. The second will be getting bankers on board. I don’t see the first one being a huge problem as issuers will likely react favorably to their retail distribution capabilities. The tougher part will be getting bankers to sign on, as it will take a while to develop this acceptance from issuers and ultimately get into the deals and get paid.”

However, Singer said, "Peter is likable and smart, which is a great combination for success."