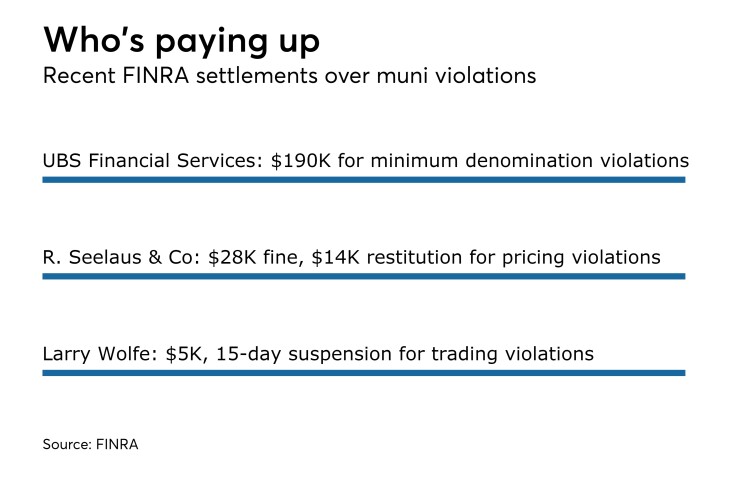

WASHINGTON – UBS Financial Services, R. Seelaus & Co., and one individual have agreed to pay a combined $223,000 in fines to settle separate Financial Industry Regulatory Authority findings of violations that they traded below established minimum denominations, charged excessive prices, and executed trades in accounts without prior customer consent.

The two firms and one individual, Larry Wolfe, agreed to the settlements with FINRA without admitting or denying the self-regulator’s findings. Wolfe and the two firms either could not be reached for comment about the settlements or declined to comment.

FINRA found New Jersey-based UBS engaged in 87 transactions with customers from Dec. 1, 2013 through June 30, 2016 in amounts below the minimum denomination. The settlement included a $190,000 fine and the firm's promise to revise its supervisory procedures related to trading and minimum denominations. The transactions were a violation of Municipal Securities Rulemaking Board Rule G-15 on confirmation, which prohibits trading below the minimum denomination outside of several narrow exceptions, according to FINRA

Rule G-15 includes the MSRB’s requirements for abiding by a security’s minimum denomination, which generally ranges from $5,000 to $100,000.

The findings follow a November 2014 settlement UBS reached with the Securities and Exchange Commission in connection with five customer transactions in Puerto Rico bonds that were below the commonwealth's minimum denomination. UBS agreed to pay a $56,400 fine and revise its policies and procedures as part of that SEC settlement.

Of the 87 transactions FINRA found in its case, 59 occurred before the SEC order, 9 occurred while UBS was reviewing its procedures under the order, and 19 occurred after the firm was supposed to have put changes in place to satisfy the SEC order.

FINRA also found that in 59 of the transactions, UBS did not let customers know that the transactions were in below-minimum amounts. The failures of a lack of supervision and a failure to inform customers represented violations of MSRB Rules G-27 on supervision, G-17 on fair dealing, and G-47 on time of trade disclosure.

R. Seelaus’ $28,000 fine stemmed from 28 pairs of transactions from April 1, 2015 through Dec. 31, 2015 where FINRA found the firm charged aggregate prices, including markups and markdowns that were not fair and reasonable. The self-regulator considered relevant factors to pricing like best judgment of the dealer as to the fair market value of the securities at the time of the transactions, the expense involved in executing the transaction, and the fact that the dealer is entitled to a profit.

The firm also agreed to pay $14,343 plus interest in restitution to the customers.

The markups in 25 of the 28 transactions ranged between 3.01% and 6.89% while the markdowns in the other three transactions ranged between 3.56% and 4.02%. The unfair pricing were violations of MSRB Rules G-17 and G-30 on prices and commissions.

Wolfe’s conduct that led to his $5,000 settlement occurred while he was working at Florida-based Herbert J. Sims & Co. He also agreed to a 15-day suspension from the market for exercising discretion in 39 customers’ accounts without getting prior written authorization from the customers or written approval from the firm to exercise discretion with the accounts. The 39 transactions between Nov. 10 to16 in 2015 were all orders to sell one particular security in each customer account.

Wolfe’s actions constituted violations of MSRB Rule G-8 on books and records, which requires dealers to maintain a customer’s written authorization to exercise discretionary power or authority with respect to discretionary accounts, as well as G-17 on fair dealing, according to FINRA.