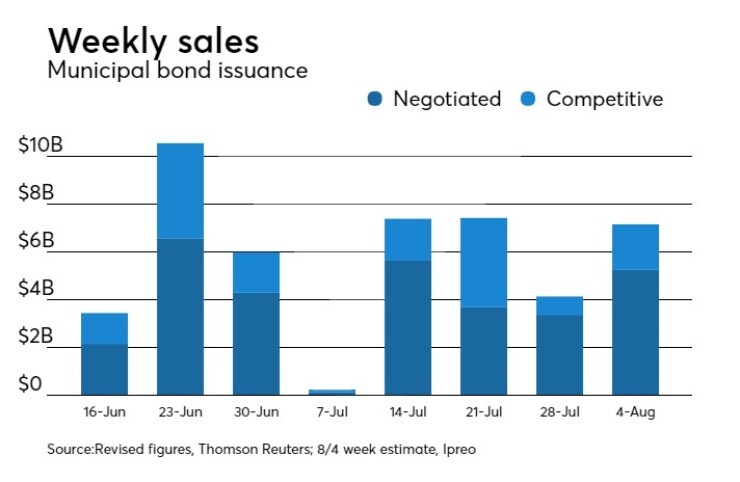

Primary municipal bond market volume is set to rebound to a more normal level in the coming week, bringing traders a variety of offerings.

Ipreo estimates volume will rise to a more normal level of $7.16 billion, from the revised total of $4.17 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.25 billion of negotiated deals and $1.91 billion of competitive sales.

There are 19 scheduled sales larger than $100 million, with six of those in the competitive arena. The calendar features five transportation related over $100 million, including the largest deal of the week.

“Volume is slightly higher than the average for the year,” said Natalie Cohen, managing director of municipal securities research at Wells Fargo. “There are a number of large transportation deals; a mix of new money, some refunding, some taxable; and a mix of securities too – sales tax, income tax and toll, i.e. a little something for everyone.”

Bank of America Merrill Lynch is expected to price the Bay Area Toll Authority’s $1.1 billion of San Francisco Bay Area toll bridge revenue bonds. It is anticipated that there will be two sales of $550 million. The first will consist of senior 2017 Series E bonds featuring term rates and index rate bonds and the second of fixed rate subordinate bonds. Both deals are scheduled to price on Tuesday after a one-day retail order period. The senior bonds are rated Aa3 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings, while the subordinate bonds are rated A1 by Moody’s and AA-minus by S&P.

The Commonwealth of Massachusetts is set to sell $1.5 billion of general obligation of bond anticipation notes on Wednesday in three separate sales of $500 million.

Wells Fargo is slated to price Washington Metropolitan Area Transit Authority’s $496.5 million of gross revenue bonds on Tuesday. The deal is rated AA-minus by S&P and Fitch.

Goldman Sachs is scheduled to price the city of Austin, Texas’ $313.535 million of water and wastewater system revenue refunding bonds on Tuesday. The deal is rated Aa2 by Moody’s, AA by S&P and AA-minus by Fitch.

The biggest competitive sale of the week will take place on Thursday, when the Metro Atlanta Rapid Transit Authority auctions off $252.835 million of sale tax revenue refunding bonds. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

"The FOMC did not raise rates and is maintaining the balance sheet unchanged in the recent July meeting," Cohen said. "It’s a good time for issuers to get into the municipal market -- before many investors disappear for vacation and before September when markets could become more volatile with federal tax reform discussions, federal budget expiration at Sept. 30 and the debt ceiling all heating up after Labor Day.”

She also pointed out that redemptions are still higher than prior years in the summer months of June, July and August, so cash has been chasing a thinner new issue market, which is good for issuers.

Secondary market

Top shelf municipal bonds finished steady on Friday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.95% on Thursday, while the 30-year GO yield was flat from 2.74%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were mixed on Friday. The yield on the two-year Treasury dipped to 1.35% from 1.36% on Thursday, the 10-year Treasury yield declined to 2.29% from 2.31% and the yield on the 30-year Treasury bond decreased to 2.89% from 2.93%.

The 10-year muni to Treasury ratio was calculated at 85.3% on Friday, compared with 84.4% on Thursday, while the 30-year muni to Treasury ratio stood at 94.7% versus 93.6%, according to MMD.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended July 28 were from New York and Washington issuers, according to

In the GO bond sector, the New York City 4s of 2018 were traded 46 times. In the revenue bond sector, the Washington state Economic Development Finance Authority 7.5s of 2032 were traded 51 times. And in the taxable bond sector, the Port of Seattle 3.755s of 2036 were traded 49 times.

Week's actively quoted issues

Illinois and Virginia names were among the most actively quoted bonds in the week ended July 28, according to Markit.

On the bid side, the Illinois taxable 5.1s of 2033 were quoted by 64 unique dealers. On the ask side, the Virginia College Building Authority revenue 3s of 2035 were quoted by 397 unique dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 23 unique dealers.

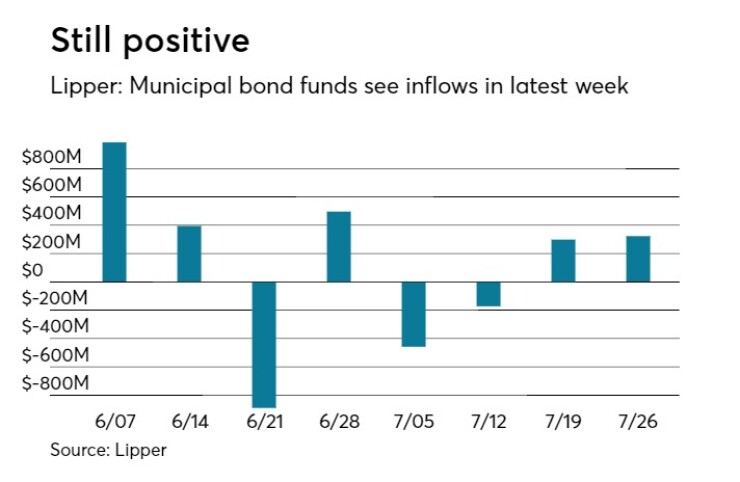

Lipper: Muni bond funds see inflows

Investors in municipal bond funds again saw investors put cash into the funds in the latest week, according to Lipper data.

The weekly reporters saw $322.992 million of inflows in the week of July 26, after inflows of $298.554 million in the previous week.

The four-week moving average turned negative at $2.329 million, after being in the green at $41.012 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $229.732 million in the latest week after inflows of $183.175 million in the previous week. Intermediate-term funds had inflows of $70.336 million after inflows of $84.015 million in the prior week.

National funds had inflows of $431.650 million after inflows of $342.243 million in the previous week. High-yield muni funds reported inflows of $188.672 million in the latest reporting week, after inflows of $39.178 million the previous week.

Exchange traded funds saw inflows of $123.905 million, after inflows of $7.650 million in the previous week.