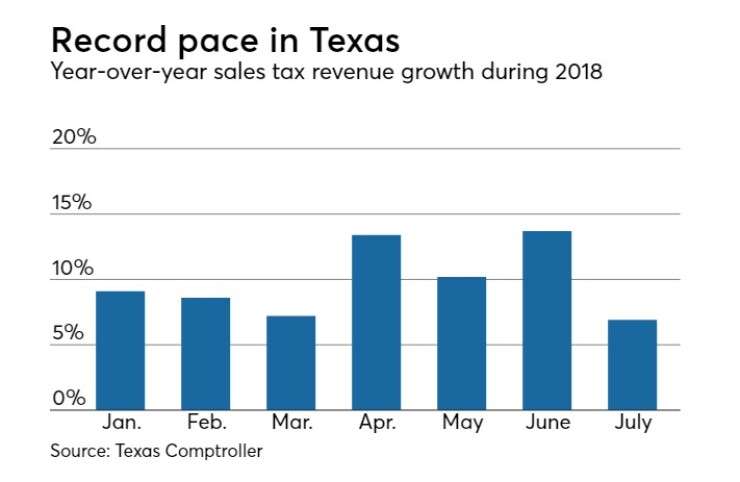

DALLAS – Texas set another monthly record for sales tax collections in July, with revenues growing 6.9% year-over-year to $2.74 billion, state Comptroller Glenn Hegar said.

“Sales tax receipts from almost all major economic sectors were up compared with last year,” Hegar said. “The most notable increases were from oil and gas mining and manufacturing sectors, followed by wholesale trade, restaurants and services."

Sales tax collections have set a record every month this year. The all-time record for any month was set in November 2017 at $2.78 billion. Collections in June of $2.77 million nearly reached that mark.

The July figures were bolstered by $39 million in delinquent sales taxes collected through a tax amnesty program, Hegar said.

The record pace coincides with a strong rebound in oil and gas production in the state. In July, oil and natural gas production taxes soared 62% year over year to $407.9 million.

Revenue from other major taxes also rose in July. Motor vehicle sales and rental taxes produced $437.1 million, an increase of 13.6% from July 2017, and motor fuel taxes edged up 1.5% to $312.9 million.

Total sales tax revenue for the three months ending in July 2018 rose 10.2% compared to the same period a year ago. Sales tax revenue is the largest source of state funding for the state budget, accounting for 58% of all tax collections. Texas does not levy an income tax.

The Texas economy gained 359,500 nonagricultural jobs from June 2017 to June 2018, an annual growth rate of 2.9%, according to the Real Estate Center at Texas A&M University. The Texas rate was higher than the nation's employment growth rate of 1.6%.

The nongovernment sector added 351,700 jobs, an annual growth rate of 3.4%, also higher than the nation's employment growth rate of 1.9% in the private sector.

Texas' seasonally adjusted unemployment rate in June 2018 was 4%, lower than the 4.2% rate in June 2017. The nation's rate decreased from 4.4% to 4%.

A cautionary note came July 29 from the Texas Independent Producers and Royalty Owners Association, one of the state’s largest oil and gas advocacy organizations, which warned of the economic impact on Texas from President Trump’s recently imposed steel and aluminum tariffs.

The association’s president, Ed Longanecker, supported Gov. Greg Abbott’s call for tariff removal.

“Newly implemented tariffs on steel and aluminum products by the Trump administration already are having a negative impact on infrastructure development and drilling projects throughout the country,” Longanecker said.

Trump increased the steel tariff to 25% and the aluminum tariff to 10% effective in late May.

Longanecker noted the industry’s large additions to state revenue and its role in building the $12 billion state Rainy Day Fund.

“Ultimately the tariffs will result in a slowdown in exploration and production activity and infrastructure projects, job loss and decreased tax revenue, which will reverberate throughout the state and national economy,” Longanecker wrote.