DALLAS -- Texas Comptroller Glenn Hegar said that recovery from Hurricane Harvey is expected to cost state government about $2 billion over the next two years but the economy of the state should continue to expand.

“While revenues remained in line with the estimates we made in January, some uncertainty remains in our outlook for the biennium due in part to the ongoing assessment of the economic impact of Hurricane Harvey,” Hegar said in releasing his updated revenue estimate for the fiscal 2018-19 biennium.

“Despite this uncertainty, we are continuing to project steady expansion of the Texas economy following a brief slowdown due to the storm’s impact,” Hegar added.

Hegar estimates how much revenue will be available for spending in the state's next two-year budget cycle before each legislative session, with an update after. The estimate comes after the Texas Legislature completed its 2017 regular session and a special session called by Gov. Greg Abbott. Texas lawmakers meet only in odd-numbered years unless a special session is called.

The hurricane that landed in Texas Aug. 25 is expected to cause a short-term blow to the state’s economy, but the recovery effort is expected to create jobs and sales that will boost the economy. For the state, revenue will be lost to exemptions on certain sales taxes on recovery-related expenses and purchases. Sales tax revenue represents the largest source of income for the state, which has no income tax.

In the fiscal year that ended Aug. 31, "the diversity of the Texas economy, coupled with conservative fiscal management and strengthening in the oil and gas sector, allowed the state economy to return to its normal pattern of growth, which exceeds that of the national economy,” Hegar said.

The updated estimate represents higher revenue forecasts for the 2018-19 biennium than the one Hegar released in January.

As a result of actions taken by the Legislature and an updated economic forecast, the comptroller's office now expects revenue available for general spending in 2018-19 to total about $107.33 billion, versus the previous estimate of about $104.87 billion. The revenue will support the $107.23 billion in general-purpose spending called for by the 85th Legislature, and will result in a final balance available for certification of $94 million, Hegar said.

The State Highway Fund and Economic Stabilization Fund or “rainy day fund” both receive funding from oil and gas severance taxes. Fiscal 2018 transfers will total $734 million each to ESF and SHF. The CRE projects that $777 million will be transferred to each fund in fiscal 2019.

A constitutional amendment passed in 2015 that directs up to $2.5 billion in annual state sales tax revenue in excess of $28 billion into the SHF begins to take effect in fiscal 2018, Hegar noted.

In 2018, the $28 billion threshold is not expected to be reached until August, he said. As a result, a projected $2.31 billion transfer will not occur until September 2018, the first month of fiscal 2019.

In 2019, the state is projected to reach the $28 billion threshold in July, triggering a $920 million transfer to the SHF in August. The remaining estimated $1.58 billion from August collections will be transferred in September 2019, Hegar said.

In addition to market turbulence, energy price fluctuations and potential changes in national economic policy, the impact of Hurricane Harvey contributes some uncertainty to Hegar’s estimate.

Texas remains in the very early stages of the recovery, Hegar said. The full impacts to the state’s economy and revenues have only begun to take shape and will likely change in the coming months.

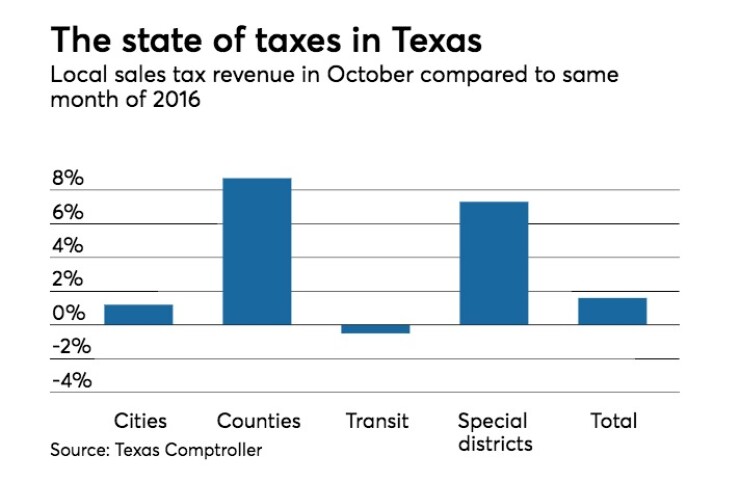

In a separate report, Hegar said that local sales tax revenues in the latest monthly report showed a 1.6% increase. The figures represent sales in August, tabulated in September and reported in October.

Hegar said Wednesday he will send cities, counties, transit systems and special purpose taxing districts $660.4 million in local sales tax allocations.

The latest report showed sales tax collections in storm-struck Houston down 3.89% for the month.

Corpus Christi, where the hurricane made landfall, saw its sales tax revenue fall 9.16% compared to the same month last year. Aransas Pass, just north of Corpus Christi and the site of the first landfall, reported an 18% decrease in sales tax revenue.

By contrast, Midland-Odessa in the heart of the Permian Basin oil and gas producing region, saw sales tax revenue soar. Midland’s revenue soared almost 42%, while Odessa’s rose more than 53%.