DALLAS – Local governments in Texas are enjoying a boom in sales tax collections as they struggle to keep pace with growth, recover from Hurricane Harvey and brace for possible changes in cross-border trade, according to recent economic reports.

“Of the nearly 1,500 city, county, special, and transportation taxing jurisdictions across the state that impose a sales tax, 82% reported greater sales tax revenue collections in 2017 than 2012,” analysts at Moody’s Investors Service said in an April 4 report. “Statewide, local government collections increased 25% to more than $8.4 billion in 2017.”

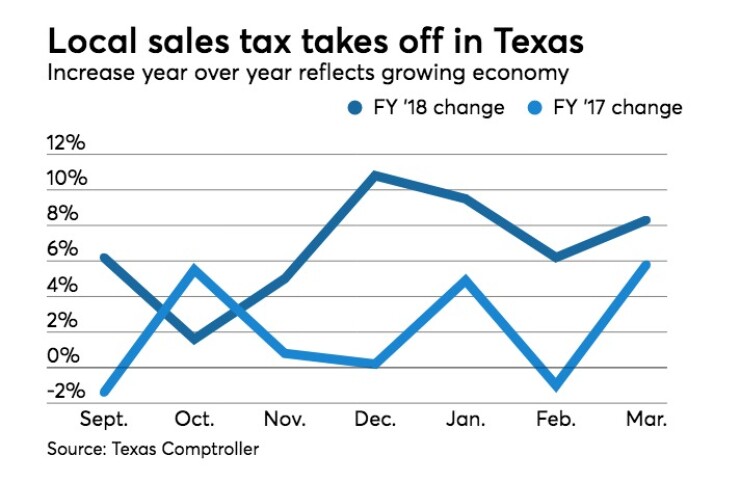

Since the beginning of Texas’ fiscal year Sept. 1, distributions of sales tax revenue to local governments have grown an average of 6.8%, according to reports from Texas Comptroller Glenn Hegar.

For the calendar year to date, sales tax revenue for cities has risen 6.8%, while counties have seen a 14.1% rise. Transit systems' revenues have increased 6% while special taxing district revenues have risen 18.7%

Sales tax collections – unlike property taxes – capture economic growth relatively quickly, providing local governments with revenues to relieve expenditure pressures related to growth, according to the Moody’s analysts led by Kenneth Surgenor.

“With strong economic expansion across the state, local governments are under pressure to maintain existing service levels and expand infrastructure as people and jobs continue to flock to Texas,” the report said. “Sales tax collections provide immediate revenue to local governments via monthly distributions from the state comptroller, although there is a 60-day lag between collection and distribution.”

Property taxes, on the other hand, can be delayed by more than a year because of the timing difference between a property's date of assessment, when property taxes are levied, and when property taxes are due and revenues are received.

While property or ad valorem taxes underpin most bond issues, sales tax revenue usually funds operations.

Local sales taxes are levied by cities, some counties, special taxing districts for hospitals, economic development, emergency and other services, and by transit authorities such as Dallas Area Rapid Transit and the Harris County Metro. Cities, by far, account for the largest share.

From 2012 to 2017, local sales tax collections across the state increased nearly 25% to more than $8.4 billion, according to Moody’s.

Cities in 10 counties in metro areas generated more than $3.4 billion in calendar year 2017. That represents a 27.6% increase over five years, Moody’s found.

Sales tax revenues accounted for 30% of fiscal year 2016 total revenues for cities and 13% for counties, the report said.

“Continued population growth and economic development will drive sales tax revenues higher in the coming years, providing much needed resources as local governments look to maintain service levels, fund pension obligations and expand infrastructure to accommodate the growth,” analysts said.

While credit ratings are buoyed by sales tax growth, reliance on the revenue during times of economic contraction can be a downside risk, they cautioned.

Most of the local governments that experienced significant sales tax revenue growth are clustered around the rapidly growing metropolitan areas in Austin, Dallas, El Paso, Fort Worth, Houston, and San Antonio. In 2017, total sales tax revenues from those cities accounted for more than 20% of total sales tax collected statewide, led by Houston, which accounted for 7.6% of statewide revenues.

From 2012 to 2017, among those cities, sales tax revenues grew an average 25.9%, “which is important because it preserves the cities' property tax margin and provides budgetary flexibility to fund increased expenditures,” analysts said.

Areas with significant decreases in sales tax revenues were generally located in more rural locations in the Panhandle, Permian Basin and south Texas, analysts said. Over the past five years, 198 cities experienced a decline in sales tax revenue collections, led by the South Texas city of Alice, which experienced a 68% decrease.

“As a result of declining sales tax revenues and assessed valuation, the city nearly doubled the property tax rate in 2017,” analysts said.

The City of Robstown, which carries a junk-bond Ba2 rating with a negative outlook, suffered a 45.5% decline, or $1.9 million, from 2012. Robstown, near Corpus Christi, has little flexibility to offset the decline with property tax increases because its levy is already among the highest in the state.

“Further increases would place additional strain on the local economy given resident income indices,” analysts said. “Collectively, cities that experienced declines accounted for a modest 3.2% of total collections statewide.”

The disaster of Hurricane Harvey last August and the threat of a trade war and the end of the North American Free Trade Agreement have shown little impact on local or state sales tax collections.

In the affluent Houston suburb of Sugar Land, which suffered the inundation from 50-inches of rain from Hurricane Harvey, sales tax collections are up more than 7% through the first quarter of the year.

In the industrial port city east of Beaumont, east of Houston, revenues are more than 24% higher for the quarter compared to the same period last year. In March, Beaumont’s collections soared 32%.

Houston’s sales tax revenues are running 8.4% ahead of last year’s as recovery from Harvey’s flooding continues.

Along the border, President Trump’s threat to end the North American Free Trade Agreement unless Mexico halts illegal immigration to the U.S. and his decision to send thousands of troops to the border have not yet impaired sales tax collections.

Laredo, the largest land port of entry on the border, has seen sales tax revenue rise 6% this year, while Brownsville on the southern tip of Texas has enjoyed a 5.5% lift. Much of the sales tax collections in border cities comes from Mexicans who cross the bridges to shop.

Meanwhile, in the oil producing regions of Texas, a rebound in oil prices over the past year has improved local economies in measurable ways.

Tax collections for the quarter in Midland, in the heart of the Permian Basin producing region, are running 15% above the same period last year. In Midland’s sister city of Odessa, sales tax revenues are more than 50% higher.