The imbalance of supply and demand continues to crimp activity for some municipal bond professionals, who say the inefficiencies in volume are most noticeable for shorter maturity bonds.

“We see the municipal bond market as still feeling the after effects of so much supply being crammed into 2017 in reaction to the tax bill,” John Donaldson, head of municipals at Haverford Trust, said in an interview Thursday.

“Everything less than three years seems priced only for individuals paying the new highest bracket of 37%,” he said. “We also see a pronounced impact from the changes in deductions for state and local taxes.”

He said the strongest demand from individuals comes from high tax states. “The dispersion of performance by states for the first quarter was as wide as we have seen in some time.”

Trading activity in the secondary market remained exceptionally light by comparison to the primary, according to Donaldson.

“Even a reduced new issue supply remains more attractive than the secondary market,” he said. “Once investors have the income exempt from their taxes, they are loath to give it up.”

Muni bonds were mostly stronger on Thursday according to a late read of both the MBIS benchmark and AAA scales, which showed yields falling as much as one basis point. The Treasury bonds were also stronger as stocks staged a rebound.

"Municipals have been performing well, driven by strong demand and muted supply," said Shaun Burgess, a portfolio manager and analyst at Cumberland Advisors. "New issues have been well received and are generally getting oversubscribed," he said.

Primary market

In the primary on Thursday, Wells Fargo Securities priced and repriced Charlotte, N.C.’s $409.92 million of Series 2018 water and sewer system refunding revenue

Yields were lowered from two to four basis points reflecting good demand for the issue, according to one trader, who added that top-rated paper was in demand.

The deal is rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

Thursday’s bond offering

North Carolina:

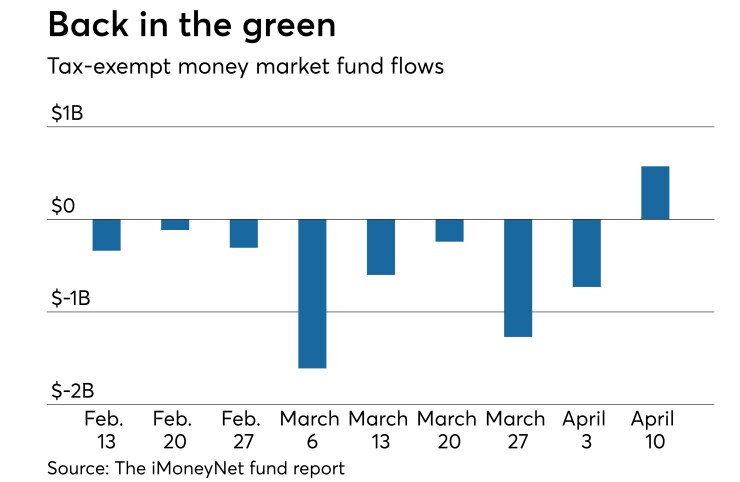

Tax-exempt money market funds saw inflows

Tax-exempt money market funds experienced inflows of $573.3 million, raising their total net assets to $133.72 billion in the week ended April 10, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $730.2 billion on to $133.15 billion in the previous week and marks the first time in nine weeks that it has seen inflows.

The average, seven-day simple yield for the 201 weekly reporting tax-exempt funds climbed to 1.09% from 1.03% the previous week.

The total net assets of the 829 weekly reporting taxable money funds decreased $15.47 billion to $2.659 trillion in the week ended April 9, after an inflow of $11.59 billion to $2.675 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 1.30% from 1.29% from the prior week.

Overall, the combined total net assets of the 1,030 weekly reporting money funds decreased $14.89 billion to $2.793 trillion in the week ended April 9, after inflows of $10.86 billion to $2.808 trillion in the prior week.

ICI: Long-term muni funds see $110M outflow

Long-term municipal bond funds saw an outflow of $110 million in the week ended April 4, the Investment Company Institute reported on Wednesday.

This followed an inflow of $126 million into the tax-exempt mutual funds in the week ended March 28 and inflows of $769 million, $703 million and $214 million in the three prior weeks.

Taxable bond funds saw an estimated inflow of $3.06 billion in the latest reporting week, after seeing an inflow of $137 million in the previous week.

ICI said the total estimated outflows to long-term mutual funds and exchange-traded funds were $1.93 billion for the week ended April 4 after outflows of $13.08 billion in the prior week.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,737 trades on Wednesday on volume of $16.29 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 17.695% of the market, Empire State taking 13.625% and the Lone Star State taking 10.576%.

Treasury sells re-opened 30-year bonds

The Treasury Department Thursday auctioned $13 billion of 29-year 10-month bonds (reopening of the 30-year) with a 3% coupon at a 3.044% high yield, a price of 99.136422. The bid-to-cover ratio was 2.41.

Tenders at the high yield were allotted 41.80%. The median yield was 2.999%. The low yield was 2.188%.

Treasury details upcoming sales

The Treasury Department announced these auctions:

· $16 billion of five-year TIPs selling on April 19;

· $42 billion of 182-day bills selling on April 16; and

· $48 billion of 91-day bills selling on April 16.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.