Santee Cooper is asking the South Carolina Supreme Court to confirm its legal authority to pay debt service on bonds the state-owned utility issued to finance its failed nuclear reactor project.

The utility, formally known as the South Carolina Public Service Authority, filed

The move was prompted by mounting litigation over the shelved twin-reactor venture, and could bolster the authority's ratings, an analyst said.

The state’s high court needs to weigh in on Santee Cooper’s rate-setting authority, the agency said, because the pending lawsuits challenge the legality of financing charges for the reactors that it partially owned. The project was scrapped in July 2017 before the reactors were completed.

“We need immediate Supreme Court action on this fundamental issue,” said Santee Cooper Senior Vice President and General Counsel J. Michael Baxley. “Credit rating agencies have already reacted to the pending circuit court litigation, citing the uncertainty it creates.”

The petition also requests a writ of injunction preventing plaintiffs in pending lawsuits from taking further legal action.

One lawsuit includes a cross claim by Central Electric Power Cooperative, a transmission cooperative that accounts for about 70% of Santee Cooper’s energy sales and 60% of its revenue, contending that Santee Cooper doesn’t have the authority to recover costs from the cooperative for the failed reactor project.

The lawsuits, including those filed by ratepayers, seek to prohibit Santee Cooper from collecting debt costs related to the two unfinished reactors at the V.C. Summer Nuclear Station, where South Carolina Electric & Gas owned 55% of the units and Santee Cooper owned a 45% share.

A consultant hired by Santee Cooper said that the completion cost, including interest, would increase to $11.4 billion from $8.1 billion. When the project was shelved, Santee Cooper had already spent $4.5 billion on it.

The controversial decision to end work on the project was made months after Toshiba-owned Westinghouse Electric Co., filed for bankruptcy March 29, 2017, to shed debt and extricate itself from the South Carolina and Georgia contracts.

Westinghouse was the engineering, procurement, and construction contractor for the South Carolina project, and a similar twin reactor project in Georgia that remains under construction by a new contractor.

Santee Cooper spokeswoman Mollie Gore told The Bond Buyer that mediation in the suit involving Central Electric was pursued and rejected.

“Santee Cooper then filed a motion to compel arbitration as set out in our coordination agreement with Central, which we understand will be opposed,” Gore said. “This is a critical public issue that should be settled quickly.”

Getting a Supreme Court ruling that finds Santee Cooper is required by state law to set and collect rates in amounts that will cover all of its expenses, including debt obligations, will avoid multiple legal proceedings and appeals, she said.

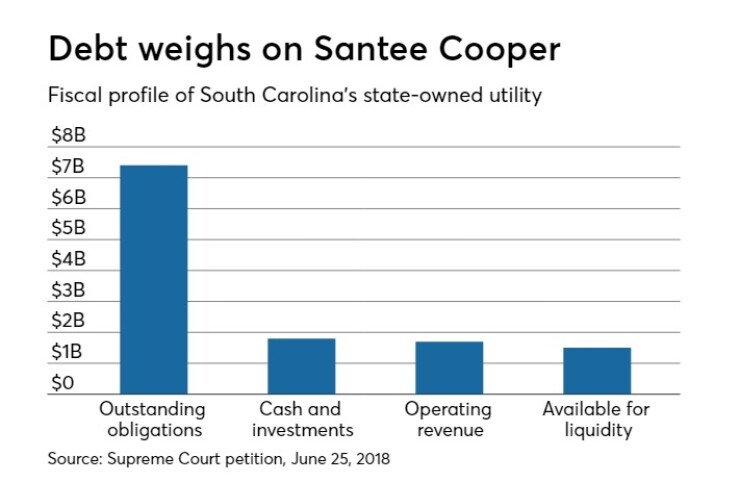

Santee Cooper has $7.4 billion of outstanding revenue obligations, $4.2 billion of which were issued for the abandoned twin reactor project for which there will be no asset.

"If, as we expect, South Carolina’s highest court affirms that Santee Cooper’s board has the authority to maintain and collect rates and charges sufficient enough to pay its debt service and expenses, it would be credit positive," Moody's Investors Service analyst Dan Aschenbach said Tuesday. "Additionally, getting the court’s view on this matter sooner, rather than later, would provide credit stability for Santee Cooper."

Moody’s placed Santee Cooper’s A1 bond rating, A2 bank bond rating and the P-1 rating on outstanding commercial paper notes under review for downgrade in May.

The action reflected the continued uncertainty surrounding the agency’s ability to maintain a self-regulated cost recovery framework, concern that legislative actions could lead to some form of permanent rate reduction at Santee Cooper, increased litigation risk and a weakened balance sheet.

Similar concerns led Fitch Ratings and S&P Global Ratings to revise their outlooks on Santee Cooper’s bonds to negative from stable in March. Fitch and S&P assign A-plus ratings to Santee Cooper’s debt.

The 388-page Supreme Court petition lays out the difficulties Santee Cooper faces if pending litigation is successful and the utility can't set its rates.

“If Santee Cooper were prevented from recovering its costs from ratepayers – which are by law its only source of revenue – it eventually would be unable to maintain its ongoing operations and fulfill its obligations to debtholders,” the petition said.

Santee Cooper contends lawsuit plaintiffs are attempting to use litigation to "dismantle" a state agency created by the General Assembly for the benefit of South Carolina residents.

“The litigation will necessarily take time, and the resulting delay and uncertainty concerning Santee Cooper’s execution of statutorily delegated ratemaking power would risk Santee Cooper’s credit rating – and potentially the state’s,” the complaint said.

South Carolina is rated AAA by Fitch Ratings, Aaa by Moody's Investors Service, and AA-plus by S&P Global Ratings. All have stable outlooks.

The state, according to the petition, has also covenanted with Santee Cooper's bondholders not to do anything that would affect or impair the utility’s ability to fix rates to pay for its operations and debt service.

The tax-exempt Public Service Authority was created by the Legislature 1934 pursuant to an enabling act that delegates the regulatory power to set rates to its board of directors.

Shortly after its creation, lawsuits challenging the utility’s constitutionality were struck down and the Supreme Court held that Santee Cooper’s “power to fix its own rates is constitutional” and bonds it issues are valid and binding, according to the petition.

The new legal challenges could endanger past rulings.

On Aug. 22, 2017, residential ratepayers filed a class-action suit in Hampton County Circuit Court – a case combined with a complaint filed in another county – alleging that Santee Cooper “lacks the statutory authority to charge and collect that portion of rates allegedly associated” with the nuclear project, the petition said. In April, Central Electric filed a cross claim that “seeks to avoid paying its share of the project’s costs.”

In addition to the pending suits, Santee Cooper's petition said that John Tiecken, attorney for Central Electric and former president of Santee Cooper, told the South Carolina House Utility Ratepayer Protection Committee this year that litigation could “drive Santee Cooper to financial ruin” and that this would negatively affect the state.

Tiecken testified that it is possible “that Santee Cooper’s bondholders could take a piece of the burden for the failure of the nuclear plant but that would only happen in the event of a bankruptcy of Santee Cooper caused by litigation, which prevents Santee Cooper from recovering costs of the nuclear plant.”

If Santee Cooper is unable to set rates and cover its expenses, the utility said it will default on its debt, and that would ruin its credit rating and render future investment “risky and expensive.”

Santee Cooper told the court that litigating the ratepayer suit would lead to an extended period of uncertainty, “as shown by the reactions of credit rating agencies,” and would prejudice the utility.

Santee Cooper asked the Supreme Court to rule expeditiously to avoid delay and uncertainty caused by litigation filed in lower court.

If the Supreme Court declines to review the core issue in the case, "uncertainty over Santee Cooper’s rate setting authority could persist for many years until the Central suit reaches a conclusion," said Moody's Aschenbach.

Central Electric is Santee Cooper’s largest customer. It buys electricity from Santee Cooper and delivers the power to its 20 member-owned electric cooperatives across the state.

In the coordination agreement both utilities signed, Santee Cooper said in a separate statement Monday, Central is responsible for paying its share of the nuclear project and related debt costs.

“For decades, Central has enjoyed the benefits of low cost electricity through a cost of service arrangement, and Central fully supported nuclear construction to lower its costs even further,” Santee Cooper said. “For Central to reverse position now puts other customers and the state of South Carolina at risk.”

In addition to the pending litigation, South Carolina lawmakers have filed several bills affecting Santee Cooper.

The Legislature is scheduled to meet in a special two-day session starting Wednesday and concluding Thursday.

Passing a budget for fiscal 2019 is top of the agenda, and it’s uncertain if action will be taken on measures that affect Santee Cooper.

The pending legislation would replace Santee Cooper’s 12-member board of directors and require the utility to seek Public Service Commission approval for future rate increases. Under current law, the governor appoints directors, who are confirmed by the state Senate.

“We understand the frustrations of customers, legislators and other stakeholders over the nuclear project, and we will continue to work to offset costs through potential equipment sales or other avenues,” Santee Cooper attorney Baxley said. “The impact to customers and the state will be far greater, however, if these plaintiff suits continue.”